Right then.

The middle of the week is almost upon us, and things haven’t gone great so far. We’re not down on the markets or anything – we’re actually a little bit up on our Monday balance – but things have been incredibly dull.

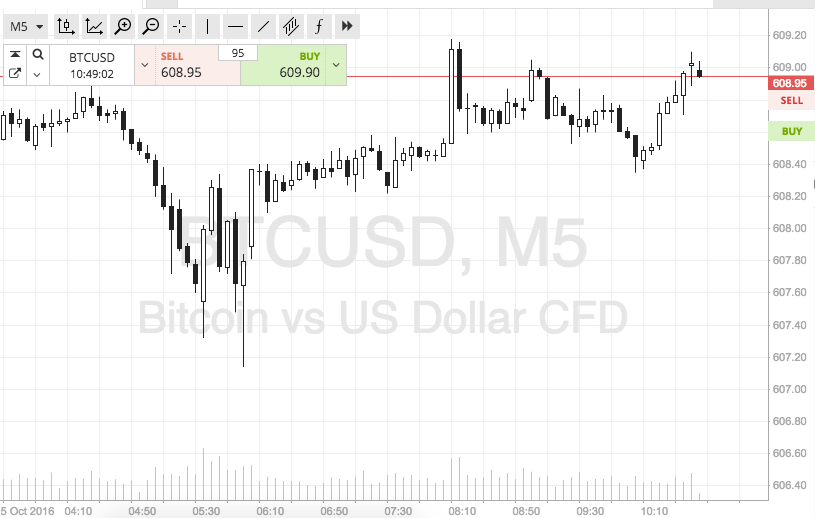

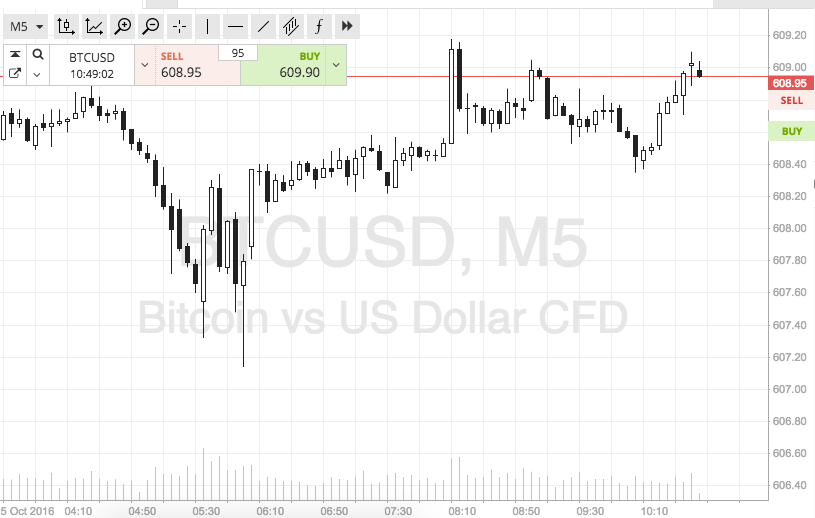

When we get action like this, all we can really do is sit and wait, maybe dabble with an attempt at a fundamental bias for a bit of variety. The thing is, you only really realize it when you pull out of the intraday charts a little, but despite everything that’s going on as part of the underlying framework in the bitcoin space, its flagship – price – is not really up to much. Take a look at the dailies, and you’ll basically see no action of note before the beginning of September. Sure, price spiked down mid to late month, but it recovered, and 600 ± 10 seems to be an inescapable range right now.

So, here’s what we are going to do.

We’re going to mix things up a bit. Yes, I realize we said we need to maintain our strategy rules, and we will be doing – long on a close above support, short on a close below resistance, target around $5-10 rewards and limit risk with a $2.5 stop loss.

Alongside this strategy, however, we’re going to bring a bit of binary scalp style trading into play.

Specifically, we’re going to pick a level, and trade along that level.

To get a better idea of what we mean, take a look at the chart below. Let’s say we’ve got 615 resistance, 605 support. Sounds good enough. Then we’ll use 610 as our binary level.

If price breaks our binary level (610), we’ll get in towards the level that sits in line with the break. A break (and not a close, this is important) above 610 puts us long towards 615. A break below 610 puts us short towards 605.

Let’s see how this plays out…