Bitcoin Price Key Highlights

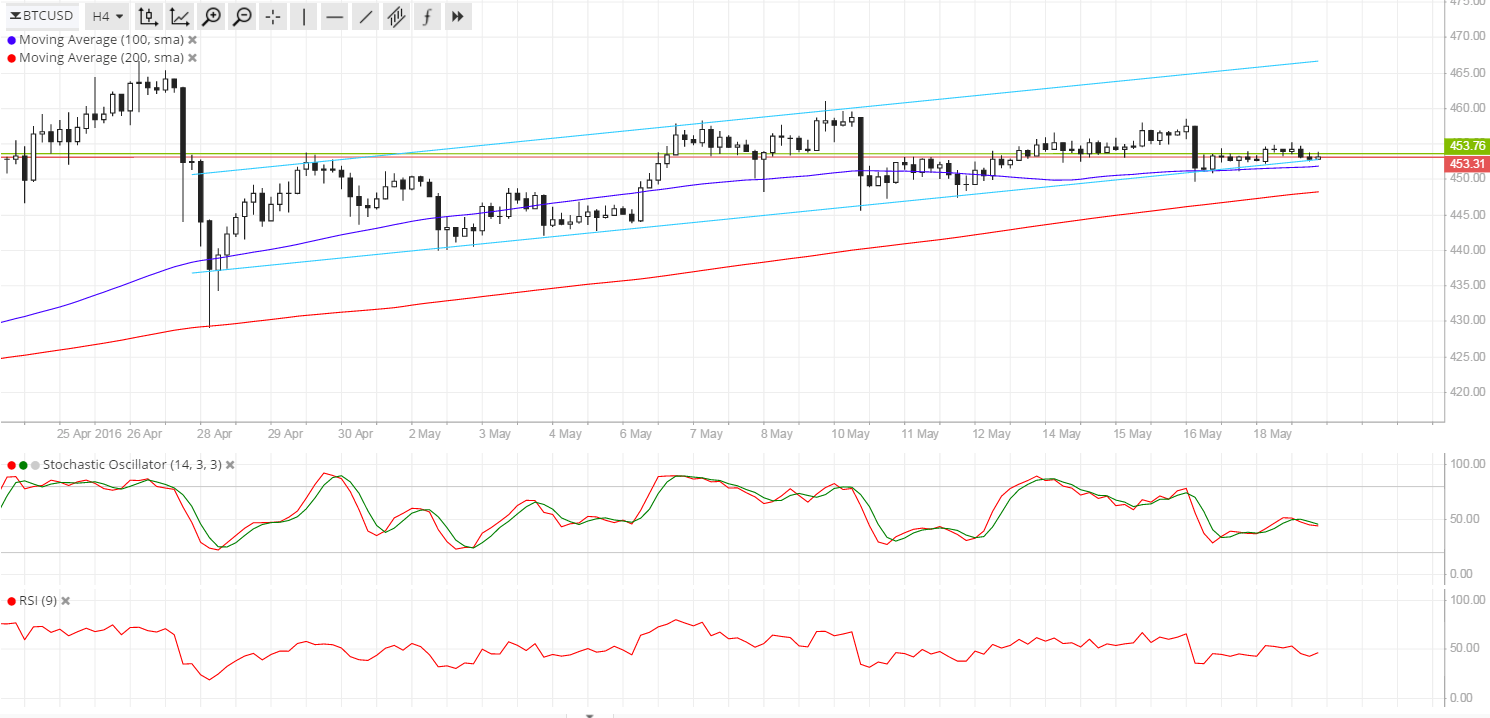

- Bitcoin price is still stuck inside the ascending channel pattern on the 4-hour time frame and still hovering around support.

- Price has been consolidating above the $450 level for quite some time, as bears are trying to find more energy for a downside break.

- The FOMC minutes failed to spur dollar demand strong enough for a downside break, leaving bitcoin traders waiting for the next big catalyst.

Bitcoin price might be able to break below the channel support if dollar demand picks up in the latter sessions.

Technical Indicators Signals

The 100 SMA is still above the longer-term 200 SMA so the uptrend could carry on. In addition, the 100 SMA coincides with the channel support, which explains its strength as a floor for now. However, the gap between the moving averages is narrowing, indicating weaker bullish pressure and a possible downward crossover.

Stochastic is on middle ground and is pointing down, which means that there’s still some selling momentum left. RSI has also been treading around the 50.0 level for quite some time, barely offering strong directional hints.

A break below this channel support could spur a move to the next area of interest at $430 then at $400. On the other hand, a bounce could lead to a test of resistance at the $465-470 area.

Market Events

The FOMC minutes released yesterday showed that some Fed officials are still considering hiking interest rates in June, provided the US economy is able to maintain its pace of growth, hiring, and inflation. This revived speculations of tightening next month even after the actual Fed statement dashed these hopes.

Data from the US economy has been mostly stronger than expected, with the latest retail sales report showing larger gains. However, earnings reports have been far from impressive, indicating that the corporate sector might still be struggling.

In addition, policymakers noted that a potential Brexit and concerns about unanticipated changes in China’s exchange rate could convince them to sit on their hands. For today, the Philly Fed index and US jobless claims are due but these aren’t likely to spur strong moves for bitcoin price.

Meanwhile, risk sentiment could continue to favor dollar strength and eventually lead to a reversal from the short-term uptrend.

Charts from SimpleFX

Header Image: NewsBTC