Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

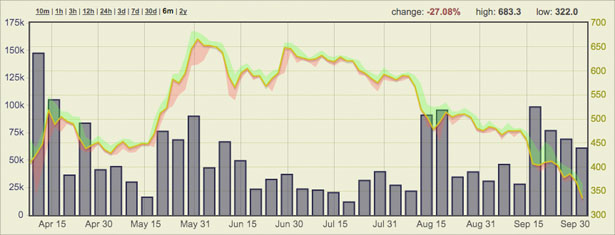

The value of bitcoin has descended over thirty percent over the past month, reaching a 2014 low of $322 USD at the Bitstamp exchange on Saturday.

The price has descended nearly 8 percent in the past twenty-four hours (dropping about $30), leading many to ask: what in the world is going on?

Social media is littered with discussion on the matter, and you can sense the overwhelming feeling of fear, uncertainty, and doubt. Lots of speculation, theories, and even an anti-suicide public service announcement.

Here’s a visual of the price over the past six months:

Certainly not a pretty sight, particularly for those with significant amounts invested in the digital currency.

Not everyone has lost hope, though. Many users are holding on tight to their digital money regardless of how far down the price goes. Some see the value climbing up again, others simply believe in the concept of bitcoin and what it stands for.

I won’t speculate about what the driving force here is for the down trend, so instead I open the floor to you. What do you think is causing the price to sink down so low? Further, what do you expect from the markets in the weeks ahead?

Chime in. I’m always interested in reading what you folks have to say.

Its hard not to feel discouraged. But it will come back up I think.. I hope

Buy now before the China and Russian whales get started. $10,000 by end 2014.

Not likely

Is the panic selling over yet? Some of us have actual work to do.

People are wising up… how can you call shit that you bid for on eBay a currency?

Probably since Russian sell off, causing knock on effect of other sell offs.

In any case, it’s still on an uptend big picture wise if you consider last year’s low of e50. If you said to us then that the new low is in triple figures, wed be pretty happy.

I’m betting the big buyers will start to come in at 200>.

The problem is the bitcoin model is broken – it was supposed to allow users an anonymous form of currency, but for the most part, any place/service you want to utilize bitcoins requires your information. Turns out that if you want anonymity, cash is still king.

It’s a combination of big merchants accepting payments in Bitcoin and then selling for cash, which puts downward pressure on the market, as well as the Russian government banning Bitcoin and imposing fines, causing large numbers of Russian Bitcoin holders to panic sell. I think this could go on for another week or two before it bounces back as huge amounts of Bitcoin are being sold, driving the price down until it gets low enough that enough people see a buying opportunity. There is a lot of money invested in Bitcoin startups and tech in the US, and I can’t see it going down for much longer, but where it will bottom out at, no one can say. There is no minimum to which it can go, because there is no fundamental value aside from the technology itself.

We are seeing an environment where Bitcoin and crypto-currencies are losing status as “world money” and becoming more marginalized to specialized uses because of government action and fear of money laundering. Even in the US, the IRS capital gains tax ruling does not bode well for Bitcoin investors and miners. All these factors are driving the price down fast. However, as a payment system it is beginning to see widespread adoption in the US, Canada, Australia and Europe. Non-profits are using it to great effect in fundraising. If it becomes regulated without being banned in the US, it will eventually stabilize and see mass adoption, at least in countries that do not ban it. If that happens, its value will skyrocket. But that scenario, if it comes to pass, is at least a year in the future, probably three or four.

Another thing that could cause Bitcoin to skyrocket again is another financial meltdown in the banking system in any country. Even in a country where it is banned, it’s not like authorities can easily stop people from owning it or buying it with cash from others that already own it. When the banking system freezes like it did in Cyprus, it will be easier for people to get Bitcoin than gold and silver, then leave the country safely without worrying about carrying lots of gold or cash across borders. Then, it could skyrocket into the $1,000 range again. But it could be some time before that happens. This is a critical time for the coin. Three major Bitcoin conferences in Vegas are starting this week. Lots is going on, and no one knows how it will all turn out.

