Bitcoin took a deep dive on Wednesday to test the levels last seen in May.

The benchmark cryptocurrency plunged by up to circa $566.29, or 7.65 percent, in just two hours of trading. The move downside brought bitcoin down to a session low of $7,402.20. While the price later corrected, its upside remained capped by the support-turned-resistance level of $7,500, hinting an extended bearish action.

The story was the same across the other top cryptocurrencies. Ethereum, the second-largest cryptocurrency by market cap, was down 7 percent while the third-largest XRP plunged by circa 6 percent. Litecoin, Binance Coin, and Bitcoin Cash also suffered similar setbacks. On a whole, the entire cryptocurrency market cap lost about $19 billion on a 24-hour timeline.

A Random Dump after Brexit Vote?

The downside in the bitcoin and altcoin markets appeared almost a day after UK President Boris Johnson was able to secure parliamentary support to his Brexit deal. Nevertheless, the optimism did not last for too long as the House of Commons refused to get Brexit implemented on or before October 31. As a result, PM Johnson would not be able to live up to its populist promise of delivering Brexit before the said, make-believe deadline.

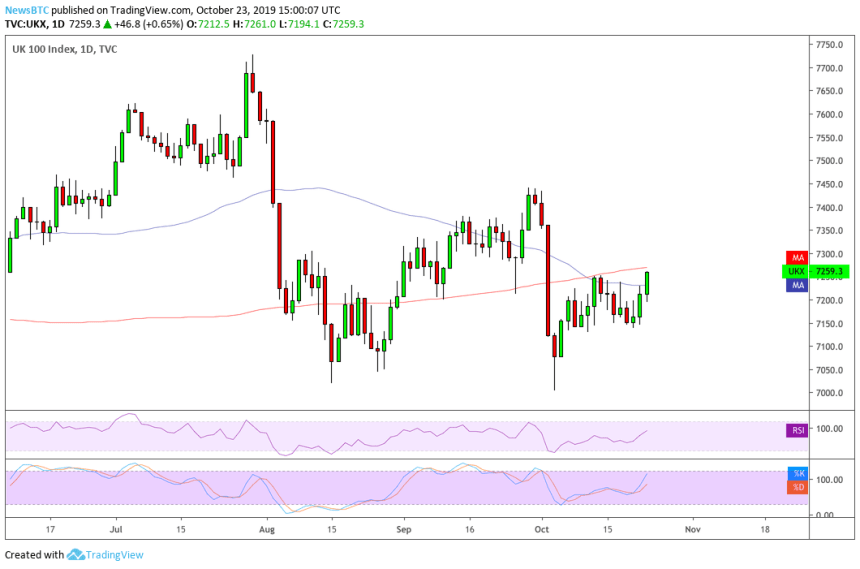

The outcome, in the long-term, appears positive for the UK, signaled by the upside performance of local equities on Tuesday and Wednesday.

As Mohamed El-Erian, chief economic adviser to Allianz, said on Twitter, a good deal could offset weakening global fundamentals” and “growing central bank ineffectiveness” to boost global equities.

.#UK #currency is up almost 1% on the day, now trading at 1.2942.

Yield on 10-year government #bonds is up 7 bps to 0.77% as #markets re-assess to the positive #UK #growth prospects.

Questions, and the uncertainties associated with them, now shift from design to implementation. https://t.co/5QONblyekO

— Mohamed A. El-Erian (@elerianm) October 17, 2019

Meanwhile, investors could take a Brexit deal as a sign to move out from hedging assets like Bitcoin to risk-on assets. With the cryptocurrency dipping massively right after the Brexit breakthrough, the signals are becoming more accurate.

Mark Zuckerberg’s Grilling on Libra

Bitcoin’s massive fall also comes on the day when Facebook co-founder Mark Zuckerberg is appearing before the US Congressional committee to answer questions about their payment project Libra. Earlier in June, the cryptocurrency had surged by more than 50 percent after Libra announcement. However, it also dropped after global lawmakers and regulators voiced their concerns against Facebook’s involvement in a financial project.

https://twitter.com/BLOCKTVnews/status/1187020618606284800

BitMEX Liquidation

Meanwhile, there are reports of more than $250 million liquidations of Long positions on controversial crypto derivative exchange BitMEX. The impact is clearly visible on the spot market rates of bitcoin.

Bitcoin slid by more than 6% in the last 20 minutes. Massive long squeeze – more than $205M in liquidations on BitMEX in the last hour. pic.twitter.com/F703F9DnEq

— Larry Cermak (@lawmaster) October 23, 2019

“If buyers weren’t interested in $7,800 bitcoin, they’re likely not interested in $7,500 price,” said market analyst Josh Rager. “It likely goes lower with confluence support at $7,200 & below Even after a natural bounce there, it comes down to where large/aggressive buyers are interested.”