Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

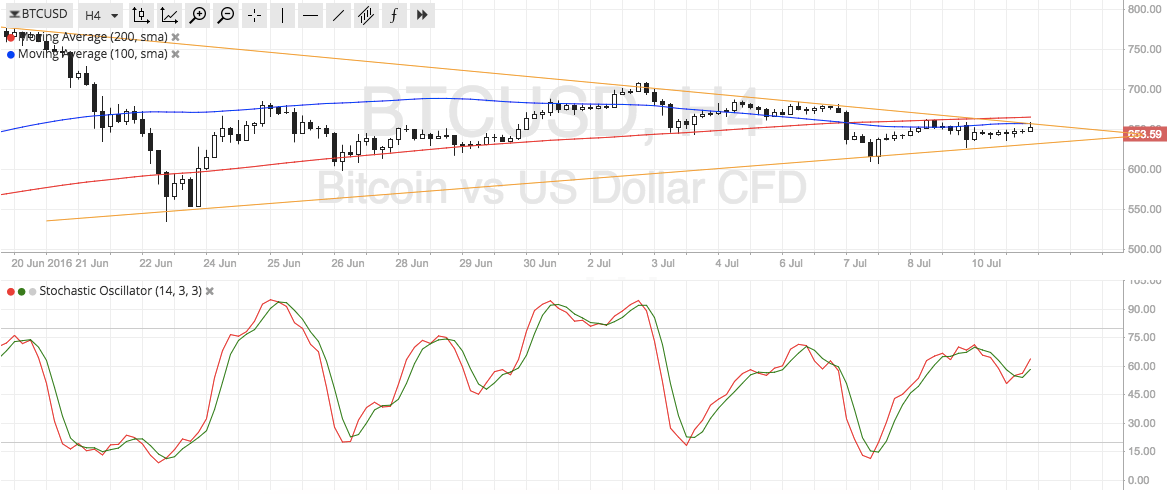

Bitcoin Price Key Highlights

- Bitcoin price formed higher lows and lower highs, creating a symmetrical triangle pattern on its 4-hour time frame.

- Price is still stuck inside that triangle pattern for now but a breakout might be due since it is approaching its peak.

- A breakout in either direction could set the longer-term trend for bitcoin.

Bitcoin price is still stuck in consolidation but might be ready to make a strong breakout in either direction sooner or later.

Technical Indicators Signals

The 100 SMA is currently below the 200 SMA, signaling that the path of least resistance is to the downside. In other words, a downside breakout might be more likely. However, the moving averages are still close to each other so they could keep oscillating and indicating consolidation.

Stochastic is on the move up so bitcoin price could follow suit. In that case, an upside breakout could take place and take bitcoin up to the triangle highs just below the $800 level. But if the oscillator reaches the overbought area soon and turns lower, sellers could regain control of price action and push for a selloff to the triangle lows near the $550 level.

Market Events

The US NFP report did result to a bit of demand for the US dollar on Friday, as the actual reading came in stronger than expected. The economy added 287K jobs in June, higher than the projected 175K increase, but the previous month’s reading was downgraded from the initially reported 38K figure to an even weaker 11K reading.

The unemployment rate rose from 4.7% to 4.9%, higher than the projected increase to 4.8%, but this was actually spurred by higher labor force participation. Average hourly earnings was weaker than expected at just 0.1% versus the projected 0.2% increase, hinting that the labor market isn’t strong enough to warrant a rate hike in this month’s FOMC statement.

For now, bitcoin price is still waiting to see how long the market uncertainties could stay before deciding on a direction. This week, Chinese data could have a stronger impact on market sentiment and bitcoin movement, as downbeat reports could funnel more funds from the local stock markets to cryptocurrencies.

Charts from SimpleFX