So that is another day done for our bitcoin price trading efforts and it hasn’t been a bad one from an intraday trading perspective. Price moved relatively fast this morning and we managed to jump in and out of the markets for a quick turnaround profit on the levels we defined as part of our initial analysis pre-European open this morning. At that time, we noted that the US markets being closed today might impact volume and – by proxy – could translate to some relatively weak volatility.

As it turns out, the US closure hasn’t really had too much of an impact on price movement and, as we head into the evening session going forward, we expect things to pick up even more as the Asian markets take over.

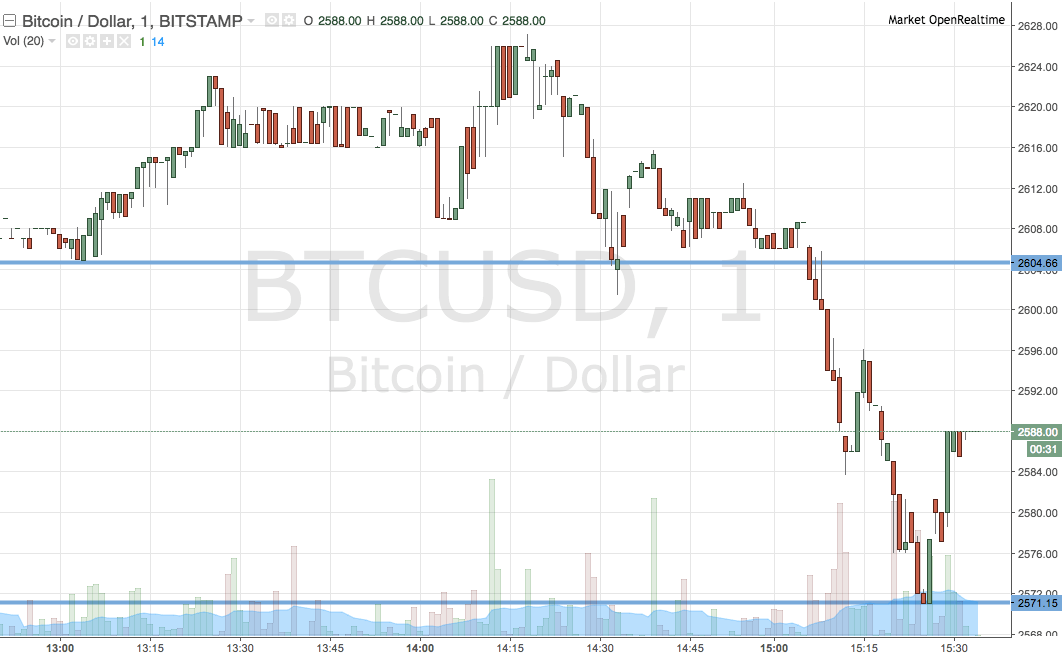

So, with that noted, here is a look at what we are focusing on in the bitcoin price right now and where we are looking to get in and out of the markets according to the rules of our intraday strategy. As ever, take a quick look at the chart below to get an idea of what is on and how action today has influenced our key levels for this evening. It is a one-minute candlestick chart and it has our key range overlaid in blue.

As the chart shows, the range we have in our sights this evening is defined by support to the downside of 2572 and resistance to the upside at 2604. We are going to stick with a breakout approach this evening, so if we see price break above resistance, we will enter long towards an immediate upside target of 2635. Conversely, a close below support will have us in short towards 2545. A stop loss on both trades somewhere around several dollars either side of the entry will ensure that we are taken out of the positions in the event that price turns against us.

Chart courtesy of Trading View

SaveSave