Gemini is one of the most established names in crypto, launched in 2014 by the Winklevoss twins and regulated out of New York as a full-reserve crypto exchange and custodian. It now serves users in 60+ countries and all U.S. states, positioning itself as a security-first platform for everyday investors and more advanced traders alike. In this Gemini review, we’ve taken a close look at the web platform and mobile app, tested the trading experience, and dug into the company’s security track record, fee structure, and product lineup. We’ll cover how safe Gemini really is, what it costs to trade, how the app performs day to day, and whether it’s a good fit compared to rivals like Bybit, MEXC, OKX, and others. Overall, our hands-on Gemini crypto exchange review found a highly regulated, security-conscious platform that suits cautious investors and long-term holders. So is Gemini legit and is Gemini a good crypto exchange? Yes, for security-focused users—but there are some drawbacks around fees, past Earn-related controversies, and mixed user reviews that you should understand before signing up.

What is Gemini Exchange?

Gemini is a centralized cryptocurrency exchange and regulated custodian founded in 2014 by Cameron and Tyler Winklevoss. It operates under a New York trust company charter and is headquartered in New York City, serving customers across the U.S. and many international markets. Unlike decentralized exchanges (DEXs), Gemini is fully custodial: users deposit funds to accounts held by the platform, which then manages order matching, settlement, and custody. This centralized model allows Gemini to offer tight regulatory oversight, fiat on-ramps, and integrated security controls, but it also means users rely on the company’s risk management and compliance framework.

In terms of products, Gemini focuses primarily on spot trading, simple buy/sell functionality, and secure storage for a curated list of 70+ cryptocurrencies and 100+ trading pairs, depending on jurisdiction and venue (standard exchange vs. ActiveTrader). For eligible non-U.S. users and institutions, Gemini also offers perpetual futures through its derivatives venues, with leverage that can reach up to 100x on selected contracts. Beyond trading, Gemini has expanded into a broader crypto-finance ecosystem that includes a regulated stablecoin (GUSD), a mobile-first app, staking services, a crypto rewards credit card, and institutional-grade custody. The big-picture pitch is a security-first, regulation-heavy platform that targets both cautious retail investors and more advanced traders-something we’ll test in more detail in the following sections.

Gemini Crypto App Pros and Cons

In our Gemini crypto app review, we focused on day-to-day usability, security, and overall trading experience across mobile and desktop to answer the question: is Gemini a good crypto exchange for your needs? The app feels designed for cautious investors first, with a clean interface and strong compliance, but there are some notable trade-offs on fees, asset breadth, and past program issues that potential users should keep in mind.

Overall, our testing shows that the Gemini app delivers a smooth and trustworthy experience, particularly for users who prioritize regulation and simplicity. However, the combination of higher default fees, a more limited asset lineup, and fewer advanced trading options means that active traders or altcoin-focused investors may find the platform restrictive. These trade-offs don’t undermine Gemini’s strengths, but they are important to understand so you can decide whether its security-first approach aligns with your trading style and long-term goals.

Gemini Exchange Key Features

In our Gemini crypto exchange review, we focused on how the platform actually behaves in day-to-day use: order execution, market coverage, yield options, and tools across web and mobile. Below are the features that stood out most in our testing, together with a few drawbacks you should be aware of.

Spot Trading and ActiveTrader Platform

Gemini’s core is its spot exchange, with around 70-80 supported cryptocurrencies and roughly 390 trading pairs, depending on your region. In practice, that means good coverage of majors (BTC, ETH, SOL, stablecoins) plus a curated set of altcoins, but not the thousands of tokens you’ll see on offshore exchanges.

In our testing, the standard app made simple buy/sell trades very quick, while the ActiveTrader interface added depth charts, advanced order types, and more granular fee tiers. Order execution was smooth even during higher volatility, and we liked how easy it was to toggle between simple and advanced views. The main trade-off is that advanced traders may miss niche pairs, and there is no built-in spot margin trading for most users.

Perpetual Futures and Derivatives (for Eligible Regions)

For eligible users outside the U.S. and certain restricted markets, Gemini offers USDC-settled perpetual futures via Gemini Perpetuals. These contracts let you go long or short on major coins like BTC, ETH, SOL, and XRP, with leverage advertised at up to 100x on some EU venues.

In our tests, the derivatives interface felt like a natural extension of ActiveTrader, with clear margin information and risk tools that make it easier to understand your exposure. The main downside is availability: derivatives are currently limited to specific jurisdictions and a smaller list of contracts than derivatives-first exchanges such as Bybit or MEXC. If you are a heavy futures trader looking for dozens of altcoin perps, Gemini might feel restrictive.

