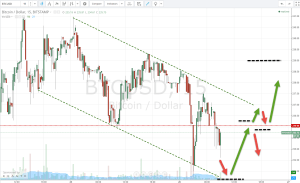

Yesterday’s action in the bitcoin price finished very much as it started. We got something of a decline throughout the Tuesday evening/Wednesday morning session, but as the US afternoon matured this decline corrected and we saw price rise towards the 239 region. However, from this level, and with a retest of resistance and the downward sloping channel we highlighted in yesterday’s analysis, we quickly declined to fresh weekly lows just ahead of 234 flat. Today’s action so far we have seen this decline correct somewhat, with an initial run towards the aforementioned downward sloping channel’s resistance around 237.50. Once again however, on the retest, resistance held firm and we are fallen back below what serves as interim resistance at 236.06. This is the level to keep an eye on in the bitcoin price as we head into the European morning session.

As the day matures, we’re likely to see 12 scenarios. The first is one in which we decline from the current position towards in term support around 233.5. This support holds, and we will look towards aforementioned interim resistance at 236.06. At this level, we could once again reverse and trade back towards the downside, with an initial target of aforementioned support. The second scenario starts off in a similar fashion, but on the upside retest we break above 236.06 and close above that level. In such a scenario, we will likely get a little bit of kickback in the bitcoin price from the downward sloping trendline resistance, we will trade for a hold on the retest and an upside reversal towards the 239.00 target.

In either scenario, it’s important to get a stop loss in place in order to avoid being on the wrong side of a losing run. A stop above 236 would ensure a timely exit in scenario one when trading the interim level to the downside on a retest, while a stop just below 236.06 (after we broke above this level) would do the same in scenario two.

Charts courtesy of Trading View