Bitcoin Price Key Highlights

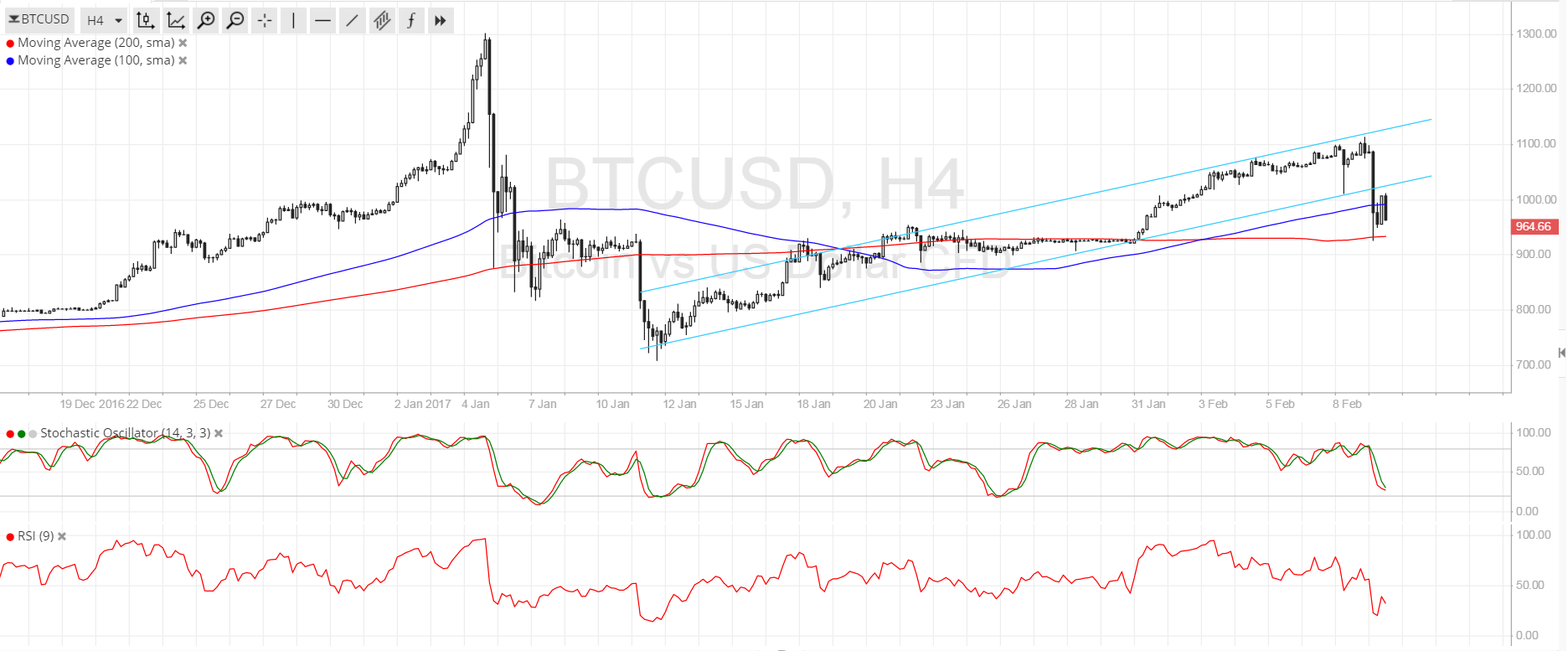

- The recent sharp drop in bitcoin price turned out to be an omen for an even larger selloff, causing a break below the ascending channel support.

- This breakdown suggests that a reversal from the previous uptrend could be in the cards, possibly taking it down to the lows near $700.

- News from China combined with strong dollar demand triggered the huge selloff.

Bitcoin price suffered a sharp decline, which might be a sign that the climb is over and that further losses are underway.

Technical Indicators Signals

The 100 SMA is still above the 200 SMA on this time frame so the path of least resistance might be to the upside. The 200 SMA appears to be holding as dynamic support for now but this is the last line of defense for the uptrend and a break lower could confirm that a longer-term selloff is about to take place.

Stochastic has finally made its way down from the overbought zone, confirming that bearish pressure has been able to return. RSI is also heading down so bitcoin price could follow suit, even as it tries to find support at the $900 area of interest.

Market Events

It looks like Chinese regulators aren’t done dampening bitcoin activity in the mainland, as their recent meeting with owners of exchanges led a couple of halt withdrawals from accounts. This sent other investors scurrying for the exits for fear of having their funds locked in later on as well. According to statements from Huobi and OKCoin, the decision was taken to intercept any “illegal transactions” and fortify their anti-money laundering efforts.

Note that China comprises the largest bitcoin market in the world and that these two exchanges account for around 25% of transactions in the mainland. Traders are now waiting to see how other bitcoin exchanges, particularly BTCC, could react.

Over in the US, President Trump dropped some hints about their tax reform plans in saying that they’re about to announce something “phenomenal” in the next 2-3 weeks. This has shored up US equity indices to record highs, renewing demand for the currency as well.

Charts from SimpleFX