Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

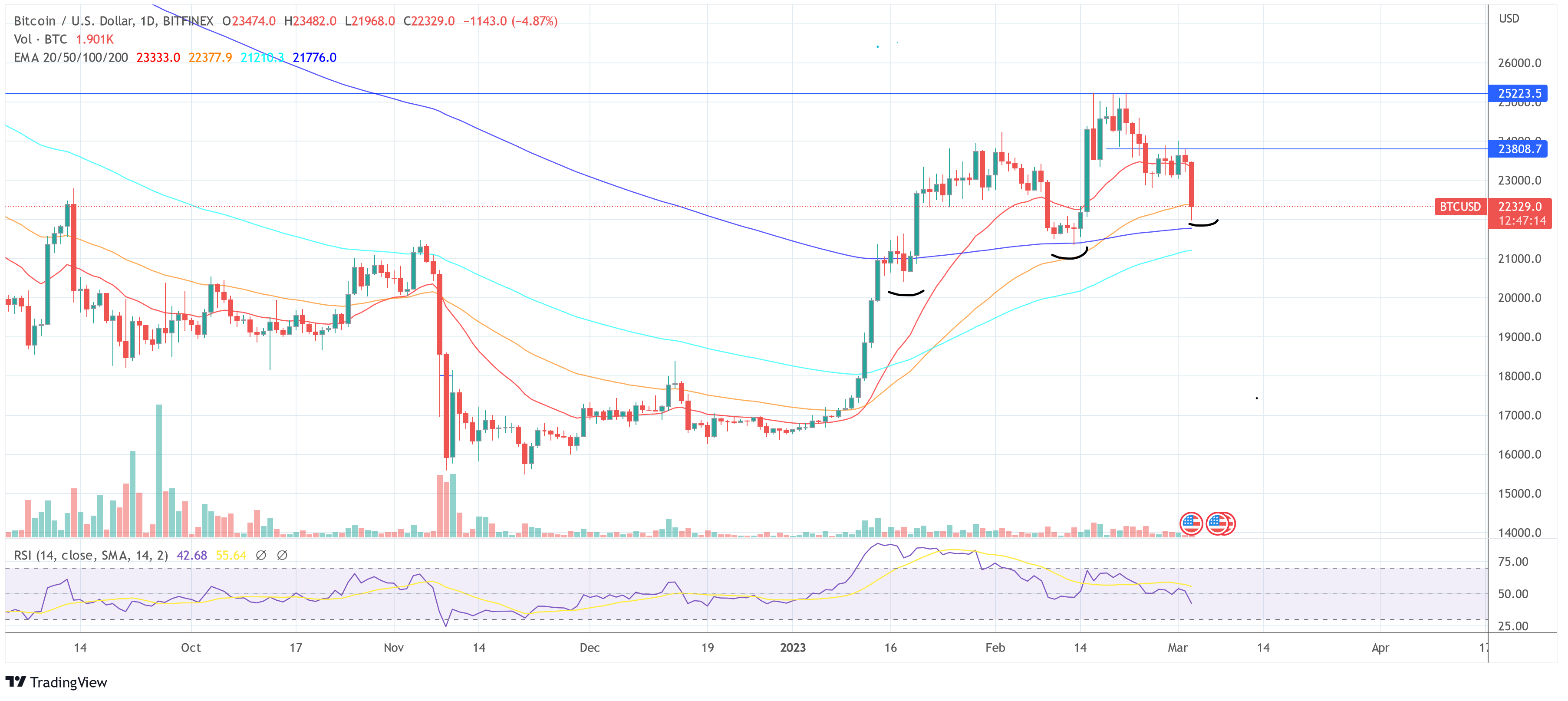

Bitcoin saw its biggest long squeeze in four months at the start of the trading day in Hong Kong today, which briefly sent the price below $22,000. Within the last 24 hours, a total of over $73 million in longs were liquidated, and over $200 million in the entire crypto market.

As NewsBTC reported, the sudden crash can be attributed to various reasons, with more than just the Silvergate narrative likely playing a role. Apparently, there was a huge transaction on Binance a minute before the collapse that triggered the cascading effect.

