Bitcoin Price Key Highlights

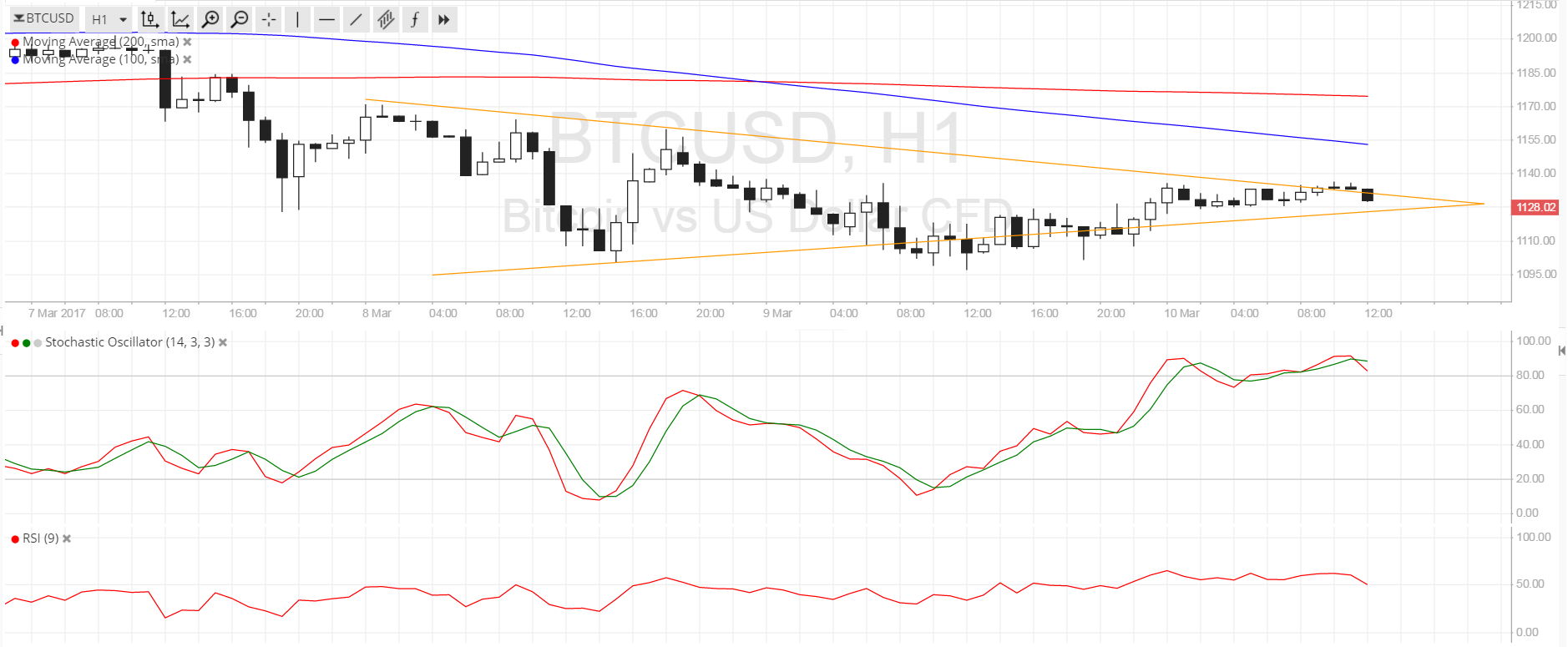

- Bitcoin price has formed lower highs and higher lows, creating a symmetrical triangle on the 1-hour chart.

- Price is approaching the peak of the formation so a breakout could be due sooner or later.

- Technical indicators seem to be hinting at a downside break, which could pave the way for a longer-term selloff.

Bitcoin price is consolidating lately, awaiting the SEC announcement on the bitcoin ETF and the US non-farm payrolls release.

Technical Indicators Signals

The 100 SMA is below the longer-term 200 SMA so the path of least resistance is to the downside. This suggests that a downside break is more likely to happen than an upside one. Also, the moving averages could hold as near-term resistance levels in the event of a spike higher, giving bulls more hurdles before taking bitcoin price further north.

Stochastic is indicating overbought conditions and is starting to cross down, hinting at a potential pickup in selling pressure. RSI is also turning lower, which means that selling momentum is returning.

A candle closing below the $1125 level could be enough to confirm a downside break while a candle closing above $1130 could signal an upside break. Take note, however, that bitcoin price tends to get volatile during top-tier events so fakeouts are possible.

Market Events

Today is a big day for the bitcoin world as the SEC is expected to announce its decision on the COIN bitcoin ETF. If the Winklevoss twins get approval, this could have as big impact on the entire industry and on bitcoin price. For one, having an ETF for bitcoin on Wall Street would make it more accessible to individual and institutional investors. This could drastically boost market interest and liquidity, possibly even drawing more firms to create their own cryptocurrency-based securities.

On the other hand, rejection could have a bearish effect on BTCUSD, especially since expectations for a Fed rate hike next week are running high. Note that the NFP report is up for release today and a higher than expected read could guarantee tightening, thereby driving the dollar higher across the board.

Charts from SimpleFX