Bitcoin Price Key Highlights

- Bitcoin price recently made a strong downside break, signaling that bears are taking control.

- Price is making a short-term pullback to the broken near-term support, offering an opportunity for more sellers to hop in.

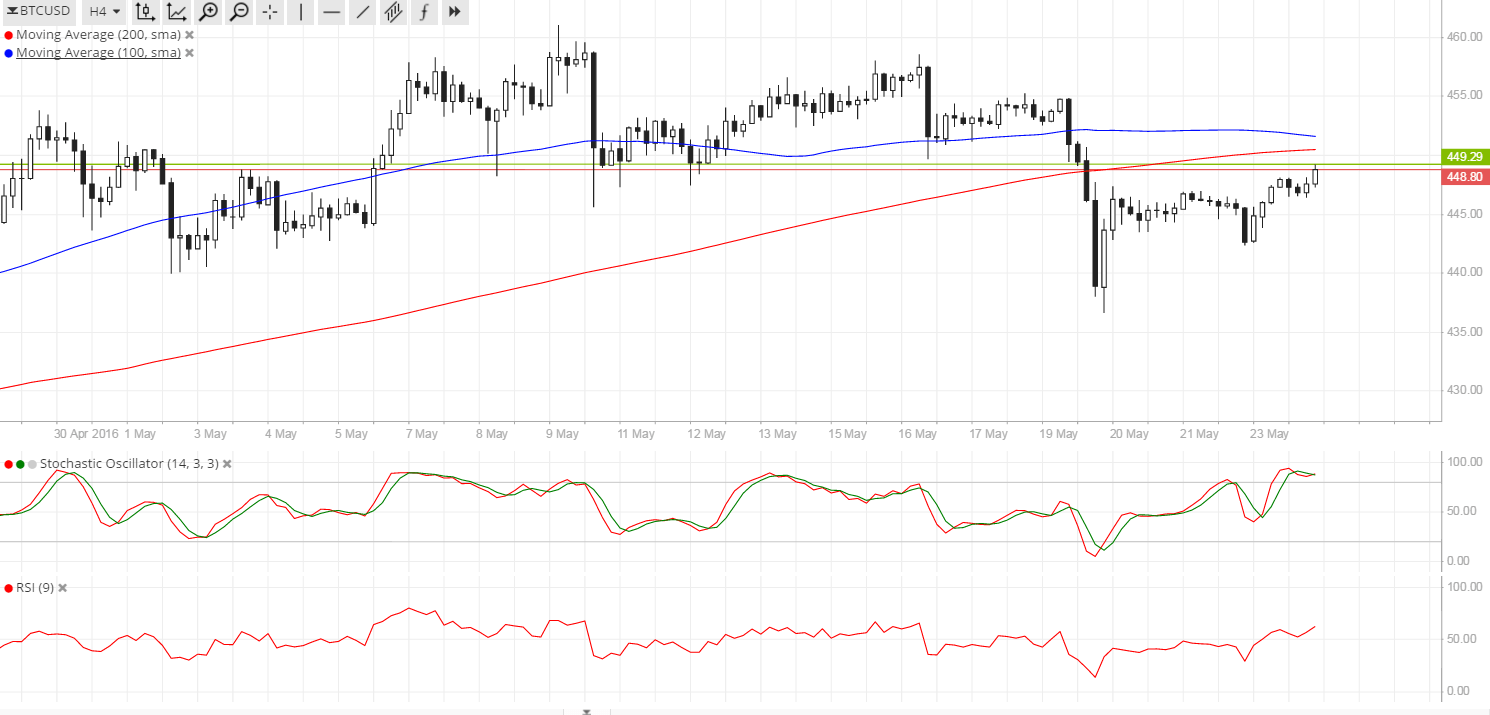

- Bitcoin is testing the area of interest at the $448-450 area, which might hold as resistance.

Bitcoin price could be ready to resume its drop if the nearby resistance levels are able to keep gains in check.

Technical Indicators Signals

The 100 SMA is above the 200 SMA for now but the moving averages have inched close together, indicating that a downward crossover is looming. This could be interpreted as a signal for more sellers to short bitcoin, taking it back down to the recent lows around $437.

In addition, the moving averages could hold as dynamic inflection points, possibly holding as resistance up to the $450.50 mark. A descending trend line can be drawn to connect the latest highs of price action since May 5, with the falling resistance level coinciding with the area of interest.

Stochastic is already indicating overbought conditions so buyers might need to take a break and let sellers take over again. RSI has finally shown more momentum and is also approaching the overbought zone, hinting at a return in bearish pressure later on.

Market Events

Data from the US economy came in weaker than expected yesterday, as the flash manufacturing PMI showed a slowdown in industry growth instead of posting a stronger pace of expansion. This explains why the dollar is returning some of its recent gains, as the numbers don’t line up with hawkish Fed expectations.

FOMC members have emphasized that the June meeting will be a live one and that their decision will be data-dependent. Some policymakers have highlighted the risks stemming from a potential Brexit, unanticipated forex fluctuations in China, and weaker inflation expectations as possible reasons for them to sit on their hands.

US new home sales, durable goods orders, and initial jobless claims are due in the next few days but perhaps the bigger catalyst could be the preliminary GDP reading due on Friday. Analysts are expecting an upgrade from 0.5% to 0.8% which might stoke rate hike expectations and revive dollar demand against bitcoin price once more.

Charts from SimpleFX

Header Image via NewsBTC