OK, that’s another day done in the bitcoin price, and we’re sort of in a similar position right now as we were earlier this morning. That is, price hasn’t really moved that much throughout the session, and as such, we haven’t been able to get in or out of the markets in any intraday positions according to the rules of our strategy.

Our key focus this morning was the 1000 flat level, and our expectations for price moving in and around this level. We predicted that a break would precede a pretty decent run, but that this break was far from guaranteed, and that we might not see it throughout the European open today.

As it turns out, these expectations were correct. What it means now, though, is that the levels in focus for tonight’s session are pretty similar to those we were focusing on earlier today.

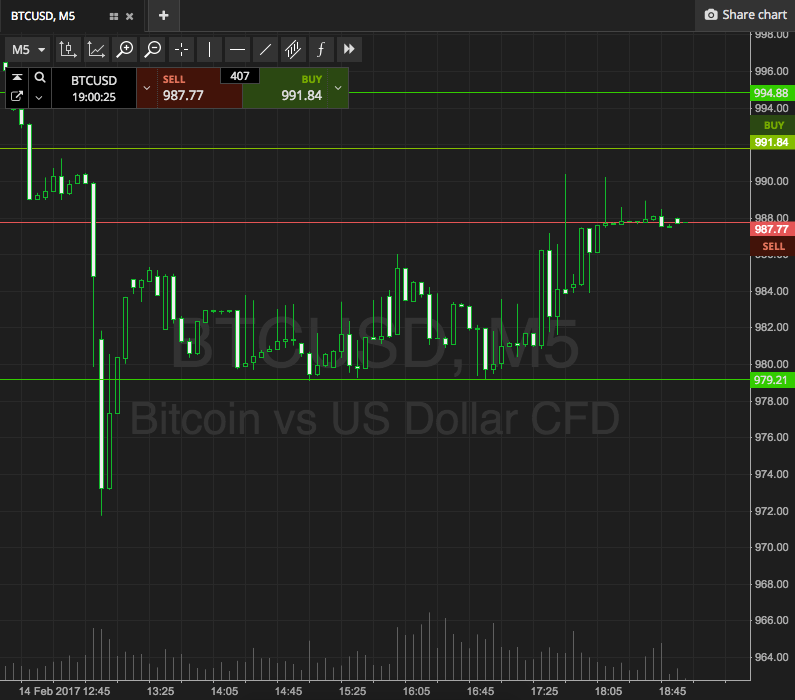

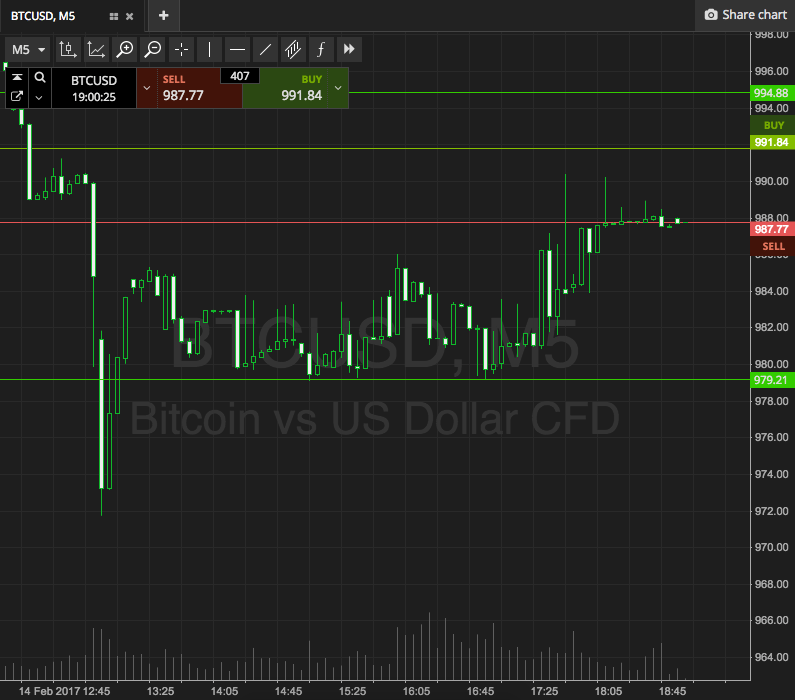

Anyway, that’s not really important. What is important is getting the levels in place, and being ready to move in to the markets as and when/if we get a signal. So, as ever, and before we get going, take a quick look at the chart below. It’s got our range highlighted in green, and there are around twelve hours’ worth of action displayed.

As the chart shows, the range in focus for this evening out of Europe (and beyond that, into the US afternoon session and early Asia tonight) is defined by support to the downside at 979 and resistance to the upside at 994. This is a little shifted lower than this morning, but for all intents and purposes, we’re going at the same entries.

If we see a break above resistance, we will look for a close above this level to put us in long towards an immediate upside target of 1010. A stop loss on the trade at 990 defines risk. Conversely, a close below support will signal a short entry towards a downside target of 970. On this one, a stop loss at 983 defines risk nicely.

Charts courtesy of SimpleFX