Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin Price Key Highlights

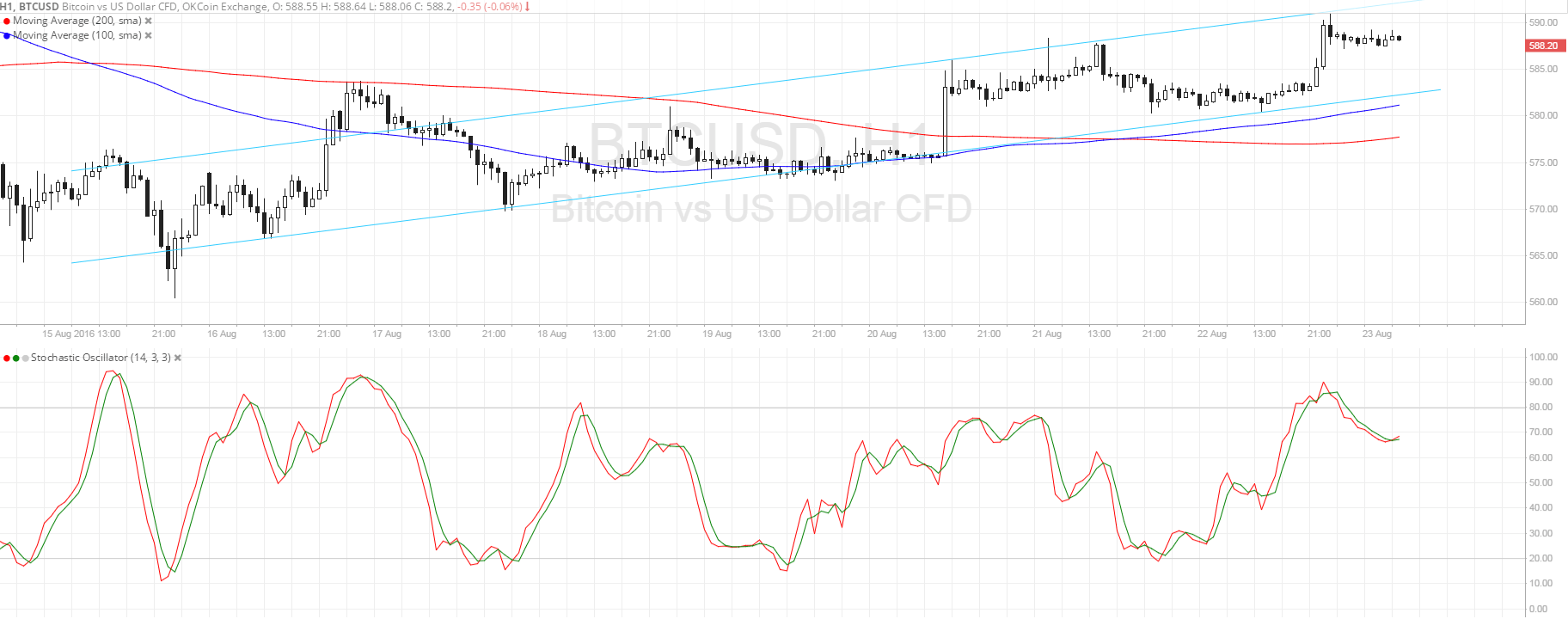

- Bitcoin price is still inside that ascending channel on its 1-hour time frame, bouncing off support as suggested in the earlier article.

- Price just got rejected on its test of the channel resistance once more, putting it back on track towards testing support.

- Technical indicators are suggesting that a pullback could take place but that the bullish trend could continue.

Bitcoin price could be ready for another bounce off the channel support as the bullish trend goes on.

Technical Indicators Signals

The 100 SMA is above the longer-term 200 SMA so the path of least resistance could still be to the upside. Also, the 100 SMA is near the channel support around $580, adding to its strength as a floor. A larger pullback could still bounce off the 200 SMA dynamic support at $575, but this would be the line in the sand for an uptrend continuation.

Stochastic is heading south from the overbought area to show that buyers are taking a break for now so bitcoin price could follow suit. If buyers are eager to hop back in, bitcoin could even push for an upside break of the channel resistance at $590 and a sharper climb.

Market Events

Bitcoin price seems to be taking its cue from technical levels recently as there have been no major market events. So far, central bank policymakers have been able to influence risk sentiment earlier in the week but profit-taking has also been pretty quick.

For now, traders are pricing in expectations for Fed Chairperson Yellen’s speech in the Jackson Hole Symposium towards the end of the week. The FOMC minutes have shown some degree of caution among policymakers while some Fed officials have been giving more hawkish remarks.

Apart from that, uncertainty stemming from the possibility that the UK government could invoke Article 50 to start the Brexit negotiations by April next year is also drawing traders away from traditional markets such as equities and currencies, encouraging them to pursue returns in alternative assets like bitcoin.

Charts from SimpleFX