Bitcoin Price Key Highlights

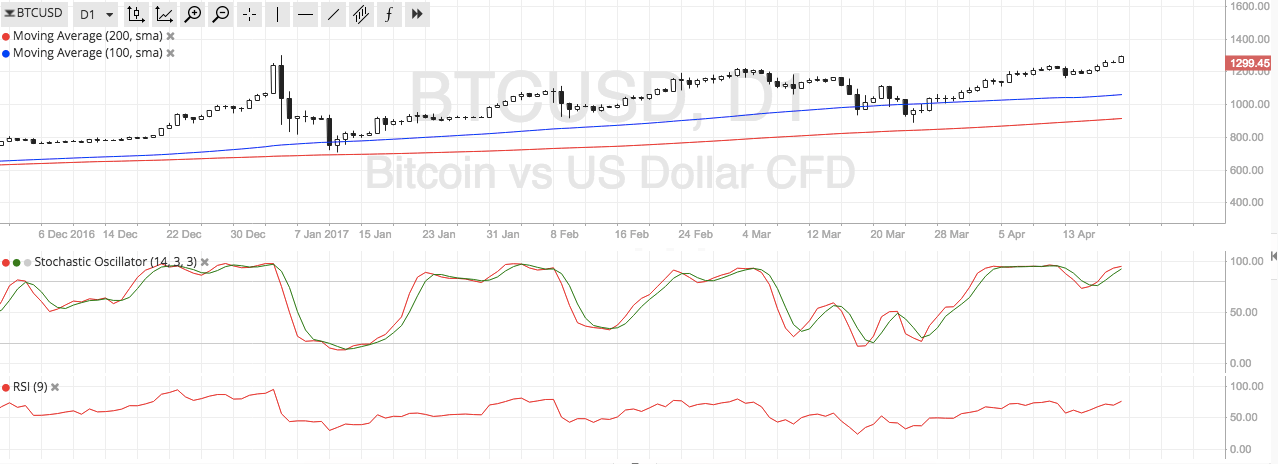

- Bitcoin price continues to climb and is currently testing the 1300 record highs.

- Profit-taking could happen at this key resistance level, but a break higher could open the door for an even stronger climb.

- A couple of technical indicators are signaling that bitcoin price has room to head further north.

Bitcoin price is testing its record highs and a couple of technical indicators are signaling that it could head much higher.

Technical Indicators Signals

The 100 SMA is above the longer-term 200 SMA so the path of least resistance is to the upside. The gap between the moving averages is maintained so there might not be any new crossovers just yet, ensuring that bulls remain in control of bitcoin price action.

Stochastic is already in the overbought area to suggest that buyers may be getting exhausted and willing to let sellers take over. If so, a pullback to the 100 SMA dynamic support could happen or until the 200 SMA potential inflection point. A break below these areas could indicate that selling pressure is coming into play.

RSI is still on the move up so there may be room for bitcoin price to keep climbing. In that case, a move past the 1300 area could take it to the next psychological barriers at 1350 and 1400.

Market Events

The recent shooting in Paris has brought risk aversion back in the markets, causing bitcoin price to pick up as market watchers are feeling jitters ahead of the French elections. The possibility of a Le Pen win could keep political uncertainty in play for Europe as this would keep Frexit issues in place.

Apart from that, talks that bitcoin could gain legal status in India is also providing additional support for the cryptocurrency. This follows news that Japan has accepted bitcoin as a legal form of payment and rumors that Russia could also follow suit by next year. However, there are some concerns about exchanges in China halting dollar deposits as stricter regulation in the mainland could hurt majority of the market.

Charts from SimpleFX