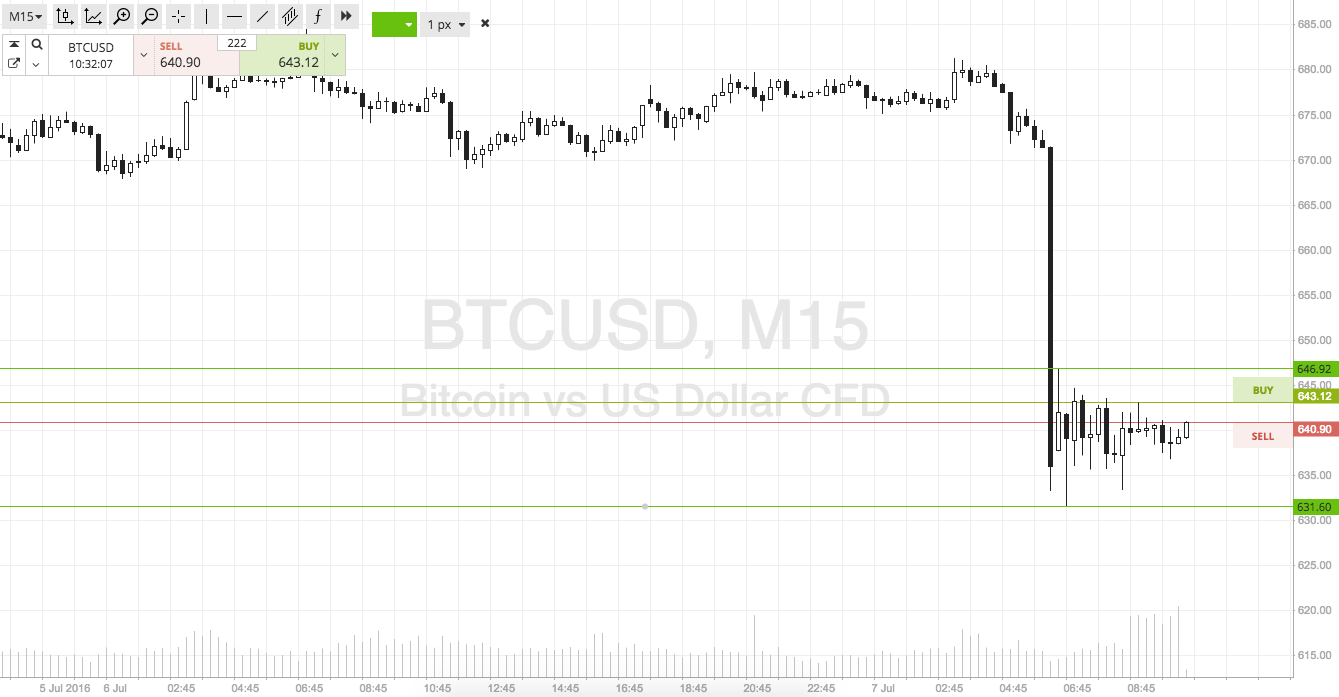

It is Thursday morning, and time to take a look at the bitcoin price. Specifically, let’s have a look at our price played out overnight, and attempt to interpret this action and apply it to our intraday strategy in order to attempt to draw a profit from the market during today’s morning European session. So, with that said, before we get going, take a quick look at the chart below. It is a 15 minute candlestick chart showing overnight action.

The first notable point is the decline seen shortly before daybreak in Europe, when price broke through 670 and served up some sustained downside momentum to reach eventual lows just ahead of 630. Having reached these lows, price has pretty much just traded flat across the session so far.

This is ok, as it gives us us something to go off from a range setting perspective. Specifically, we are going to look at putting interim support somewhere around the recent lows, and resistance at the most recent correction (which, in this instance, is an upside swing point.

Let’s define the range, then. In term support comes in at 631 to the downside, which is the low point on overnight action. Conversely, in term resistance comes in at 646 to the upside.

Intrarange is on today, so long on a bounce from support and short on a correction from resistance, with a target of the opposite level and a stop just the other side of the entry.

Of course, our primary focus is our breakout strategy. So, if price breaks through in term support to the downside we will look to enter short towards an initial downside target of 620 flat. A stop at 635 keeps things tight.

If price breaks through resistance and we get a chance to enter long, it will be towards an upside target of 655 with a stop at 640.

Charts courtesy of SimpleFX