Gemini Staking and Yield Options

Gemini now focuses on regulated staking rather than the old Gemini Earn program, which became controversial after the Genesis bankruptcy. For those asking is Gemini Earn safe today, it’s worth noting that the lending-based Earn program has been discontinued, and the platform now offers only direct staking services, which involve different risk profiles. For supported regions, you can stake assets like ETH and SOL directly from your account, with advertised yields of up to around 6% APR, depending on the asset and market conditions.

In our experience, the staking flow is straightforward: you pick an eligible asset, opt in, and Gemini handles the underlying validator infrastructure. No minimums and no separate transfer fees make this especially appealing for anyone exploring crypto for beginners. The trade-off is that Gemini takes a relatively large service fee out of rewards before they hit your account, so net yields can be lower than running validators or using some DeFi alternatives.

Mobile-First Gemini App Experience

Gemini’s mobile app is clearly a core product, not an afterthought. On both iOS and Android, we found it easy to track prices, set up recurring buys, and manage portfolios with just a few taps. The app supports buying, selling, storing, and staking crypto, along with push notifications for price alerts and key account events.

In our testing, the app felt fast and responsive, and the layout remained clean even when switching to more advanced order tickets. The main limitation is that some power-user tools (like deep chart customization or multiple layouts) are still better on desktop. If you are a very active day trader, you may prefer to do heavier analysis on the web platform and use mobile mainly for monitoring and quick execution.

Automation, API Trading, and Tools

While Gemini doesn’t offer built-in social copy trading, it does provide robust REST and WebSocket APIs that integrate well with third-party trading bots and automation platforms. In our Gemini auto trading app review testing with external bots, we were able to automate DCA strategies and simple trend-following systems without connection issues or unexpected throttling.

This makes Gemini appealing if you want a regulated, U.S.-based venue but still like the idea of automated or semi-automated trading. Our Gemini auto trading app review found that while the platform lacks native bot marketplaces, its API infrastructure is solid for users who are comfortable setting up their own automation workflows. The flip side is that setting everything up requires more technical effort than exchanges that ship native copy-trading marketplaces. Beginners who just want plug-and-play automation may find the learning curve a bit steep.

Gemini Crypto Exchange Security

In our Gemini crypto exchange safety review, security is clearly the core selling point. Gemini operates as a New York trust company, is subject to NYDFS oversight, and promotes a “security-first” custodial model with strict internal controls. A large majority of customer crypto is stored in offline cold storage, with only a small portion kept in online “hot” wallets to support withdrawals and trading liquidity. For users asking is Gemini legit, this custody model combined with NYDFS oversight provides a strong foundation of legitimacy and regulatory compliance.

Gemini employs industry-standard protections including hardware security modules (HSMs), strong encryption for sensitive data, and mandatory two-factor authentication (2FA) for logins and withdrawals. Users can further lock down their accounts with features like device approval, login alerts, and withdrawal address whitelisting, which helps reduce the risk of funds being sent to a new address without your consent.

On the fiat side, Gemini states that U.S. dollar balances held on the platform are kept in FDIC-insured bank accounts or money-market funds, although this insurance only applies in the event of a bank failure, not an exchange hack. Historically, Gemini has not suffered a widely reported, catastrophic security breach of its core exchange infrastructure, but there have been isolated account-takeover incidents tied to phishing or poor individual security practices. These underline why using strong 2FA and good OPSEC is still essential.

KYC and AML controls are strict. In our experience, you cannot meaningfully use Gemini without completing identity verification, including providing government-issued ID and sometimes additional documents for higher limits or institutional accounts. Transactions are monitored for suspicious activity, and Gemini has systems in place for sanctions screening and SAR reporting, which brings it closer to traditional financial institutions in terms of compliance obligations.

It is also important to separate security from counterparty and lending risk. While Gemini’s core exchange and custody stack has a solid record, the now-defunct Gemini Earn product was caught in the Genesis Global Capital bankruptcy, leading to frozen funds for many users and enforcement actions from U.S. regulators. That episode did not stem from a hack but from lending/counterparty risk, and it’s a reminder that “is Gemini safe?” depends on which product you use: basic spot trading and custody are far less complex than yield or lending programs.

