Bitcoin Price Key Highlights

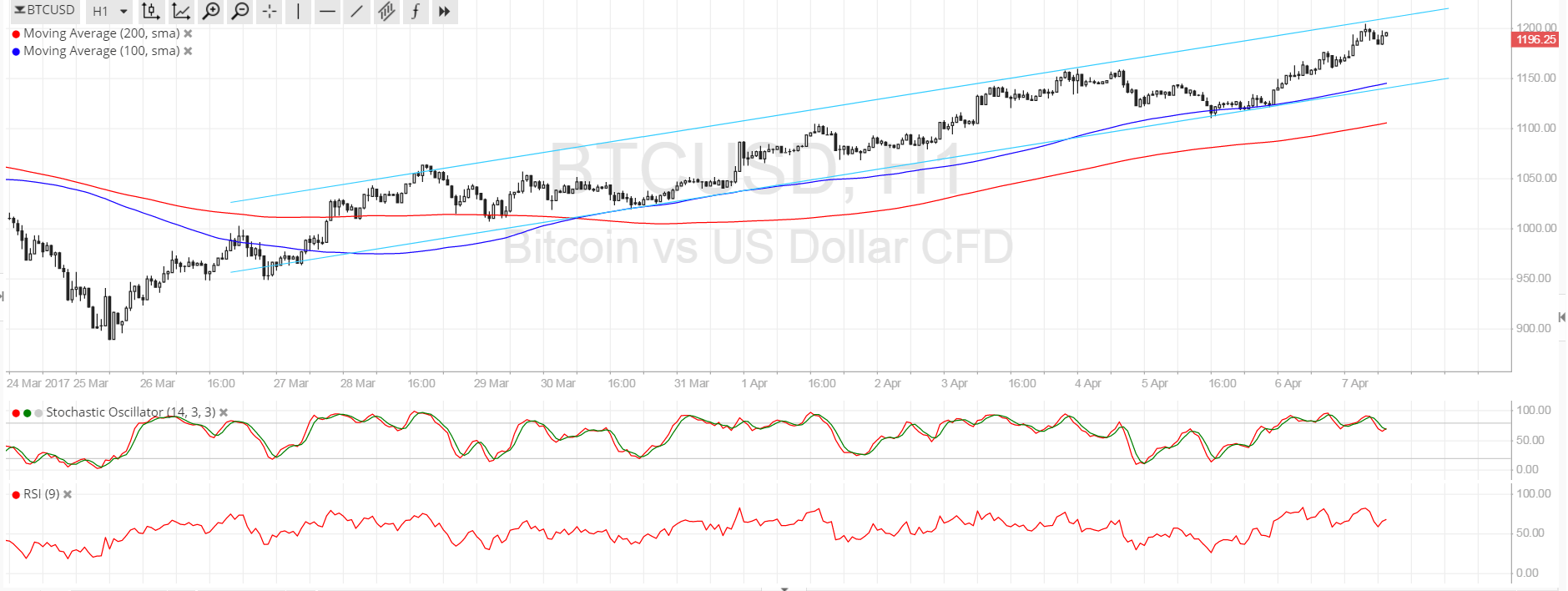

- Bitcoin price continues to trend higher and is still moving inside the ascending channel highlighted in earlier posts.

- Price is testing the channel resistance at the $1200 major psychological level, which could lead to profit-taking and a pullback to the channel support at $1150.

- Technical indicators are giving mixed signals but there are strong arguments for the climb to continue.

Bitcoin price is still moving inside its ascending channel and could be due for a quick correction to the support.

Technical Indicators Signals

The 100 SMA is above the longer-term 200 SMA on this time frame so the path of least resistance is to the upside. In addition, the 100 SMA lines up with the bottom of the channel at the $1150 level, adding to its strength as a floor in the event of a pullback.

A larger correction could last until the 200 SMA dynamic inflection point at $1100 but a break below this area could be enough to confirm that a downtrend is underway. Stochastic has been indicating overbought conditions for quite some time and appears ready to turn lower and draw sellers to the game. RSI is also turning down from the overbought zone and bitcoin price could follow suit.

Market Events

One potential event risk for bitcoin price against the dollar today is the NFP release. Analysts are expecting to see only 174K in hiring gains but there could be a chance for an upside surprise as the ADP figure released earlier in the week printed much stronger than expected results. If so, dollar gains could return as traders look forward to more Fed rate hikes once more.

However, bitcoin price is currently drawing support from geopolitical tensions, particularly between the US and Syria. Earlier this week, Syria launched a chemical bomb attack and the US government looked into military options. A few hours ago, an airstrike was launched on Syria and brought risk-off vibes to the financial markets.

Charts from SimpleFX