Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

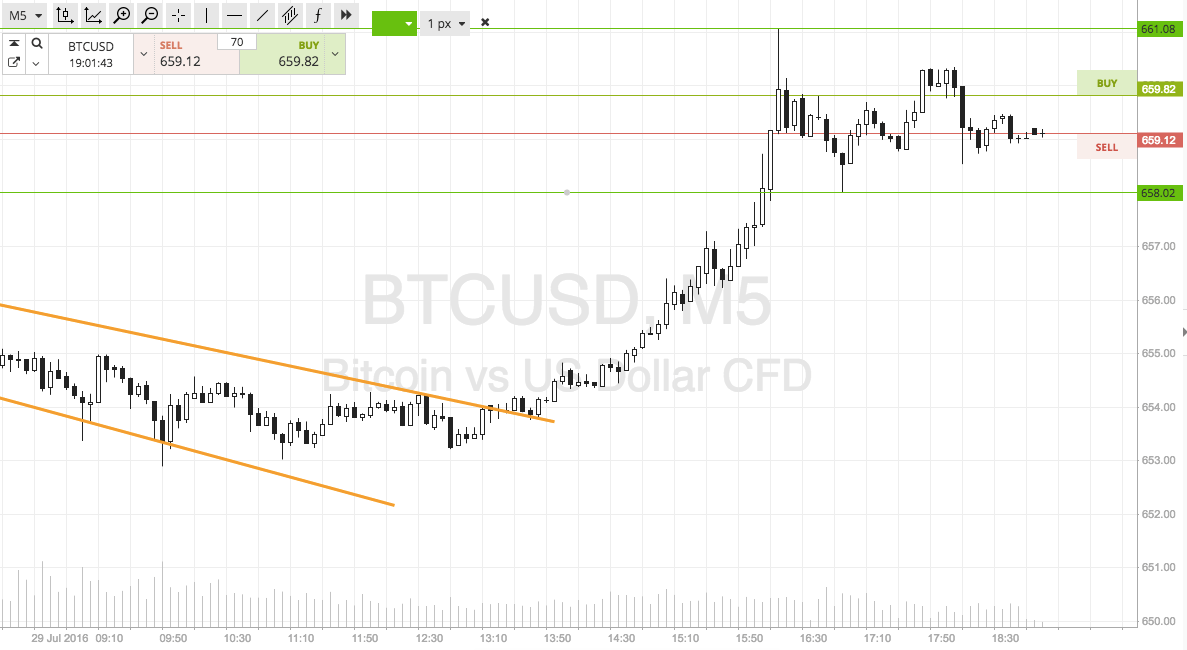

In this morning’s bitcoin price analysis, we mixed things up a little bit, and went with a variation on our standard strategy. Specifically, we looked at a downward sloping channel range (as opposed to our horizontal usual range) and said we would look to enter towards a five-dollar target on a break above or below the channel, dependent on which way price broke. We would go for some pretty tight risk management principles, with a circa two for one reward to risk profile, and see what happens on a set and forget scalp breakout.

As it turns out, this was a rewarding approach for the session. We got a nice upside break shortly after publishing our analysis, and this upside break carried right on through to our predetermined target. We did get a bit of a stutter early on, which turned out to be a retest, but this didn’t end up affecting the trade any.

As we go into tonight’s session, we are going to revert back to our horizontal range strategy, as this gives us a nice way to get in on the action that today’s price has carved out.

The image below shows the chart for today’s session, and also has the downward channel that we outlined this morning highlighted to show the trade.

As the chart shows, we are going to go at price tonight with a range defined by in term support to the downside at 658 flat, and in term resistance to the upside at 661 flat. These two levels are very close to one another, but it should give us some entries on any volatility, which is good.

So, we are looking for a close above resistance to validate an upside entry with a target of 666. Conversely, a close below support will signal a short position towards an immediate downside target of 654.

Charts courtesy of SimpleFX