Gemini Crypto Fees

In our Gemini review, we found that the platform’s cost structure depends heavily on which interface and products you use. Casual users who stick to the default “Gemini mode” pay some of the highest fees in the market, while ActiveTrader and derivatives pricing is much more competitive.

| Fee type | Where it applies | Typical cost | Our take |

| Instant / Recurring Buy | Default Gemini web & app (“Gemini mode”) | 1.49% transaction fee + 1.00% convenience fee per trade (total ~2.49%) | Very expensive vs most competitors; fine for one-off small buys, not ideal for active traders. |

| Limit orders (Gemini mode) | Default web & app | 1.49% transaction fee, no convenience fee | Still pricey compared to standard maker/taker models on top exchanges. |

| Spot trading (ActiveTrader) | ActiveTrader web & mobile | Tiered 0.20% maker / 0.40% taker below $10k 30-day volume, dropping to 0.00% / 0.03% at the highest tiers | Mid-pack: cheaper than Gemini mode, but higher than Binance, Bybit, OKX at low volumes. |

| Stablecoin spot pairs | ActiveTrader | Selected USD/stablecoin pairs at 0.00% maker / 0.01% taker | Very cheap for stablecoin trading, good for frequent USD↔stablecoin flows. |

| Perpetual futures | Gemini Perpetuals | 0.02% maker / 0.07% taker at base volume, falling to -0.01% maker / 0.03% taker for very high volume | Competitive with other major perps venues, especially at higher volume. |

| Margin interest (spot margin) | Gemini Margin (ActiveTrader) | 0.003% per hour on USD (≈26.3% APR), plus 0.5% liquidation fee if you’re liquidated | Expensive to hold margin loans for long periods; best for short-term use only. |

| Fiat deposits | ACH, wires, debit card, PayPal | ACH: free; wire in: free (Gemini side); debit card: 3.49%; PayPal: 2.5% | Bank transfers are cost-effective; card and PayPal funding are costly and mainly for convenience. |

| Fiat withdrawals | Bank transfer, wire | ACH: free; USD wire out: $25; non-USD bank transfers (SEPA/FPS etc.): free; SGD FAST: 3 SGD | ACH and SEPA/FPS are cheap; USD wires add up if you move money often. |

| Crypto deposits & withdrawals | On-chain | Deposits: free; withdrawals: dynamic network fee based on blockchain gas, Gemini does not mark this up | Transparent, roughly in line with competitors; cost depends on network congestion, not Gemini. |

| Custody transfers | Exchange ↔ Gemini Custody | Exchange → Custody: free; Custody → Exchange: $125 per withdrawal | Standard institutional-style pricing; retail users usually won’t touch Custody. |

Gemini splits trading between the default interface and ActiveTrader. In the default mode, Instant and Recurring buys cost about 2.49% per trade, and even limit orders still carry a 1.49% fee, reflecting the typical Gemini fees users encounter.

ActiveTrader uses a maker–taker model. Spot fees start at 0.20% maker / 0.40% taker and drop with higher volume, while key stablecoin pairs like USDC/USD and USDT/USD are priced at 0.00% maker / 0.01% taker.

Perpetual futures use a separate schedule (roughly 0.02% maker / 0.07% taker at base, down to -0.01% / 0.03% at high volume). Bank transfers are generally cheap (ACH and most non-USD withdrawals are free; USD wires cost $25), and crypto withdrawals use dynamic network fees. Margin interest is 0.003% per hour plus a 0.5% liquidation fee, so it’s best for short-term leverage.

Compared with Binance, Bybit, OKX, and Kraken, Gemini’s Instant buys and standard app are expensive, ActiveTrader spot fees are mid-range, and derivatives pricing is competitive. In practice:

- Occasional small buys → default app is easy but pricey

- Regular trading → switch to ActiveTrader to cut fees

- Active derivatives trading → perps are solid, but still compare total costs with Bybit, MEXC, OKX, etc.

Is Gemini Trading Platform Easy To Use?

In our Gemini review, we found the platform generally beginner-friendly, especially in the default “Gemini” interface. The onboarding process is straightforward: you sign up with an email, verify it, and then complete KYC by submitting an ID and, in some cases, additional documents for higher limits. Gemini also offers a help center and basic “getting started” guides, which make the first deposit and purchase relatively painless for most users. In addition, navigating between the default layout and Gemini’s more advanced ActiveTrader view felt intuitive in our testing, making it easier for beginners to understand how different Trading Platforms present charts, orders, and market data.

