Bitcoin Price Key Highlights

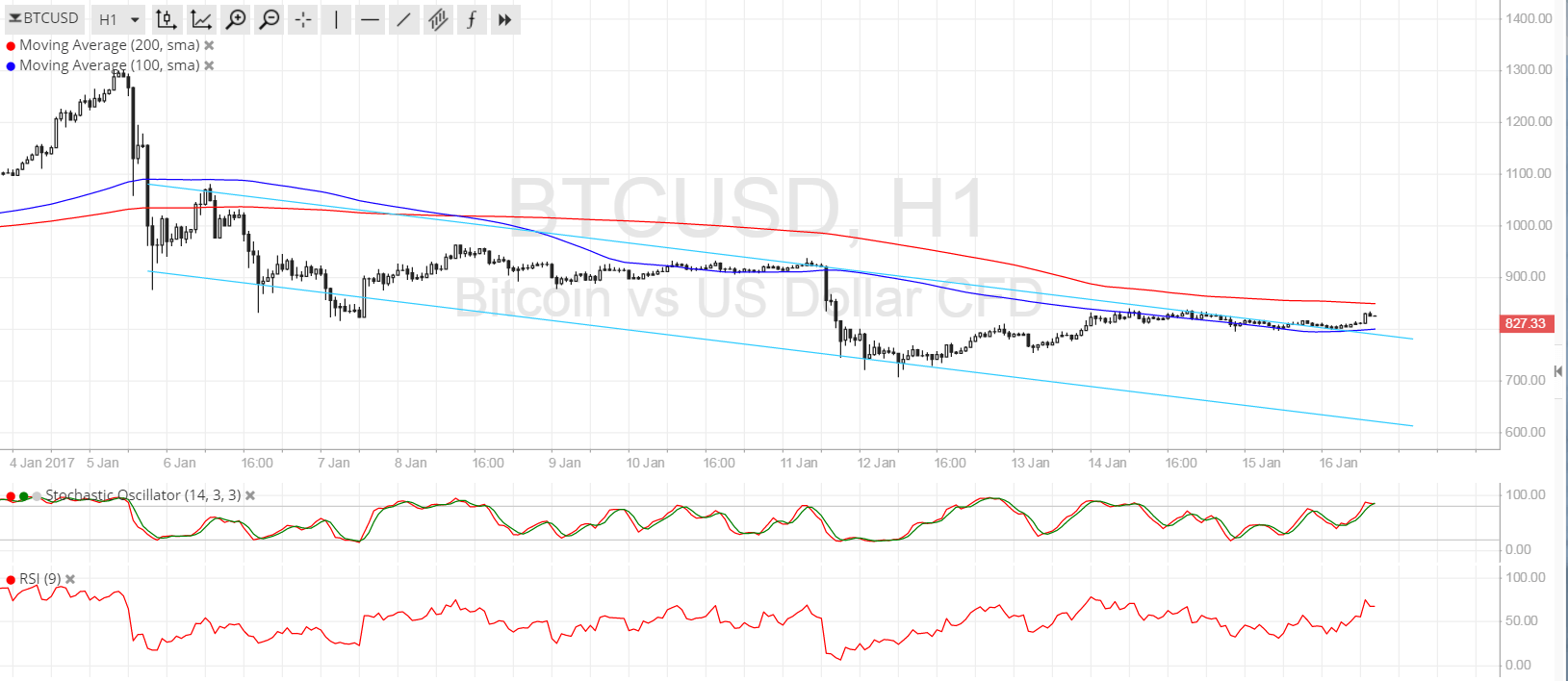

- Bitcoin price was previously trading inside a descending channel visible on its 1-hour time frame but bulls seem to be putting up a fight.

- Price is starting to break out of its downtrend pattern, signaling that an uptrend might be in the cards.

- Stronger bullish pressure could push price past the next inflection points and onto the January 5 highs.

Bitcoin price seems exhausted from its dive and might be looking to start a climb once more.

Technical Indicators Signals

The 100 SMA is still below the longer-term 200 SMA so the path of least resistance is to the downside. However, bitcoin price has already moved past the 100 SMA dynamic inflection point and is making its way towards testing the 200 SMA. A break past that area could be an early signal of a reversal, especially if it is followed by an upward crossover.

Stochastic is heading up but is closing in on the overbought zone, which suggests that buying pressure could fade soon. Similarly, RSI is heading north so bitcoin price could follow suit but bulls might need to take a break and let sellers take over in a while. In that case, bitcoin price could pull back to the channel resistance for a quick retest or resume its slide back down to the support at $600.

Market Events

Geopolitical uncertainties seem to be back haunting the financial markets this week, as traders are still reeling from Trump’s first press conference and biting their nails ahead of this week’s event risks. This includes U.K. Prime Minister Theresa May’s speech outlining their Brexit negotiation plans, which might suggest their willingness to forego access to the single market. More jitters in the global markets could encourage investors to move their funds to bitcoin and out of traditional securities.

Over in China, the government still seems intent on cracking down on bitcoin activity in the country and preventing more investors from hedging against their yuan-denominated holdings. So far, though, there hasn’t been any indication that stricter restrictions would be put in place so traders are able to breathe easy for the time being.

Charts from SimpleFX