Okay. Here we are. The penultimate day of the week, and bitcoin price has finally started to pick up momentum. At the start of the week, we noted that we could be looking at targeting 800 as a medium-term upside target if the volatility that we saw towards the end of last week maintained throughout this one. As it turned out, however, action throughout the early half of this week was relatively flat, and we didn’t end up with our focus target available to us. However, once again, the end of the week is nearly here, and it is looking more and more likely that we’re going to hit 800 at some point near term. We have a couple of strong key levels that carved out overnight, and we are going to use these to put together some intraday targets (and in turn, an intraday strategy) for today. Chances are these won’t include 800, but we will have one eye on that level looking forward.

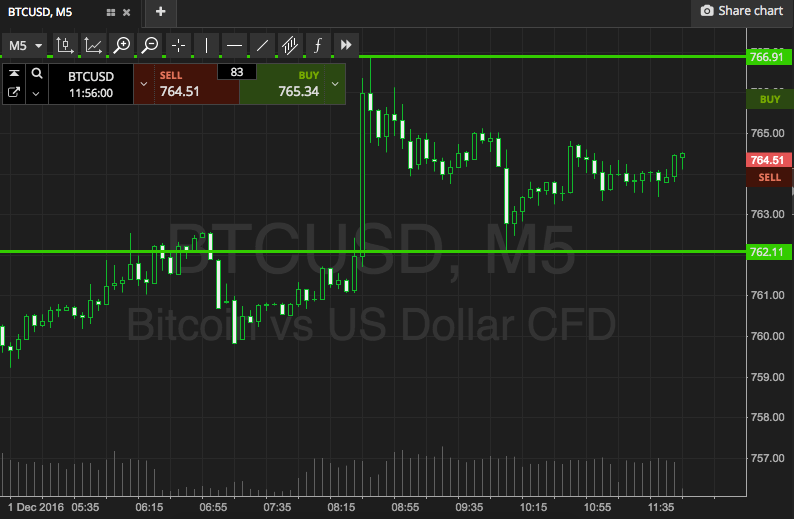

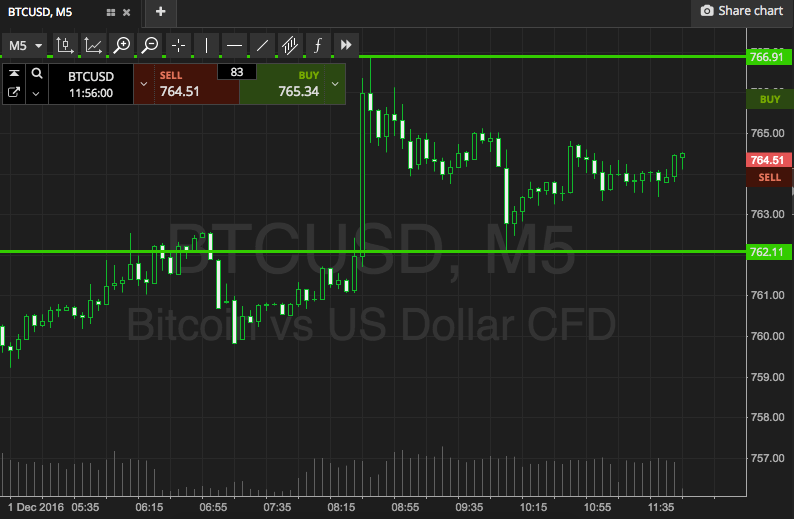

So, take a look at the chart below, to get an idea of the levels in focus for today’s session. The chart is a five minute candlestick chart, showing overnight action out of Europe.

As the chart shows, the levels we are watching for today’s session are support to the downside at 762, and resistance to the upside at 767.

If we see price break below support, we will get in short towards a downside target of 755. A stop loss on the position somewhere around 764 controls risk. Conversely, a close above resistance will put us long towards 773.

Again, a stop loss is necessary on the position, so we are going to look at controlling risk with a parameter somewhere in the region of – once again – 764.

This will ensure that we are only taken out for a small loss in the event that price reverses and starts to run against our bias.

Charts courtesy of SimpleFX