It’s taken us a little longer than expected, but we’ve finally got some decent momentum in the bitcoin price. In yesterday’s analysis we highlighted the fact that – despite the fundamentals suggesting we might see some action – price had stayed relatively flat across the last week or so. This isn’t necessarily a bad thing, but it doesn’t make for particularly interesting intraday trading. Well, last night, price finally broke through resistance and we managed to get in and out for a quick scalp profit. It looks as though we may be correcting on the return side now, but with any luck, it’s a sign that the European session has something to give today.

So, as we head into a fresh session out of Europe, and as volume picks up on the mid week push, here’s a look at how we intend to approach today’s markets.

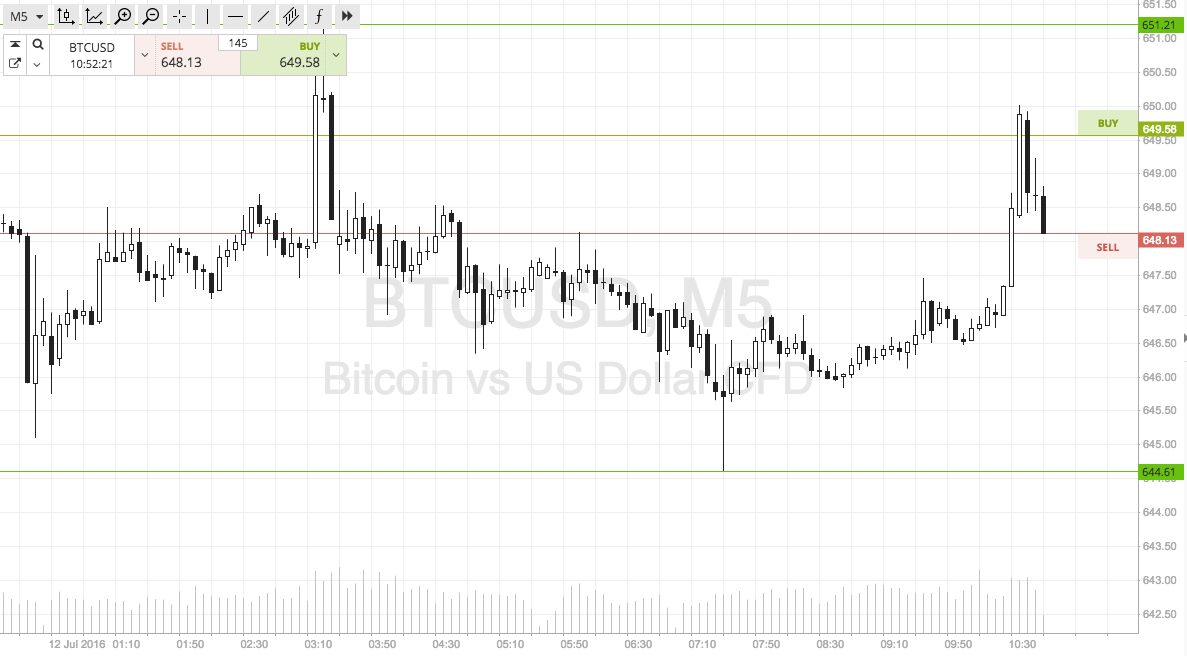

As ever, take a quick look at the candlestick chart below to get an idea of our key levels. It’s a five minute time frame (we are favoring these as late, compared to the standard fifteen minute) and it has our price parameters overlaid in green.

So, as the chart shows, the levels we are focusing on for today’s breakout and intrarange strategies are in term support to the downside at 644 and in term resistance to the upside at 651. The latter represents overnight highs, while the former is a recent swing low.

If price breaks through resistance to the upside, we will be looking to get in to a long trade towards an initial upside target of 660 flat. A stop loss on this one somewhere in the region of current price – say, around 648 – defines risk nicely.

To the downside, a close below support signals short towards 635. A stop at 647 works well on this one.

Charts courtesy of SimpleFX