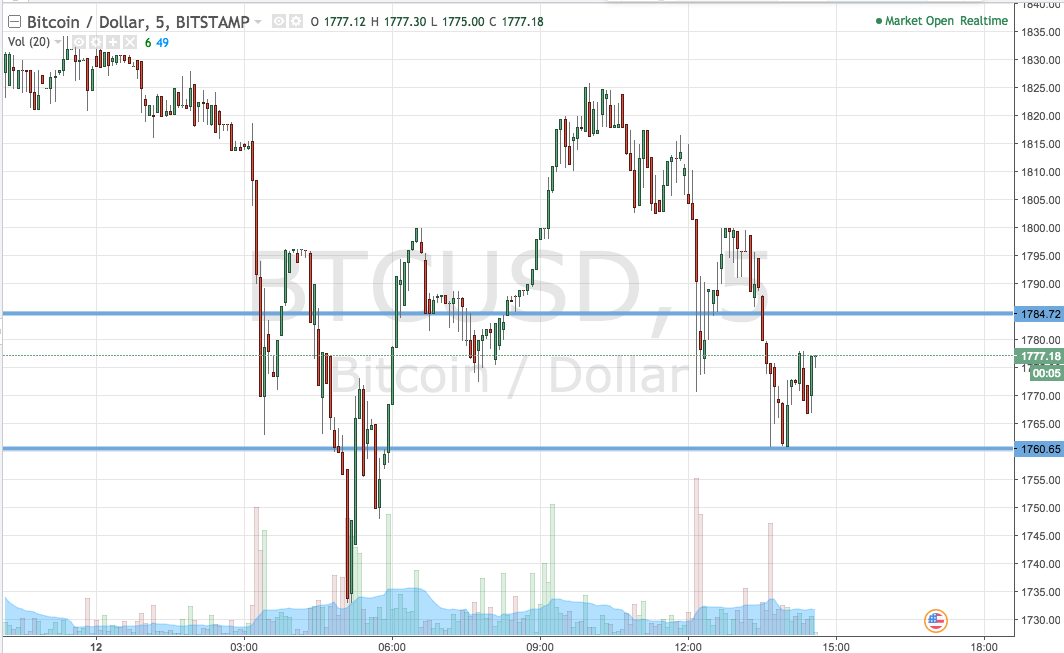

So we have reached the end of the week in bitcoin price trading efforts, and as we noted this morning, it is been a pretty good week. We have seen plenty of volatility, and price has gained on aggregate to the tune of something like $300. That’s a pretty nice move for a long-term holding, and add this to the fact that we have been able to get in on a number of occasions on the volatility that has accompanied this move, and we’ve essentially won on two counts. Exactly how things are going to play out over the weekend remains to be seen. Price seems to have settled into a bit of a sideways trading pattern this afternoon, and this sort of sideways trading can make things difficult to predict. We may see a breakout to the upside, and a return to the overarching bullish momentum. However, if instead, we see a downside break, we may see a slightly deeper correction than we were hoping for. Anyway, whatever happens, let’s set up some levels against which we can trade, and see if we can draw a profit from the market as the week draws to its own close. As ever, take a quick look at the chart below to get an idea of what is on and where we are looking to get in and out of the markets according to the rules of our strategy.

As the chart shows, the range we are looking at for this evening is defined by support to the downside at 1760 and resistance to the upside at 1784. We are going to keep things simple this evening and go after price with a breakout strategy only. Specifically, if price breaks above resistance, we will look out for a close above this level to get us into a long trade towards an immediate upside target of 1800 flat. Conversely, a close below support will get us in towards 1750. A stop loss on the first trade at 1780 looks good, while a stop loss on the second position around 1764 does the job.

Let’s see how things play out.

Charts courtesy of Trading View