Key Points

- Bitcoin cash price is slowly recovering and is currently trading above $640 against the US Dollar.

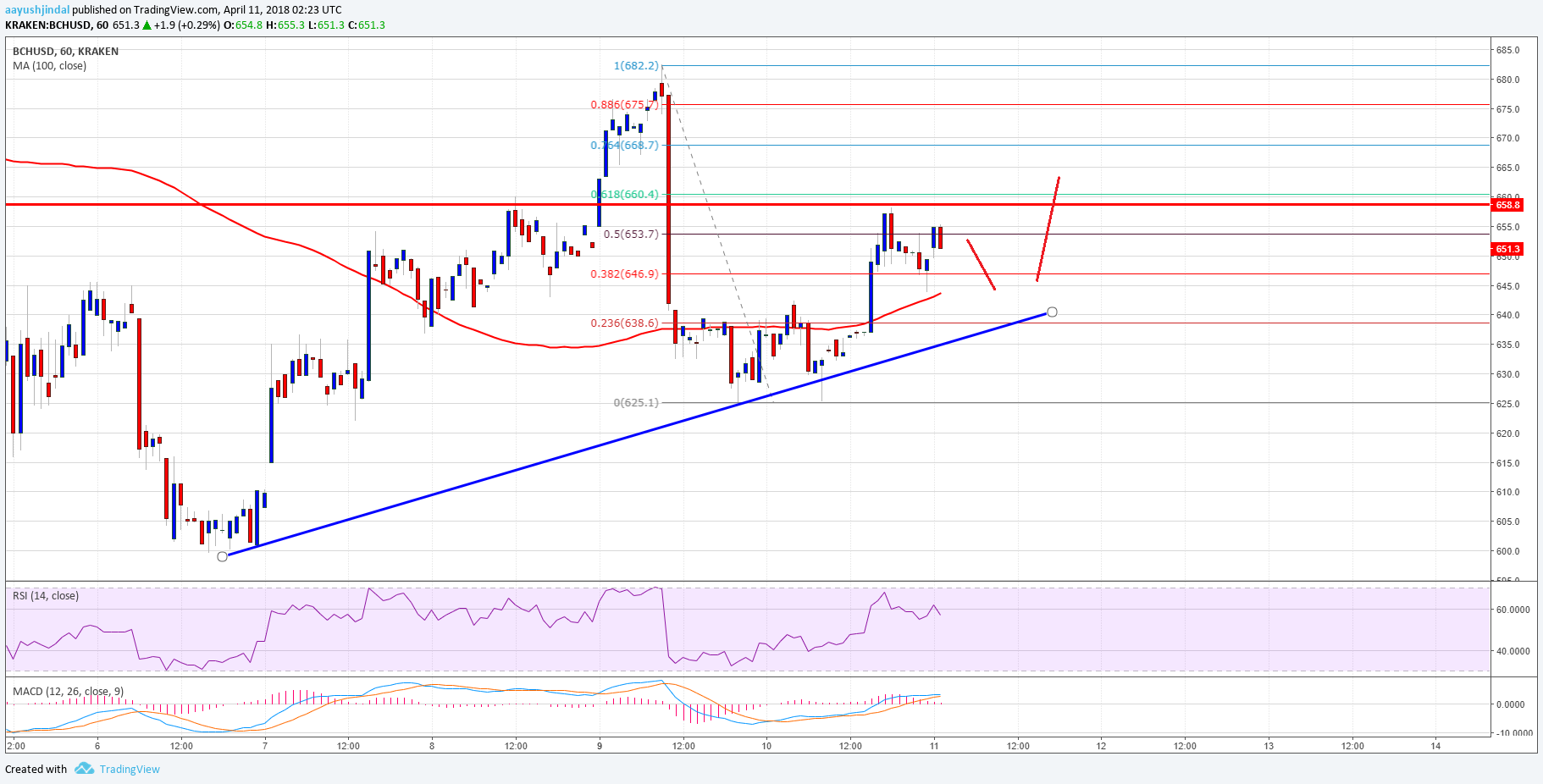

- There is a new connecting bullish trend line forming with support at $642 on the hourly chart of the BCH/USD pair (data feed from Kraken).

- The pair has to move above the $660 resistance to retest the $680 resistance in the near term.

Bitcoin cash price is back in a positive zone above $640 against the US Dollar. BCH/USD is now above 100 hourly SMA and looks set to break the $660 resistance.

Bitcoin Cash Price Resistance

Yesterday, there was a sharp downside correction below $640 in bitcoin cash price against the US Dollar. The price traded as low as $625 where buyers appeared. There were two attempts to break $625, but the price succeeded in overcoming selling pressure. As a result, there was an upside move and the price moved above the $640 resistance and the 100 hourly simple moving average.

Moreover, there was a break above the 38.2% Fib retracement level of the last decline from the $682 high to $625 low. At the moment, the price is placed nicely above the $640 support, but it is facing a major hurdle near $660. The mentioned $660 resistance is the 61.8% Fib retracement level of the last decline from the $682 high to $625 low. A break above the $660 resistance would open the doors for more gains in the near term. The next hurdle for buyers is near the $680 level.

On the downside, an initial support is near $645 and the 100 hourly SMA. There is also a new connecting bullish trend line forming with support at $642 on the hourly chart of the BCH/USD pair.

Looking at the technical indicators:

Hourly MACD – The MACD for BCH/USD is now in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BCH/USD is currently near the 60 level.

Major Support Level – $640

Major Resistance Level – $660

Charts courtesy – Trading View

I gave up on BCH, I think the whales got weak and can’t push this anymore, I love how ETH/USD is having more gains than BCH/USD which had a couple of good news recently unlike the ETH ASIC mining threat.