Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

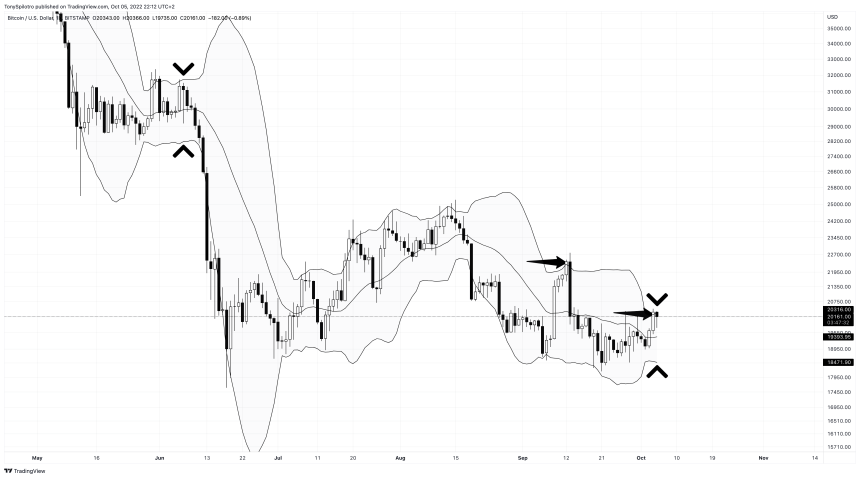

In this episode of NewsBTC’s daily technical analysis videos, we look at the latest move up in Bitcoin price using the Bollinger Bands across a variety of timeframes and explain why a close above the upper band could lead to a larger move to the upside.

Take a look at the video below:

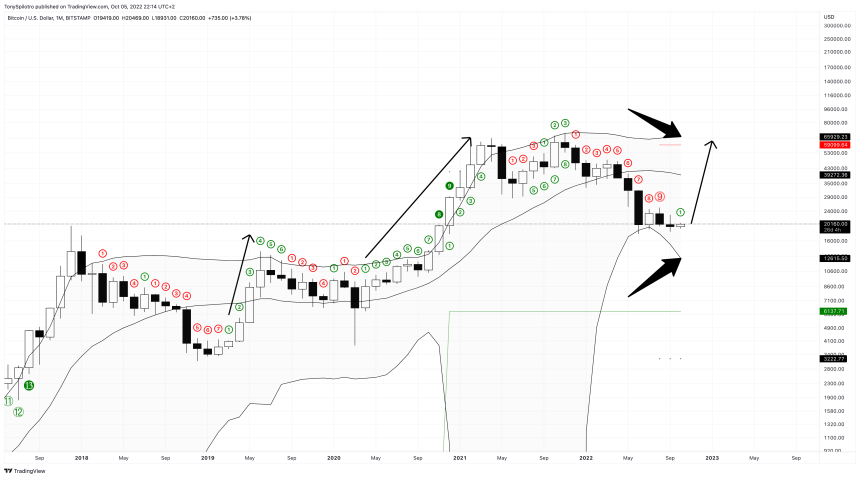

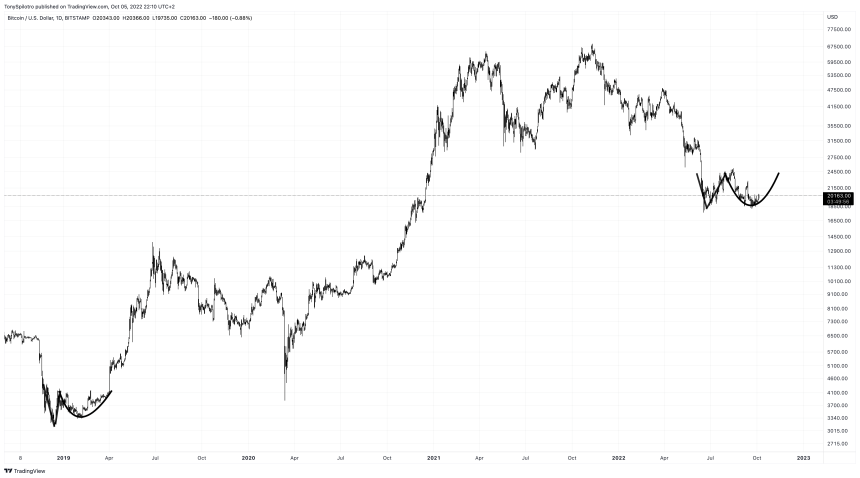

Biblical Bear Market Bottom Pattern Is Back

The rounded bottom would be the second half of an Adam and Eve double bottom formation. This is the same pattern that resulted in the 2018 bear market bottom and is characterized as a V-shaped correction followed by a slower rounded bottom.

Is another bear market bottom building? | Source: BTCUSD on TradingView.com

Crypto Market Gears Up To Ride The Bands

Bitcoin’s latest move up is particularly notable due to the daily close taking place outside of the upper Bollinger Band. As you can see from the last time this happened, it can lead to a strong rejection back to the mid-BB. Holding above this level could lead to a larger move to the upside.

Expansions in volatility are most important and worth paying attention to, as the tool’s creator would probably say himself. When the Bollinger Bands squeeze, it is a sign of low volatility – a short-lived phase that always ends with a bang and large move.

Closing today’s daily above around $20,350 should do the trick and keep Bitcoin above the upper band. If not, the next logical target is likely the middle-band at $19,400.

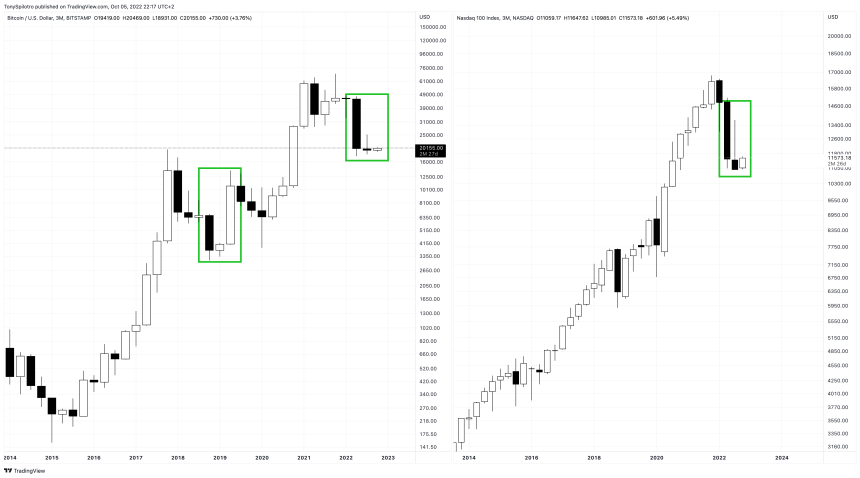

Monthly Bollinger Bands Give Two Possible Targets

The monthly Bollinger Bands were tapped for the first time in Bitcoin history during this bear market. This suggests that Bitcoin price is extremely low relative to monthly price action historically and it could imply a buying opportunity.

The lower band is drifting downward, which means if Bitcoin continues downward also, the next target could be as low as $12,000 before more dynamic support is found. If Bitcoin heads back toward the upper band, $60,000 BTC is the target instead, making the setup decent in terms of risk versus reward.

However, if Bitcoin can maintain upward momentum, a new uptrend could confirm. The TD Sequential isn’t just helpful for finding potential turning points when the series reaches a 9 or 13, a new 1 can often signify the start of a new uptrend and is yet another important signal.