Earlier today, we published the first of our twice daily bitcoin price watch pieces. In the article we noted that the bitcoin price has been pretty unpredictable over the past few days. Despite no real fundamental developments, we gave seen a considerable amount of conflicting volatility, with overnight highs giving way to swiftly carved out lows pre-European session. Despite the unpredictability, however, we have managed to draw a decent profit through our intraday breakout strategy this week. By bringing tight risk management parameters into play, we have avoided taking too big a hit on the choppy action, and in doing so, kept our week’s bottom line at a net gain. Over the next couple of days, we expect low volume to dominate action. The Christmas sessions will likely keep market participants away from their trading desks, and low volatility can mean a single large buy or sell can impact the price of bitcoin considerably, and quickly. So, as we head into tonight’s Asian session, and the Christmas break beyond, what are the levels we are looking at in the bitcoin market this evening, and where will we look to get in and out of the markets according to our strategy? The chart below outlines our range.

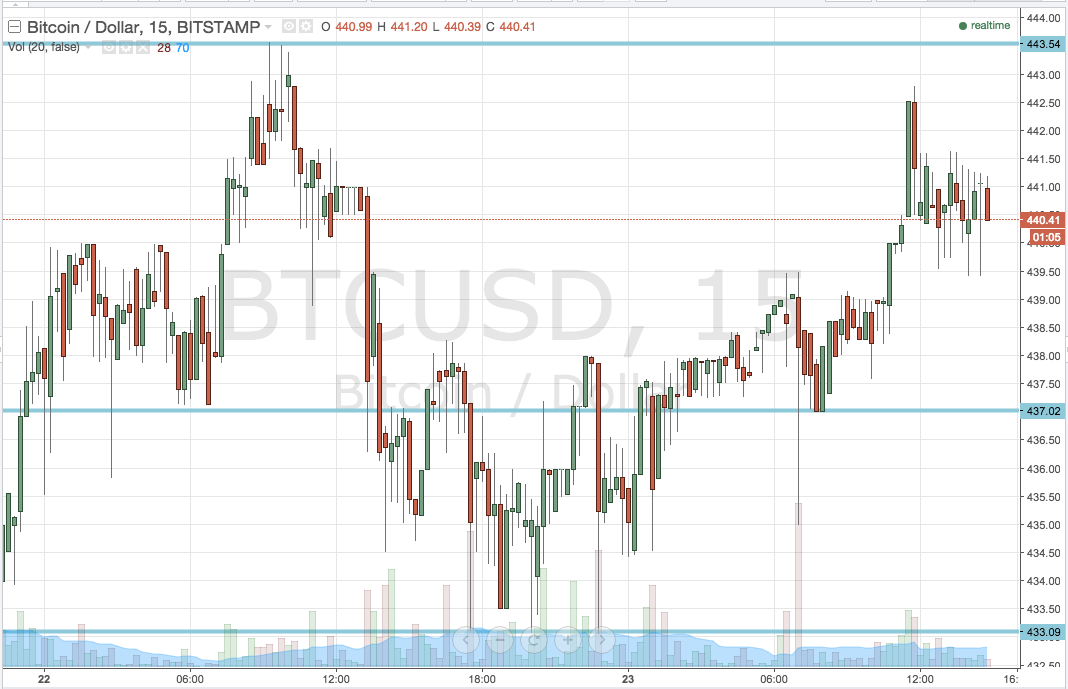

As you can see from the chart, tonight’s range is defined by in term support at 437.02 and in term resistance at 443.54. These are the levels to watch going forward.

Let’s look at the upside first. If we get a break above in term support, we will look for a close above this level to validate a medium term upside bias, and a long entry towards an initial upside target of 447 flat.

Looking the other way, a close below 437.02 will put us short towards a downside target of 433.09. A stop on this one somewhere in the region of 438.50 will maintain our risk profile on the trade.

Charts courtesy of Trading View