Bitcoin prices edged higher on Wednesday as traders pinned hopes on the ongoing stimulus talks and fresh guidance from the Federal Reserve.

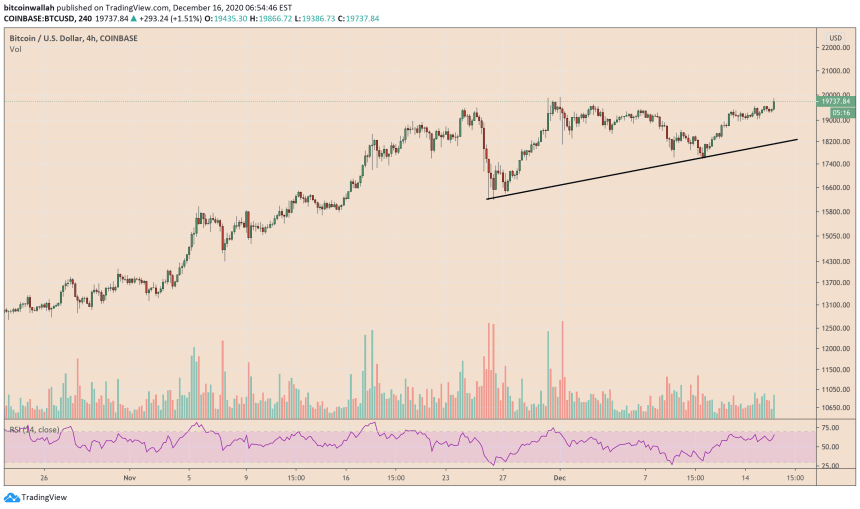

The flagship cryptocurrency rose up to 2.18 percent to $19,866, its best level in two weeks, after breaching above the previous resistance area between $19,500 and $19,600. The move uphill accompanied a spike in trading volume, suggesting an outright breakout attempt.

Bitcoin hits two-week high after breaking above $19,500-19,600 resistance. Source: BTCUSD on TradingView.com

Meanwhile, Bitcoin’s climb coincided with a further plunge in the US dollar. The greenback fell 0.30 percent to 90.423 against a basket of foreign currencies in the European morning session, primarily in response to reports that US lawmakers have come closer to reaching a deal for coronavirus relief package.

It also fell in the wake of pound’s renewed strength after hints of a Brexit deal.

Bitcoin typically trades inversely to the US dollar due to its anti-fiat narrative. Traders and investors look at the cryptocurrency as their hedge against a weakening greenback, a philosophy that takes cues from its gold-like scarce features. On Wednesday, the narrative helped BTC/USD eking decent intraday gains.

FOMC Meeting

The pair remained well supported also by the Federal Reserve’s policy meeting update scheduled for release on Wednesday, 1430 EST. Money managers are waiting to see that for now longer the US central bank would continue its current asset-purchasing facilities, and at what pace.

The Bitcoin market has grown incredibly faster amid the Fed’s dovish policies, which include near-zero lending rates and unlimited bond-purchasing programs. While aiding the US economy, the facilities have also reduced shine off the short-dated US Treasurys, with many of them now returning negative yields.

https://twitter.com/lebas_janney/status/1338842266870423554

Furthermore, the Fed chairman Jerome Powell earlier committed to keeping the programs interact unless they achieve maximum employment or annual inflation rate above 2 percent. Combined, the dovish stance further prompted investors to shift their capital into the riskier assets like Bitcoin, which promised to return better profits.

Bitcoin Technical Outlook

A pseudonymous analyst earlier spotted the Bitcoin price in an Ascending Triangle, a bullish continuation structure that forms when an asset makes higher lows under a horizontal resistance level. The analyst noted that breaking above the Triangle resistance would take the price as high as $23,000.

Bitcoin trade setup as presented by CryptoHamster. Source: BTCUSD on TradingView.com

But other analysts reminded about the recent downside rejection that came immediately into Bitcoin’s all-time high achievement. To them, breaking above $20,000 is still a challenge.

“Sell signal just given above $19,700,” said one trader after Bitcoin corrected from its intraday high Wednesday.