Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

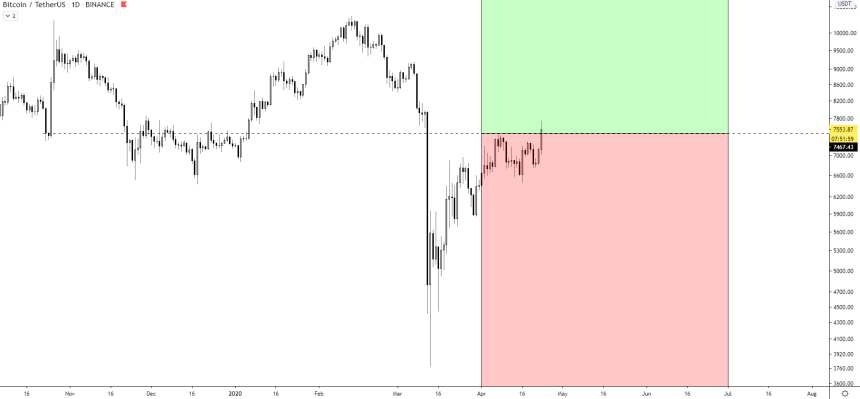

The entire crypto market saw a notable upswing today that was driven by Bitcoin’s sharp movement up to highs of $7,800 earlier this morning. This has led most major altcoins to push higher, with the aggregated market’s strength continuing to grow.

In the time following this movement, Bitcoin’s price has settled back below $7500 – a critical level that analysts are now closely watching.

How it reacts to this level in the days and weeks ahead could dictate which direction the aggregated crypto market trends next.

Crypto Market’s Fate May Rest on How Bitcoin Responds to Key Level

The market-wide upswing seen today came about after the benchmark cryptocurrency pushed up to highs of $7,800, leading Ethereum, XRP, and virtually all other major altcoins to also push higher.

Altcoins have formed an incredibly close correlation to Bitcoin in recent times, just slightly outperforming it during uptrends and underperforming it during downtrends.

This correlation means that the fate of the crypto market rests on which direction Bitcoin trends next, and traders could soon gain some clarity as it fast approaches a critical level.

One popular crypto analyst on Twitter spoke about this critical level in a recent tweet, explaining that the $7,500 region has proven to be important on multiple occasions throughout 2019 and 2020.

“Since 2019 a level of upmost importance has been 75xx – Above it: trend has been very bullish. Below it: trend has been very bearish (provided great entries) – Currently testing waters above it, confirming it support would be exciting to say the least,” he noted while referring to the below chart.

How BTC responds to this level is likely to have a major impact on where the aggregated crypto market trends next.

Could the Market’s Outlook be More Dire Than It Seems?

There’s no question that today’s upswing was an overtly bullish occurrence, as it marked continuation of the trend that was incurred when Bitcoin rebounded from March lows of $3,800.

This uptrend may not last long, however, and could soon lead the aggregated crypto market to see a significant decline.

One pseudonymous trader on Twitter recently offered a grim chart that shows the multiple heavy resistance levels that exist just above Bitcoin’s current price level, with a labeled downside target sitting at around $4,700.

If this possibility does unfold in the near-term it will likely lead most major cryptos to similarly see some intense losses, potentially severely underperforming Bitcoin.

Featured image from Unsplash.