Bitcoin Price Key Highlights

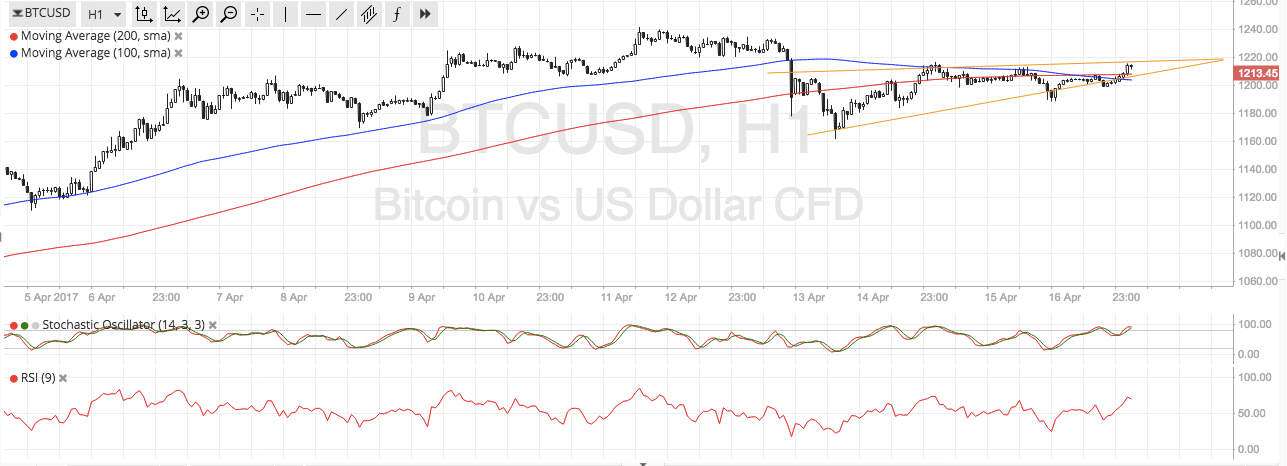

- Bitcoin price has formed higher lows and found resistance around $1220, creating a small ascending triangle pattern.

- Price is testing the triangle resistance and a bounce could lead to a move below support at $1200.

- In that case, a longer-term head and shoulders pattern could be completed, signaling that price is in for a decline.

Bitcoin price appears to be forming a head and shoulders uptrend reversal pattern on its 1-hour time frame, possibly hinting at further losses.

Technical Indicators Signals

The 100 SMA is crossing below the longer-term 200 SMA to signal that the path of least resistance is to the downside. In other words, a triangle breakdown might be more likely to happen than a move higher. Note that the potential head and shoulders spans $1160 to $1240 so the resulting selloff could be of the same size, assuming that bitcoin price breaks below the neckline.

On the other hand, a break past the triangle resistance could lead to a move up to the recent highs at $1240 or higher. Stochastic is pointing up to show that buyers are in control of bitcoin price action while RSI is also heading north so bitcoin price might follow suit. However, both oscillators are also nearing overbought levels to show that selling pressure could return soon.

Market Events

Geopolitical risks still remain as tensions in the Asian region are picking up due to North Korea’s missile tests. US President Trump has said that he will not back away from military action if North Korea doesn’t rein in its activity, further increasing the risk of retaliation.

Meanwhile, liquidity could still stay low as most European markets are closed for Easter Monday. This means that headlines could still lead to big market moves as traders appear to flock to bitcoin in times of uncertainty, particularly in other financial markets.

As for the US, only the Empire State manufacturing index and NAHB housing market index are up for release next. As always, stay on the lookout for headlines that could inspire risk-off flows, which usually benefit bitcoin price.

Charts from SimpleFX