Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

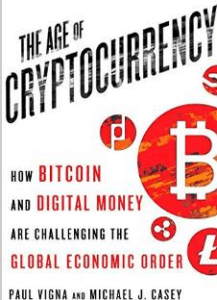

Yesterday evening, Wall Street Journal reporters and authors Paul Vigna and Michael Casey announced the release of their new co-authored book “The Age of Cryptocurrency: How Bitcoin and Digital Money Are Challenging the Global Economic Order.”

The pair took to Reddit overnight to take on one of the highly popular ask me anything (AMA) sessions – for the uninitiated, a thread on which Reddit users can fire questions at the pair regarding – as the name suggests – anything. Unsurprisingly, the questions focus primarily on the new Age of Cryptocurrency book and what impact the two authors and journalists expect it to have on bitcoin mainstream popularity.

Among the top 200 popular questions was this one (snippets taken from actual answers):

There is a lot of startups, investment and innovation in various cryptocurrency and blockchain technologies. What is the low hanging fruit and who’s playing the long game against regulatory institutions?

The answer:

Holy Grail for now seems to be in developing apps that make international remittances feasible. The savings for immigrants and their back-home families from digital currency transfers could be significant.

And this:

What impact do you believe Bitcoin will have on economic growth?

Answered:

Huge potential. Starting point: $80 trillion global economy. If you just save 3% in fees on that, you start with $2.4 trillion in savings. That’s about 16 times the total global development aid budget alone.

And finally:

What is the advantage to using bitcoin over regular money at banks?

To which the pair responded:

If you work for a company, if you’re a retailer, the advantages start to pile up. It’s faster, and cheaper. I’ve heard from and heard of retailers who are sold just on the cost savings versus credit cards.

Good to see some individuals involved in mainstream finance actually dig deeper into digital currency and its application. A shady bunch of numbers controlled by one hacker in his bedroom and only used for buying drugs? Perhaps this impression is finally starting to falter.

Did you follow the thread, or ask a question? What were some of your favourite responses? Let us know!

If you want to take a look at the whole thread, you can do so here.

If you want to buy the Age of Cryptocurrency using bitcoin, go here.

If you want to buy the the Age of Cryptocurrency using what Vigna refers to as old money, you can here.

Images from Reddit and Michael Casey and Paul Vigna.

Bitcoin fees are not a savings over conventional credit card fees, and are higher fees than a CC with a rewards program. The fees are paid by a 3rd party process of bitcoin printing, but they are the incentive that motivates the system.

Merchants should be happy to accept bitcoin. They can rapidly convert to dollars and have a no worries about CC validity issues. The fees being paid by the merchant side is already the norm, so they can accept a little transactional loss.

Consumers should use the purchasing process that pays them: a credit card with a rewards program. And in this case, the merchants that are not monopolies who can turn down non-cash, non-bitcoin sales … they have to take the transaction conditions set by the customer.