We’re heading into the Christmas period in the bitcoin price, and traditionally this is a pretty quiet period in the markets. We’re expecting a pretty similar trend across the crypto space (although there’s obviously some degree of Asian influence that will hold volume up in crypto, unlike in the US financial markets) so we’re not expecting any fireworks near term. With that said, over the weekend, we did finally get some solid momentum, and price ran up and through the 800 mark that we’ve been watching so closely over the last few weeks.

We got in long on the break and are still long towards 810. Normally this would negate any other potential entries, but as we outlined earlier in the week, because this 800 long entry is a secondary position, we are going to run it parallel to our standard strategy. In other words, we’re holding that in the background, but still running our standard intraday strategy up front.

So, with this said, and as we push into today’s session, let’s try and outline some key levels with which we can go at the bitcoin price today, and see if we can pull a profit from the market on any session volatility.

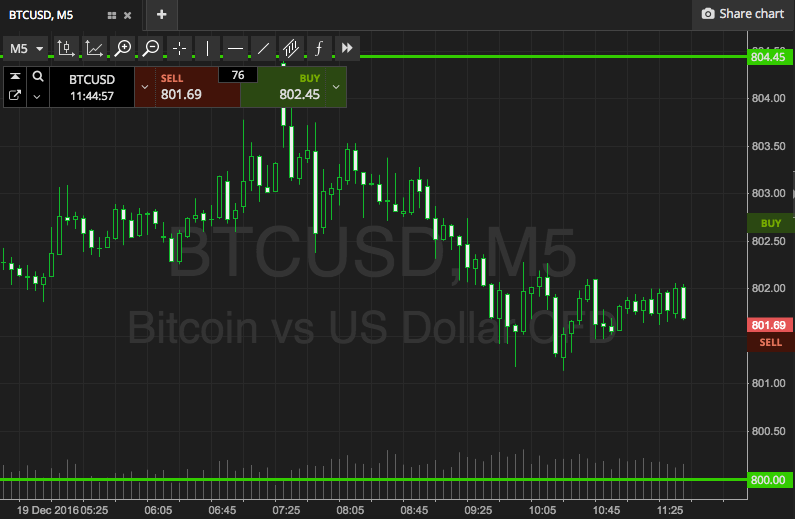

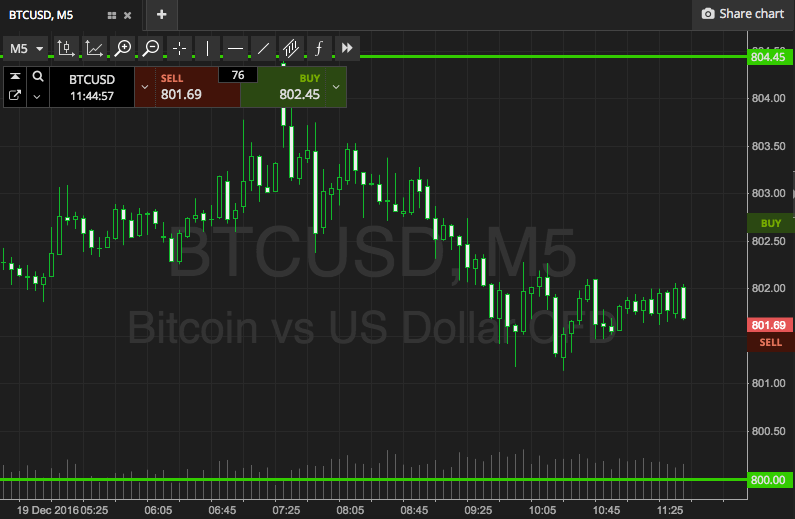

Take a look at the chart below to get an idea of where things stand, and where we are looking to get in and out of the markets as price moves.

As the chart shows, the range we are focusing on for today’s session is defined by in term support to the downside at 800 flat, and in term resistance to the upside at 805. If we see price break through resistance, we will look at getting in long towards 810, with a stop at 802 defining risk.

Conversely, a close below support will put us short towards 793. Stop at 803 on this one to make sure we are taken out if price reverses.

Charts courtesy of SimpleFX