Bitcoin has finally done it. Minutes ago, the asset rocketed past $10,000 for the first time in weeks, reaching as high as $10,250 in a massive surge upward. This was a more than 7% jump from where the cryptocurrency was trading prior to the move.

Traders were largely unaware that this move was going to happen.

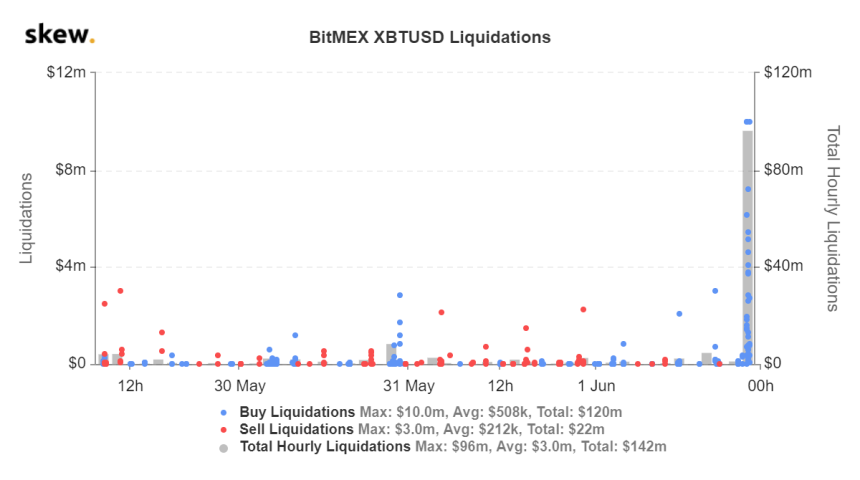

As a result, data from Skew.com shows that more than $80 million worth of short positions were liquidated on BitMEX alone. These shorts were liquidated within the span of an hour, and these numbers only count BitMEX, not other margin exchanges.

Mike Novogratz Expects More Bitcoin Upside

Galaxy Digital co-founder and CEO Mike Novogratz expects more upside.

Just an hour prior to this explosive surge higher, he noted that Bitcoin was “coiling” and was poised to “take out $10,000 soon.”

Novogratz explained that with government balances skewing in favor of debt, there is a narrative rapidly forming that could boost Bitcoin. This echoes the lines of Tesla CEO Elon Musk and billionaire hedge fund manager Paul Tudor Jones, who said that the increase in government spending and debt make BTC look good.

“$BTC is coiling. It will take out 10k soon. All the tragic turmoil in the USA adds to the narrative. Budgets are going one way and it’s the opposite of balanced. When 10k goes it will move fast. Get on the train,” Novogratz said.

$BTC is coiling. It will take out 10k soon. All the tragic turmoil in the USA adds to the narrative. Budgets are going one way and it’s the opposite of balanced. When 10k goes it will move fast. Get on the train.

— Mike Novogratz (@novogratz) June 1, 2020

Novogratz believes that prices will “move fast” now that $10,000 has been taken out, presumably referencing the importance of the $10,000 resistance.

An Auspicious Candle Close

Bitcoin’s outperformance comes shortly after the cryptocurrency saw an extremely auspicious candle close for the month of May.

As reported by NewsBTC previously, the asset closed May above a crucial resistance — $9,360. An analyst explained the importance of that level with the following:

“We’ve not had a Monthly close above 9360 in nearly 12 months. Rejections from this level have led to tests of $6k and eventually $3k.”

When Bitcoin failed to pass this level in February, prices dove to $3,700 during March’s capitulation. And when BTC was rejected from this level in 2018, there was a brutal bear market to $3,150 in the ten months that followed.

The fact that BTC closed above it is “incredibly important for bulls,” as one analyst described.

Featured Image from Shutterstock