Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

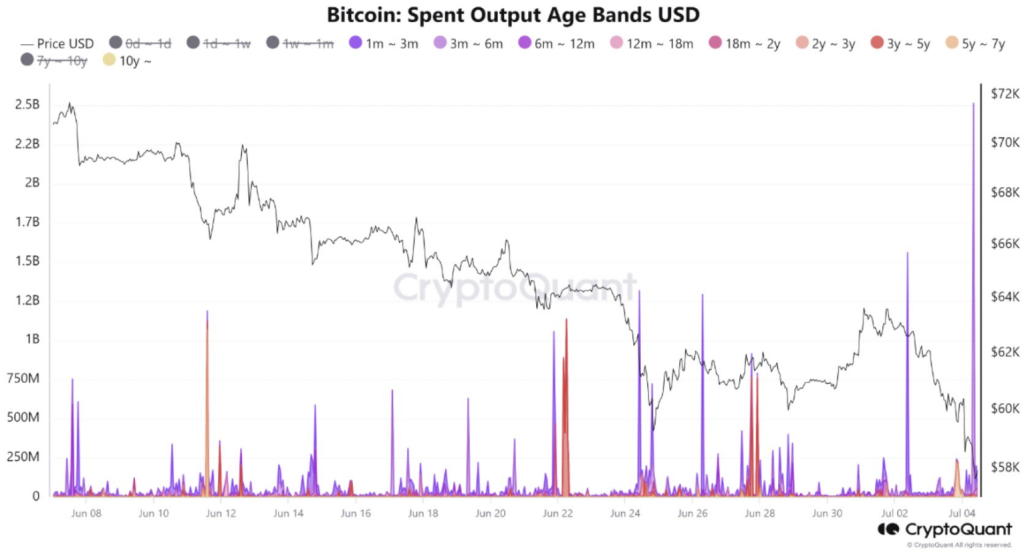

A recent study by CryptoQuant shows a notable change in investor behaviour, hence the Bitcoin market is riding a sea of uncertainty. About $2.4 billion worth of Bitcoin, most likely obtained by investors this year, has flowed through the system and generated discussion on the causes of the migration.

Short-Term Jitters Drive Sell-Off

Short-term investors that entered the market early 2023 are thought to be the cause of these outflows. Back then, a purchasing frenzy driven by excitement over Bitcoin Exchange-Traded Funds (ETFs) and the mining reward halving — an event believed to lower supply and maybe raise prices. But their excitement seems to have been subdued by the present bear market, which causes them to limit their losses.

Beginner investors are capitulating and increasing selling pressure

“Approximately $2.4 billion worth of #Bitcoin aged between 3 and 6 months moved on the network during the drop.” – By @caueconomy

Read more 👇https://t.co/W46LKwg9Hb pic.twitter.com/C3OzfIMbSo

— CryptoQuant.com (@cryptoquant_com) July 4, 2024

This behaviour emphasises the distinctions between those pursuing rapid gains and actual long-term believers. Although the sell-off is driven by short-term emotion, it is noteworthy that Bitcoin has survived such challenges in the past.

Calm Amidst The Chaos: Long-Term Investors Stay The Course

The relentless confidence shown by long-term Bitcoin holders is a lighthouse of consistency in this tumultuous market. Data from CryptoQuant shows that investors with holdings older than a year have not changed in response to the current market volatility. This points to a strong conviction in the long-term possibilities of Bitcoin, which may help to offset more price declines.

It’s amazing how different new and experienced investors act. Short-term holders are influenced by changes in the market; long-term investors know that Bitcoin is a marathon rather than a sprint. Their ongoing belief in the technology can offer the whole market much-needed stability.

Uncharted Territory: Market Responds To Investor Tug-Of-War

How will the market respond to this significant sell-off by short-term holders remains the million-dollar mystery. Some analysts fear it can set off a chain reaction that results in more declining prices. Others, however, contend that the relentless faith of long-term investors will stop a freefall. Which force wins will depend much on the next few weeks.

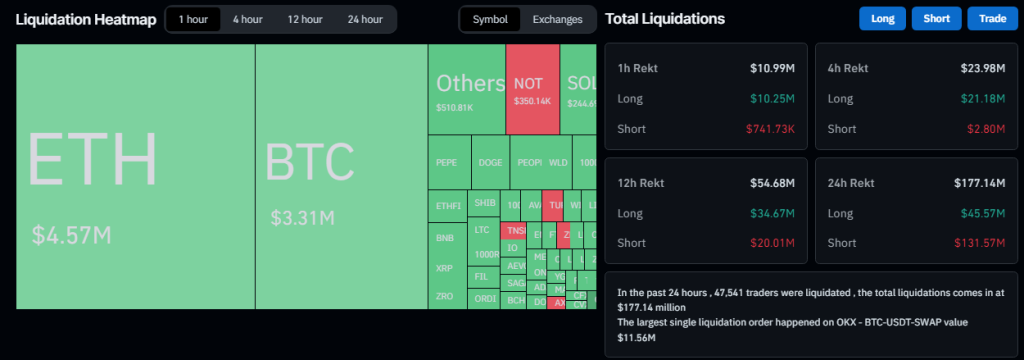

Massive Bitcoin Liquidation

Though the percentage is smaller than that of other cryptocurrencies, its dominance results in a naturally larger monetary worth of liquidated Bitcoins. Actually, the statistics shows that during the recent price drop, Bitcoin performed better than other altcoins.

Though the percentage is smaller than that of other cryptocurrencies, its dominance results in a naturally larger monetary worth of liquidated Bitcoins. Actually, the statistics shows that during the recent price drop, Bitcoin performed better than other altcoins.

The Bitcoin market is at a junction. While long-term owners stick to their belief, other investors are jumping ship due to short-term worries. The interaction of these opposing forces will decide the course of the most often used cryptocurrency going forward.

Featured image from Alamy, chart from TradingView