The default app and web interface focus on simple buy/sell flows, portfolio tracking, and recurring purchases. In our testing, it was easy to find major markets, place market or limit orders, and view balances without being overwhelmed by charts or complex order types. More advanced users can switch to the ActiveTrader interface, which adds depth charts, advanced order tickets, and faster market views-but this does introduce a steeper learning curve for complete beginners.

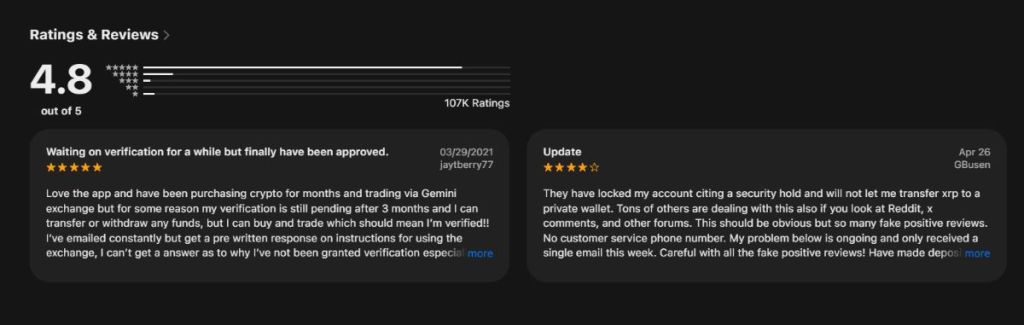

On mobile, the Gemini app scores well. Recent data shows ratings around 4.3/5 on Google Play and 4.8/5 on the Apple App Store, with many users praising the clean design and straightforward navigation. In our experience, performance was smooth on both iOS and Android, and features like price alerts and recurring buys worked as expected. Power users, however, will still prefer desktop for chart-heavy analysis and multi-window setups.

User feedback, especially on review platforms like Trustpilot, is more mixed. Gemini’s Trustpilot score sits around 1.4/5, with many complaints centered on account holds, extra KYC checks, and slow responses during security reviews or high-volatility periods. This doesn’t mean the interface is hard to use, but it does highlight that compliance checks and risk controls can interrupt the experience, particularly if you trigger additional verification.

Customer support is another trade-off. Users can contact Gemini via email, support tickets, and a site chatbot, but there is no phone support, and response times can vary significantly. In our own tests, we received clear answers, but not always quickly-fine for routine questions, less ideal if your account or withdrawal is under review and you want real-time updates.

Overall, our conclusion is that Gemini is easy to use for straightforward buying, selling, and holding, especially on mobile, but advanced features require a bit of learning and the broader user experience is heavily shaped by compliance. If you value a clean UI, strong regulation, and transparency around Gemini fees, you will likely be satisfied; if you want ultra-fast support, thousands of coins, and zero friction, you may find the platform feels conservative and occasionally slow.

How Does Gemini Compare to Other Crypto Exchanges?

In our Gemini review, we also compared it with a few popular alternatives: Margex, Bybit, MEXC, and OKX. The table below gives a quick snapshot so you can see which platform might best match your priorities (security, leverage, asset variety, or low fees).

| Exchange | Top Choice For | Asset Support | Markets | Standout Features |

| Gemini | Security-focused investing and long-term HODLing | ~90 coins and 100+ trading pairs, depending on region | Spot, perpetual futures (limited regions), staking, card, stablecoin | NYDFS-regulated trust companyStrong security and compliance focusBeginner-friendly mobile app and fiat on-ramps |

| Margex | Simple, high-leverage derivatives trading | Dozens of major crypto pairs for BTC- and USDT-settled contracts | Perpetual futures only | Up to 100× leverage on selected pairsUser-friendly derivatives interfaceCopy trading and staking options |

| Bybit | Active traders and derivatives specialists | 100+ coins and 300+ spot pairs; hundreds of derivatives pairs | Spot, perps, options, margin, copy trading | Deep derivatives liquidityRich tools, bots, and copy tradingGenerally low trading fees for active users |

| MEXC | Altcoin hunters and volume traders | 2,600+ spot pairs and 1,100+ futures pairs, among the largest in the industry | Spot, futures, margin, launchpad, staking | Huge range of small/mid-cap coinsFast new-listing paceHigh-liquidity futures markets |

| OKX | Balanced all-rounder with strong tools | 300+ coins and 500+ trading pairs, depending on jurisdiction | Spot, perps, options, margin, copy trading, DeFi | Advanced charting and trading botsIntegrated Web3 wallet and DeFi accessUp to 125× derivatives leverage in some markets |

So is Gemini a good crypto exchange overall? So is Gemini a good crypto exchange overall? In short, Gemini is our top pick when regulation, security, and a clean, beginner-friendly experience are your main priorities. It is especially attractive if you want a heavily regulated exchange for long-term BTC, ETH, and large-cap holdings, and you are comfortable with mid-range fees on ActiveTrader.

