Bitcoin Price Key Highlights

- Bitcoin price made a huge gap down just recently, signaling that bears are taking over.

- This could mean more losses for bitcoin price, although the gap could still be filled before this happens.

- Technical indicators are giving mixed signals at the moment.

Bitcoin price made a large gap down, possibly indicating profit-taking off the recent highs heading up to the Holy Week holidays.

Technical Indicators Signals

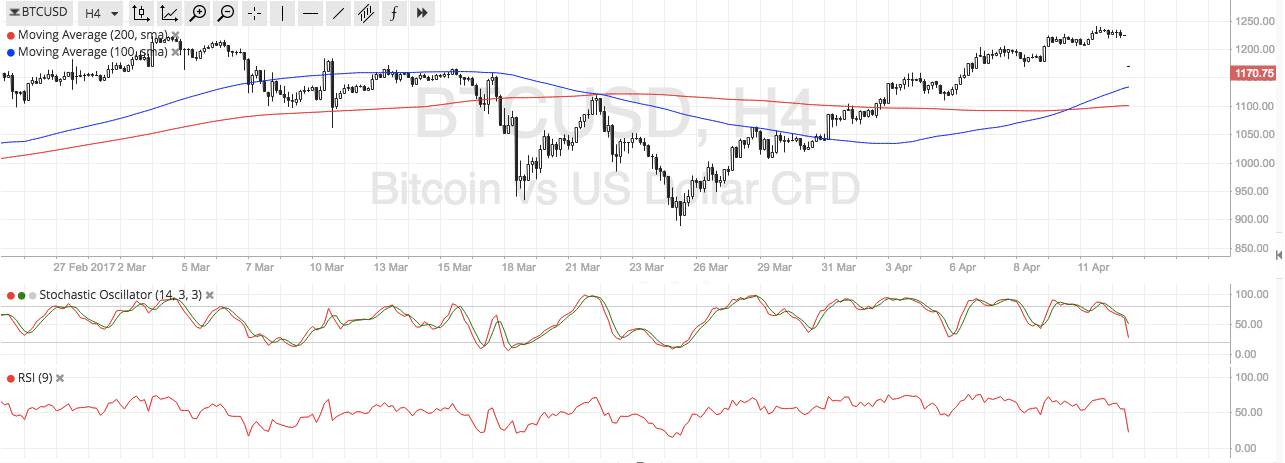

The 100 SMA is above the longer-term 200 SMA so the path of least resistance is to the upside. In other words, the rally is more likely to resume than to reverse. In addition, the moving averages could hold as near-term support around the $1100 area of interest.

Stochastic has turned down from the overbought area to indicate that sellers are on top of their game and ready to push for more losses. RSI is also on its way south so bitcoin price might follow suit. If selling pressure is strong enough, a break below $1100 could force a steeper decline to the next long-term support around $900.

Market Events

Recent reports revealed that lawmakers in Washington are almost done with their bill for bitcoin regulation that could lead some cryptocurrency-focused startups to think twice about operating in the state on worries of strict oversight. Bitcoin exchanges like Bitfinex, Bitstamp and Poloniex are operating in the state, with the latter exiting Washington a few days back.

The bill states that “A licensee transmitting virtual currencies must hold like-kind virtual currencies of the same volume as that held by the licensee but which is obligated to consumers in lieu of the permissible investments required in of this subsection.” Additional requirements could include mandatory third-party cybersecurity audits of “all electronic information and data systems.”

But while these moves appear to be discouraging some firms in the US, the prospect of government regulation in Russia and the recent acceptance in Japan has proven positive for the cryptocurrency.

Charts from SimpleFX