Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

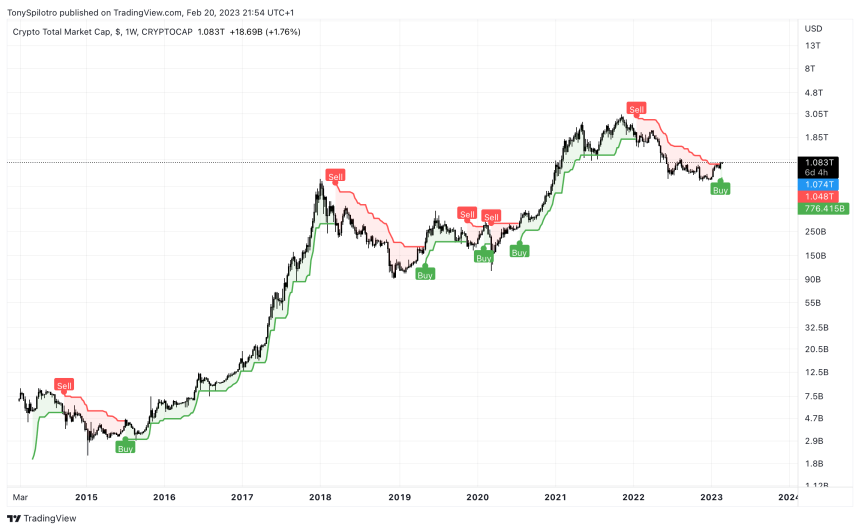

It’s a bird! It’s a plane! It’s a SuperTrend buy signal on the total crypto market cap chart, as calculated by TradingView! Find out exactly what this signal means and what has happened in the past when it has appeared.

Why The SuperTrend Matters, Even Without The Cape

The study of technical analysis looks at a variety of chart patterns, candlesticks, indicators, and more to get a read on the trend and if an asset is overbought or oversold, for example.

One such tool called the SuperTrend gives simple buy and sell signals, helping to indicate a change in the direction of a trend. The trend-following indicator was developed by Olivier Seban and much like other trend-following tools — such as moving averages — can lag behind price movements.

The SuperTrend is plotted as a trend line above or below price action depending on if the price chart is bullish or bearish. It acts as dynamic support and resistance that moves up or down with price action, making it possibly useful as part of a trailing stop loss strategy.

If the trend line is touched by the price, the color of the trend line changes from red to green (or vice versa) and a signal is triggered. As you can see below, a buy signal was triggered on the weekly total crypto chart last week. More importantly, after last night’s weekly close, the signal has officially confirmed.

SuperTrend says "buy," but should you? | TOTAL on TradingView.com

Total Crypto Market Buy Signal Triggered, What’s Next?

With a buy signal now on the TOTAL crypto weekly chart forever forward, let’s consider the past results of the “super” technical tool. The buy signal is the first confirmed signal since July 2020. The total crypto market grew 10x from under $300 billion to just under $3 trillion after the words “buy” appeared in the price chart.

Prior to that, however, the previous buy signal resulted in an immediate loss due to the catastrophic Black Thursday selloff at the onset of COVID. If the tool had been used for a trailing stop loss, losses ultimately would have been minimal.

A long-term look at SuperTrend buy signals | TOTAL on TradingView.com

The buy signal before that came in the weeks following the 2018 bear market bottom. No one knew it was the bottom at the time, but the SuperTrend did. Moving back even further to the 2015 bear market bottom, the weekly SuperTrend nailed the trend change from bear to bull, sans a misfired signal seen after the 2018 buy signal.

The first ever buy signal given on the TOTAL weekly crypto chart resulted in a 200x increase from roughly $3 billion to $750 billion. With yet another “buy” permanently on the weekly TOTAL chart with the SuperTrend turned on, what might it provides for results that the future will eventually look back on?