However, if you want maximum coin variety and very active trading, MEXC or Bybit may be a better fit. If you care most about advanced tools, bots, and a strong DeFi/Web3 tie-in, OKX often has the edge. And if your primary focus is high-leverage derivatives in a simplified environment, Margex is worth a closer look.

Gemini isn’t the cheapest or most feature-packed exchange overall, but it stands out as a security-first, regulation-heavy option that will appeal to cautious investors who are willing to trade away some asset variety and ultra-low fees in return for that extra comfort.

Gemini Exchange’s Reputation – What Are People Saying?

When reviewing Gemini’s reputation and answering the question is Gemini legit, we looked beyond our own testing to long-term data points: its regulatory track record, mobile app store ratings, independent software review platforms, and community feedback on forums like Reddit. Overall, the picture is mixed but consistent with our experience-strong marks for security and usability, but persistent complaints around compliance checks and customer support.

On the mobile side, Gemini scores well. Across Google Play and the Apple App Store, the Gemini crypto app sits around 4.3/5 and 4.8/5 respectively, based on well over 100,000 combined reviews. Most positive comments highlight the clean interface, simple buy/sell flow, and perceived security of a heavily regulated exchange-very similar to what we found in our own testing.

Professional review sites are generally favorable but not glowing. One leading software review platform aggregates Gemini at roughly 3.7/5 overall, with users praising its secure, beginner-friendly environment and variety of products, while noting downsides like limited availability in some regions and slow or unhelpful support at times. This aligns with our view: Gemini is strong on fundamentals, but not the most responsive exchange in the industry.

Consumer review platforms tell a harsher story. On major customer-review sites, Gemini’s score is around 1.4/5 (“Bad”) across more than 1,000 reviews, a pattern similar to many large exchanges but still important to consider. The most common complaints involve account freezes or withdrawal holds triggered by security or AML checks, followed by slow, template-like responses from support. In several cases, users reported that issues were eventually resolved, but only after extended back-and-forth and long wait times.

Community feedback on Reddit and other forums is more nuanced. Some users share positive experiences with features like OTC execution or the overall reliability of the platform, while others point to third-party security ratings that classify Gemini as solid but not flawless and question the lack of fully transparent proof-of-reserves audits. The legacy of the Gemini Earn/Genesis saga also surfaces frequently, with many users still asking is Gemini Earn safe or whether they should trust yield products on the platform. Recent updates showing that Earn users have now been made whole have improved sentiment in some corners, though the platform has since shifted away from lending-based yield entirely.

Putting this together, our view is that Gemini’s reputation is bifurcated: it is widely respected for regulation, security, and a polished app, but criticized for rigid compliance processes and uneven customer service. If you value a conservative, security-first environment and are prepared for occasional extra verification friction, the reputation data is broadly reassuring; if you expect frictionless withdrawals and instant human support, the public reviews are a clear signal to set realistic expectations.

How to Use Gemini Crypto Exchange – A Step-By-Step Guide

In our experience, getting started with Gemini is straightforward if you follow a simple sequence: create and verify your account, secure it properly, deposit funds, place your first trade, and then decide whether to hold, stake, or withdraw. The overall onboarding flow is comparable to what we’ve seen on some of the best crypto exchanges, which helps make the process smooth even for newer users. Below is a concise step-by-step guide to walk you through the process.

Step 1: Create and Verify Your Gemini Account

Start by visiting the official Gemini website or downloading the Gemini app from the iOS or Android store. Create an account using your email address, then confirm it via the verification link you receive.

In our experience, you’ll need to provide basic personal details and complete KYC by uploading a government ID and, in some regions, proof of address. Once your identity is verified and your account is approved, you can move on to funding. If you’re interested in automation, our Gemini auto trading app review found that API access is available immediately after verification, though setting up bots requires technical knowledge.

Step 2: Secure Your Gemini Account

Before depositing any money, secure your account. In our experience, the quickest win is enabling two-factor authentication (2FA) via an authenticator app rather than SMS. This adds a second layer of protection on every login and withdrawal.

You can also approve trusted devices, set up login alerts, and, if available in your region, enable withdrawal address whitelisting so funds can only be sent to pre-approved addresses. Taking five minutes here significantly improves your overall security posture.