If you are going to get involved, you need to understand something – buying and holding Bitcoin or any other crypto-currency is NOT investing – it is speculation. Not quite gambling, but not far from it. You need balls of steel to be in this game, and the capability to hold even if your “investment” goes down to 10% of it’s value in a month because it could then go back up 1000%. If you sell during these times, you guarantee yourself a loss if you bought in higher. On the flipside, you might lose it all.

You need to be in a position where your survival and retirement is not at stake if your Bitcoin loses a large portion of its value compared to USD that way you can have the patience to hold and realize your gain. It’s just like the stock market. If you panic sold in 2008 when the market crashed, you would not only have lost a lot, you would have failed to reap the 30% a year gains we have recently seen.

Don’t let your fear control you. That is what the market manipulators want. Bitcoin will probably bounce back as new innovations around it and wider acceptance spreads in the US. The dollar is strong now, but probably won’t be for much longer. Interest rates are about to go up again in early 2015 for the first time in eight years, and the world financial system is likely in for a major shift when the dollar sees hyperinflation. It could happen in months, or it could be a few years, but it’s probably not far off, and when it happens, Bitcoin, gold and silver all stand to gain massive value as demand for them go through the roof.

But it could drop far and fast before that happens because the market is VERY vulnerable to trading and right now the public is very confident in trusting the dollar and the stock market because of the significant gains those asset classes have seen recently. People are dumping Bitcoin left and right because Bitcoin does not look attractive to most investors, and some easily scared people are panic selling like crazy right now to cut their losses. I think they’ll be kicking themselves in a few months. It could easily rebound to the $500 level or higher in a matter of days. This is par for the course for Bitcoin. Don’t play the game if you don’t understand that this is the most volatile asset class in human history!

The holiday season bodes well for Bitcoin, as fractured families can send money to family members in other countries with no fees and buy gifts at discount during Black Friday. The charities will likely leverage it to make donating easier. I predict a rally in late November and early December as people load up for holiday spending and anticipating the anniversary of the last big rally. Until then, it will probably keep falling because there are more downward pressures than upward ones right now. Panic selling leads to price dropping, which causes more panic selling until the price gets so low that new people see a buying opportunity and all jump in and once, causing another rally.

We need to remember that Bitcoin went from $185 to $1000 in less than a month in October/November of 2013. It could happen again, or it could go to near zero. Buying and holding Bitcoin and other cryptocurrency is without question the riskiest speculation you can do with your money because there is a very small market, no regulations, and nothing of fundamental value aside from the technology itself backing it. The price of Bitcoin is easier to manipulate for those who hold a lot of it than the stock market is. You could lose all the money you put into Bitcoin and other crypto in a matter of days. But it also still has the potential for a huge payoff, and you could become a millionaire overnight if you time it right, which is very very hard but not impossible. There is no way to tell what will happen until it does. Whatever you do, don’t let your emotion rule you. Realize you are playing with your money. Don’t be a sore loser if you happen to lose. Have no illusions, dollars are still a safer place to keep your money, for now.

But that may not be the case once all that bank bailout money the Fed is bribing the banks NOT to lend or spend hits the economy! The only way for the Fed to keep that from happening at this point is for them to keep bailing out and printing more, but once interest rates go up again and it become more profitable for the banks to lend to corporations than to accept more newly-made fiat from the Fed, since the Fed is already leveraged debt-to-capital 77 to 1 and banks are at 30 to 1 or so, dollars and stocks are going to take a huge dive some day in the next year or so. Until then, the powers that be will keep doing everything they can to drive down the price of gold, silver and Bitcoin to make it as cheap as possible for them to buy right before they let the floodgates of fiat open. When they do, Bitcoin, gold and silver will go to the moon!

If you are going to enter the Bitcoin game, my advice is to set up a Circle account and buy in when the next big wave of good news hits, probably right before Thanksgiving. Use some of it to do your Black Friday Christmas shopping, and hang on to the rest to have a shot at riding the next big wave. And don’t put it all into Bitcoin. Buy some gold and silver too. Those will never be worth nothing and they may well gain faster than Bitcoin when the next big crash occurs.

Tulip bulb – END OF STORY.

Who is so fool to sell bitcoins in that low prices??