Bitcoin Price Key Highlights

- After spending weeks sitting pretty inside a tight consolidation pattern, bitcoin price is finally getting back on its feet and showing some momentum.

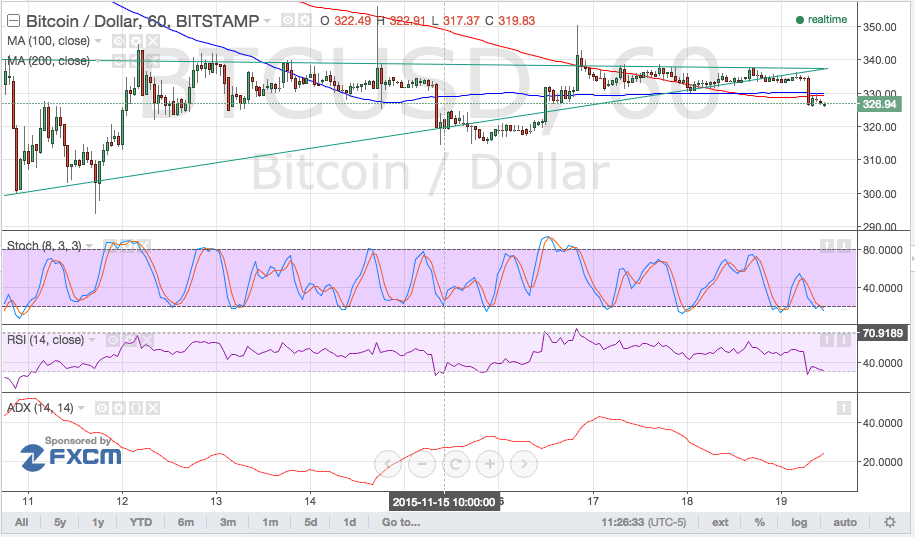

- A downside breakout from the ascending triangle pattern and short-term pennant formation appears to be taking place.

Bitcoin price could be in for more downside now that a long red candle has closed below the ascending triangle support at $330.

How Low Can It Go?

Bitcoin price could have its sights set on the bottom of the triangle pattern near the $300 major psychological level as its target for the selloff. Before further declines take place though, price could still pull up to retest the broken triangle support.

The 100 SMA crossed above the 200 SMA briefly but looks ready to make another downward crossover, indicating that further downside is to be expected. Stochastic is on the move down but is already nearing the oversold region so a bit of profit-taking might be possible soon.

RSI is also heading south, indicating that bearish pressure is present. Once the oscillator reaches the oversold area and turns higher, bulls might still take control and push for a move up to the triangle resistance near $340. Sustained buying pressure might even lead to a pop higher that could show the downside break was a fake out.

The average directional index is starting to make its way up to the 50.0 level, possibly indicating a return to trending market conditions. If bearish momentum stays in play, this could be a signal that a longer-term downtrend is underway.

For now, bitcoin price could target the next near-term floor around the $320 area of interest. This level has acted as resistance then support, likely spurring a quick bounce when price reaches it soon.

Intraday support level – $320

Intraday resistance level – $340

Technical Indicators Settings:

- 100 SMA and 200 SMA

- Stochastic (8, 3, 3)

- RSI (14)

- ADX (14, 14)

Charts from Bitstamp, courtesy of TradingView

Very accurate as usual.

Unfortunately, the Bitcoin bubble has burst.

No evidence its been used by terrorists,, yet we do have evidence they use USD and Gold… should the EU try ban that????

Also this is all lies from CoinDesk not sure why maybe they want cheaper BTC or have been paid off by the bankers,, the hacker came out and said he found no link to the Paris attack.

Some Anonymous god should help take out CoinDask and warn the Bitcoin community about this infiltration.

Also the EU isn’t stupid but the people that dump now are,, if the EU once again confirms the validity of Bitcoin and they will as banning Bitcoin because of a group that uses it would be the same as banning gold or USD that the same group really does use.

And dare I even say the Euro… you think they stayed in France without using the Euro???? come on give me a brake!

If these people had used Bitcoin they’d of flown in first class,, not infiltrated via refugees lol… money is money lets ban all money because a terrorist might use it????? this is the sort of thinking that’s taking away the freedoms of honourable people world wide.

And I can’t stress this enough the world elites support Bitcoin, as it means the governments or the people could never take their money or limit it to 100 million per person…. theirs only one country in the world they don’t fully control at the moment and that’s Russia, yes they own land in Russia, but have very limited control on government corporations that’s why Bitcoin is banned in Russia…

Yet China supposed friend of Russia lmao, is the biggest producer of Bitcoin because its controlled by the Li’s one of the 13 families.

China will back stab Putin or the elites will find a way to kill him off, if he’s not part of the plan for world war 3 and the coming new world order.

So with all that said, as I get my freedom of speech over here at newsBTC yet Coindesk censor my posts!! I leave you the Bitcoin community to find a way to shut down Coindesk, I for one no longer wish to see them trolls on first page google and they deserve to be disrespected, censorship is not in the interest of open source freedom.