Bitcoin Price Key Highlights

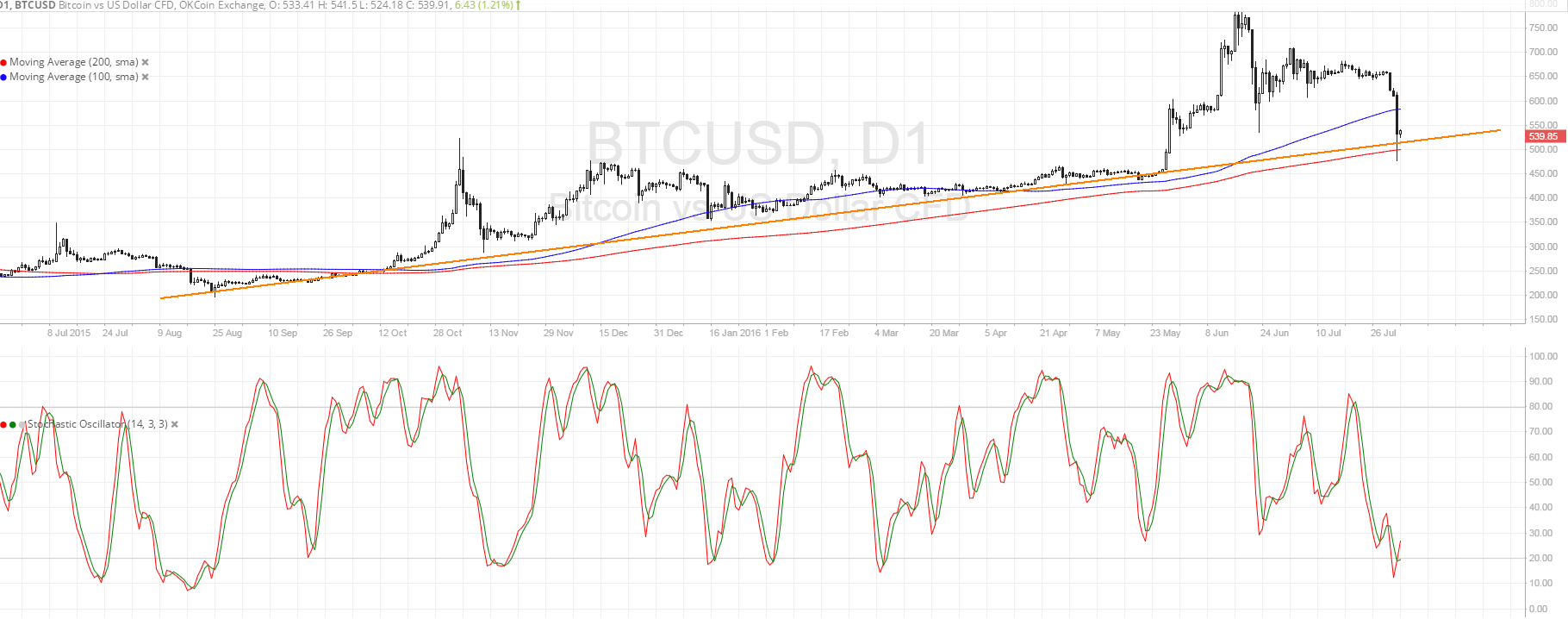

- Bitcoin price is in the middle of a sharp selloff but it seems to have found support at the rising trend line as predicted in the previous post.

- Price spiked off the $500 level, as plenty of buy orders were likely waiting in that area of interest, which held as resistance in the past.

- Technical indicators seem to be suggesting that the longer-term climb could resume from here.

Bitcoin price is testing a long-term support area, with technical indicators hinting at a continuation of the climb.

Technical Indicators Signals

The 100 SMA is above the longer-term 200 SMA so the path of least resistance is to the upside. Also, the 200 SMA lines up with the rising trend line support, adding to its strength as a floor. Bitcoin price could be poised to climb back to the highs at $780 or at least until the near-term area of interest at $600-650.

Stochastic is already indicating oversold conditions and is turning higher, which means that buyers are ready to take control of bitcoin price action once more. A bit of bullish divergence can be seen as the oscillator made lower lows from early March while price made higher lows then.

Market Events

Uncertainties in the bitcoin industry are weighing on the cryptocurrency heavily at the moment while the US dollar enjoys strong safe-haven demand across most financial markets. Just recently, bitcoin core developers had a closed-door meeting with cryptocurrency miners to discuss the future of the network so it’s understandable how market participants are feeling jittery about the outcome of this meeting and dumped bitcoin in the process.

Meanwhile, the increased volatility in other asset classes spurred by central bank action and government stimulus has drawn traders to stocks and forex once more, also drying up demand for bitcoin. Weaker commodity prices may have also factored in the slide in higher-yielding and riskier assets for the past few days and could continue to do so, depending on the outcome of this week’s top-tier reports.

Charts from SimpleFX