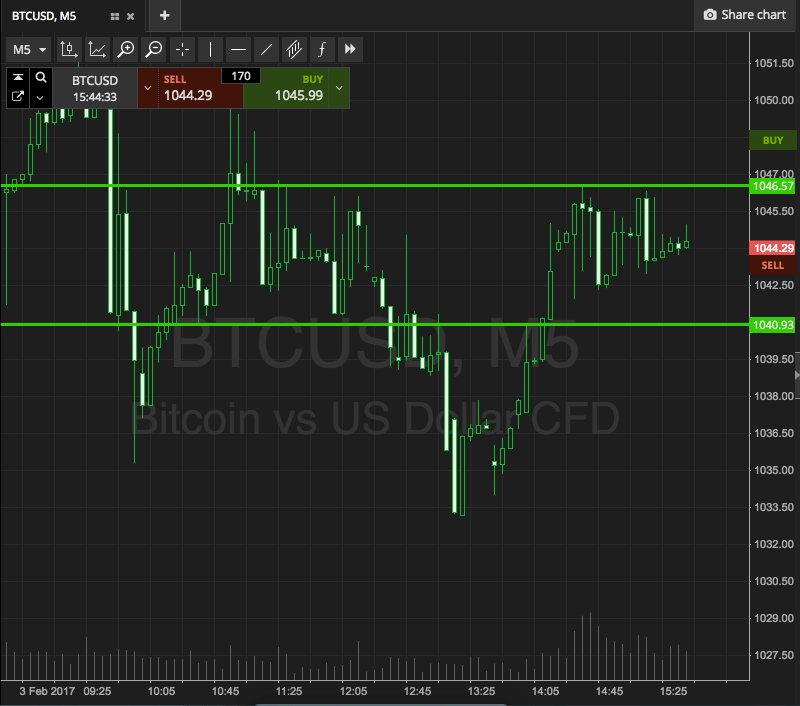

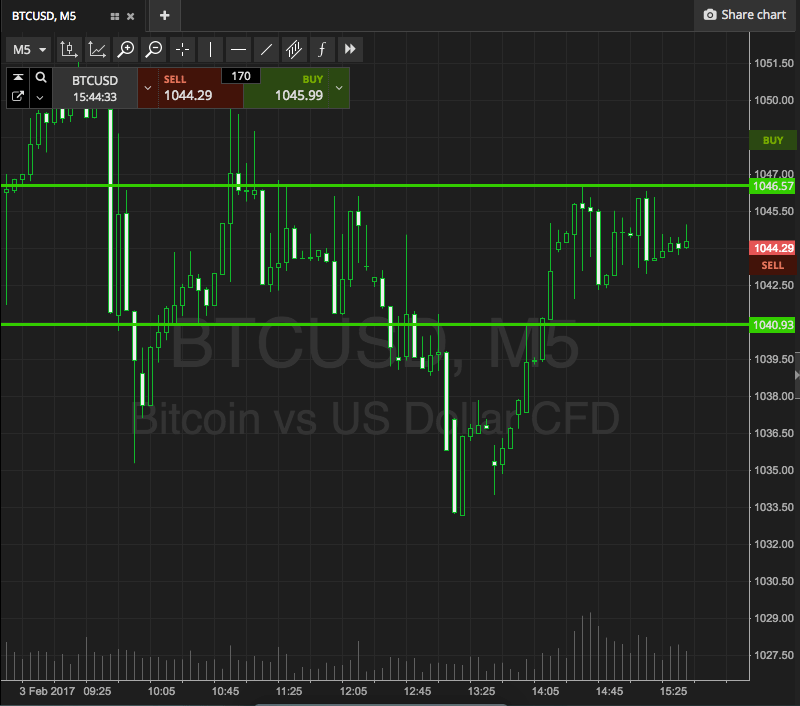

When we conducted the first of our two bitcoin price watch piece analyses this morning, we went into markets with something of a bullish bias. Action has now matured throughout the European session on Friday, and this bias looks to have been a bit premature. Price has been a bit choppy throughout the day today, without breaking either of our key levels, and as a result, this has meant that we haven’t managed to get into any substantial trades as yet. This isn’t a bad thing, it just means we have to be a little bit patient going forward. So, as we head into tonight’s Asian session, and the end of this week, let’s take a look at what we’re focusing on as far as our intrarange strategy is concerned. The chart below shows our range for this evening, overlaid on about 8 hours’ worth of action on a five-minute candlestick chart.

We are going to go at things with a breakout strategy, as mentioned, so the range we are targeting is defined by 1040 as support to the downside, and 1046 as resistance to the upside. This is a real tight range, and that’s why intrarange is out of the picture this evening. If thing’s alter a little bit later on, we will try and bring the slightly more aggressive element of our intraday approaches into play. If things don’t change, we’ll leave it on the sidelines.

So, with our range defined, let’s put together our system. If price closes below our predefined level support at 1040, we will look to enter a short position towards an immediate downside target of 1030. On this one, a stop loss somewhere in the region of 1043 looks good from a risk management perspective. Looking long, a close above resistance signals a bullish entry towards 1050. Again we need a stop loss, and somewhere in the region of 1042 looks like it should do the trick.

Charts courtesy of SimpleFX