Bitcoin Funding Rates Fall Into Negative

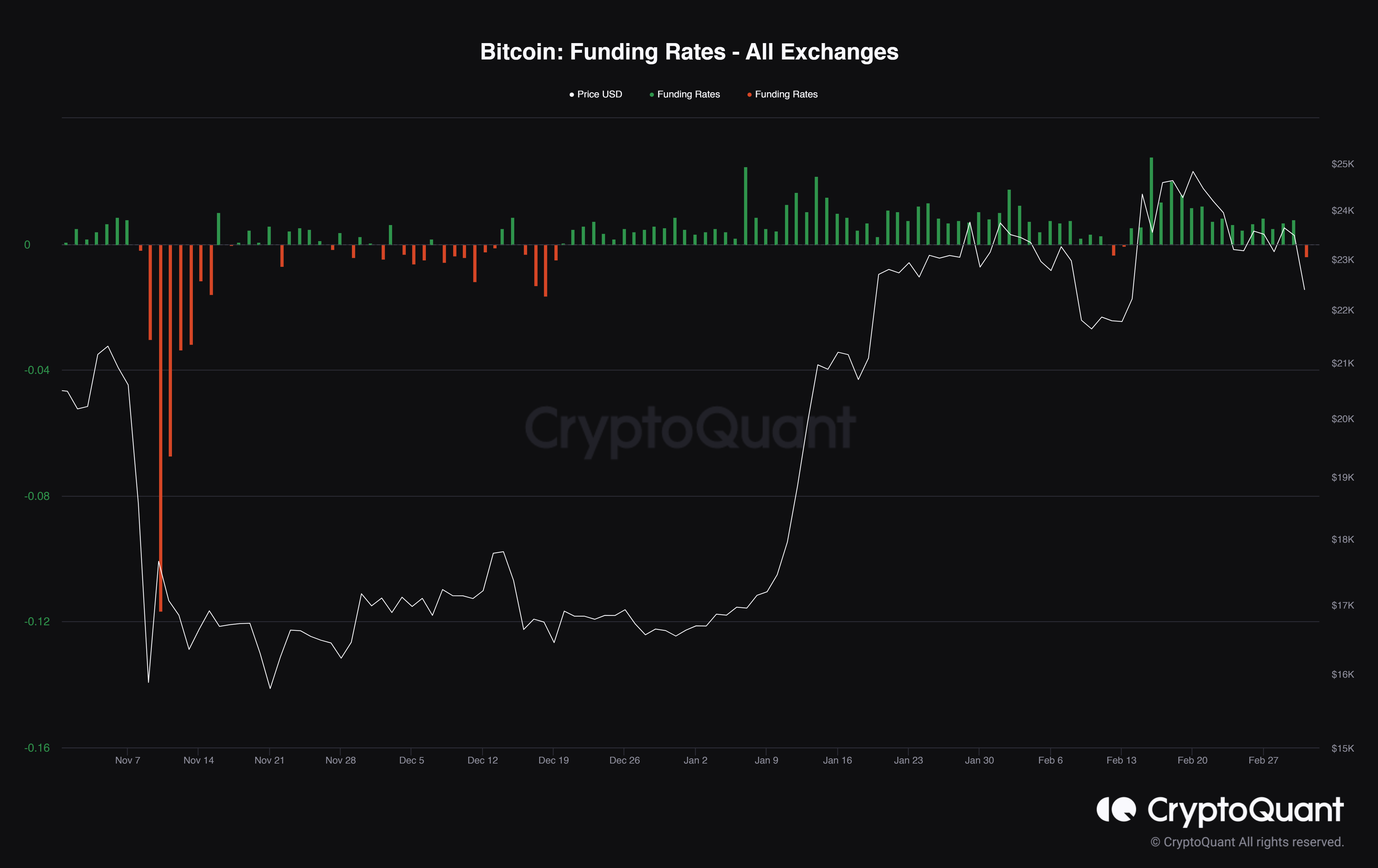

The liquidation of the long positions has the positive side effect that the Bitcoin funding rate across all exchanges is negative for the first time since February 13. Remarkably, that day marked the last local low before the Bitcoin price rallied from $21,300 to $25,200.

As the chart from CryptoQuant shows, the Bitcoin price was in a consolidation phase from January 20 to mid-February, after a massive Bitcoin rally during the first three weeks of January. During the uptrend, the funding rate was consistently positive, reflecting the bullish sentiment on the market.

It required a reset before the next leg up could happen. When the sentiment seemed to turn around, the bulls took the opportunity to short-squeeze the bears and initiated the next move upwards. This scenario could now be on the table again.

Funding rates are periodic amounts paid between short and long traders holding positions in open-ended futures contracts. Their purpose is to keep the spread between Bitcoin spot and Bitcoin futures in sync.

When a funding rate is positive, long positions are paid with short positions, reflecting bullish sentiment. The opposite is true, when funding rates are negative, bearish sentiment prevails in the market. Commenting on today’s pivot, analyst James V. Straten said:

Bitcoin perpetual funding rate turns negative. So far this year it’s gone wrong for the bears every single time.

Even though Bitcoin’s funding rate is only slightly negative, today’s trend is notable as the metric is negative for the first time in weeks, reflecting concerns of another price drop.

However, it is important to note that from a purely technical perspective, Bitcoin is still in an uptrend. Theoretically, BTC could fall even further to maintain the higher low structure.

Nevertheless, Bitcoin is now close to the “do or die” level. A fall below the block around $21,600 would mean a break in the market structure.