Step 3: Deposit Fiat or Crypto

Next, fund your account. In our tests, linking a bank account for ACH/SEPA/FPS transfers was the most cost-effective option, although you can also use wires, PayPal, or a debit card in some regions. Just be aware that card and PayPal deposits typically carry higher fees.

If you already hold crypto elsewhere, you can generate a deposit address for your chosen asset and send funds on-chain to Gemini. Always double-check the network (e.g., ERC-20 vs. TRC-20) and address before confirming the transaction.

Step 4: Place Your First Trade

Once your balance arrives, you can buy your first asset. In our experience, beginners are usually more comfortable starting in the default Gemini interface with a simple market buy of BTC, ETH, or another large-cap coin. You just select the asset, choose the amount, and confirm the order.

If you plan to trade more actively, consider switching to the ActiveTrader interface for lower fees and more order options. There you can place limit, market, and stop orders, view the order book, and monitor charts in real time.

Step 5: Manage, Stake, or Withdraw Your Crypto

After your trade executes, your new asset will appear in your portfolio. From here, you can simply hold it, set up recurring buys, or, where available, opt into staking to earn yield on supported coins. In our experience, the staking flow is quite intuitive: you choose an eligible asset, review the estimated yield, and confirm.

When you want to move funds off the exchange, you can withdraw to your bank account (for fiat) or to an external wallet (for crypto). Always test with a small withdrawal first to ensure you have the correct address and network before sending larger amounts.

Gemini Crypto App Review – Our Verdict

In our Gemini crypto app review, we found a platform that excels on security, regulation, and overall polish. The mobile app is intuitive, fiat on-ramps are well integrated, and features like staking, recurring buys, and a regulated stablecoin make it easy to build and manage a long-term portfolio. For security-focused users who want a conservative, U.S.-regulated venue, Gemini delivers on its core promise.

The trade-offs are clear. Default app fees are high compared with many rivals, the asset list is curated rather than expansive, and while our Gemini auto trading app review confirmed strong API support, there’s no built-in bot marketplace like some competitors offer. The legacy of the Earn/Genesis saga plus mixed customer-service reviews mean you should expect a more conservative, compliance-heavy experience. Power users who want hundreds of small-cap tokens, ultra-low fees, and instant support will likely be better served by alternatives such as Bybit, MEXC, or OKX.

Overall, Gemini is best suited to cautious investors and long-term HODLers who value regulation and security over maximum choice and rock-bottom trading fees. If that sounds like you, opening an account via the official Gemini website or app and testing it with a small deposit can be a sensible first step. Just remember that this is not financial advice (NFA), and you should always do your own research (DYOR) and compare multiple exchanges before committing larger amounts of capital.

FAQs

Is Gemini crypto app safe?

Gemini is generally considered one of the more security-focused, regulated exchanges. It operates as a New York trust company, keeps most customer funds in cold storage, and enforces KYC/AML plus strong security options like 2FA and withdrawal whitelisting. No major hack of its core exchange has been reported, but as with any custodial platform, there is always some counterparty and regulatory risk.

Is Gemini crypto app available in the US?

Yes, Gemini is available in most of the United States and is headquartered in New York. However, specific products (like certain derivatives or staking features) may not be available in all states due to local regulations. It is always best to check availability and supported products for your particular state during sign-up.

Is Gemini better than Coinbase?

Yes, Gemini works well for beginners thanks to its simple interface, clear order flow, and strong emphasis on security and regulation. The main downside for new users is cost: Instant buys and default app trades are noticeably more expensive than many competitors. If you start on Gemini, it is worth learning the ActiveTrader interface as you gain confidence to reduce your trading fees over time.

Is Gemini a good crypto exchange for beginners?

Yes, Gemini works well for beginners thanks to its simple interface, clear order flow, and strong emphasis on security and regulation. The main downside for new users is cost: Instant buys and default app trades are noticeably more expensive than many competitors. If you start on Gemini, it is worth learning the ActiveTrader interface as you gain confidence to reduce your trading fees over time.

What are the main downsides of using Gemini

The biggest drawbacks we found are higher fees on the default interface, a smaller asset list than major offshore exchanges, and mixed reviews around customer support speed and strict compliance checks. For some users, these are acceptable trade-offs for a more conservative, regulated environment. For others-especially very active traders and altcoin hunters-exchanges like Bybit, MEXC, or OKX may feel more flexible and cost-effective.