Bitcoin Price Key Highlights

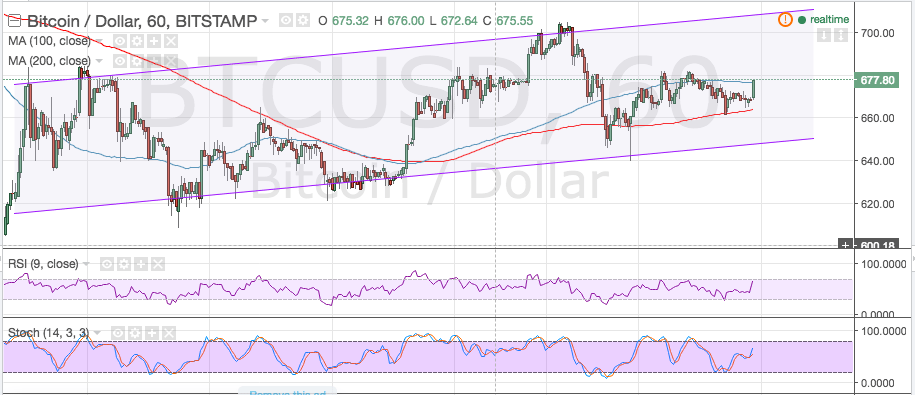

- Bitcoin price appears to be showing a return in bullish momentum as it bounced off a nearby support zone.

- Bitcoin seems to be on track towards climbing to the top of its ascending channel on the 1-hour time frame.

- For now, price is still hovering around the mid-channel area of interest, waiting for a stronger surge in bullish momentum.

Bitcoin price got a boost from fresh concerns in the UK financial sector, leading traders to price in more uncertainty.

Technical Indicators Signals

The 100 SMA is still above the 200 SMA so the path of least resistance is to the upside. This suggests that bitcoin price could have enough energy to climb back to the top of the channel around the $700 to $710 levels. Stronger bullish momentum could even lead to an upside breakout and a move towards the previous month highs closer to $800.

RSI is on the move up, which confirms that buyers are taking control of price action. Stochastic is also heading north so bitcoin price could follow suit. The 200 SMA has also held as a dynamic inflection point and might continue to hold as support from here.

Market Events

Fresh concerns about the UK financial sector brought risk aversion back in the financial markets, leading investors to put their funds in assets that can’t be controlled by institutions or the government. Three of the UK’s top property funds announced that they would be suspending redemptions, which means that investors can’t conduct withdrawals and that a huge amount of capital would be frozen.

This has sparked fears of contagion in the banking sector, as a number of small businesses and banks use commercial properties as collateral and capital buffers, so sharp price declines could lead to big losses. The BOE has tried to assure markets through its Financial Stability Report that banks have passed stress tests, although it appears that more capital flight will be seen in the coming days.

With that, bitcoin price could continue to enjoy more upside as traders move their funds elsewhere. ECB Governor Draghi’s speech and the FOMC minutes are lined up today, providing more catalysts for volatility in the financial markets.

Charts from TradingView