Bitcoin Price Key Highlights

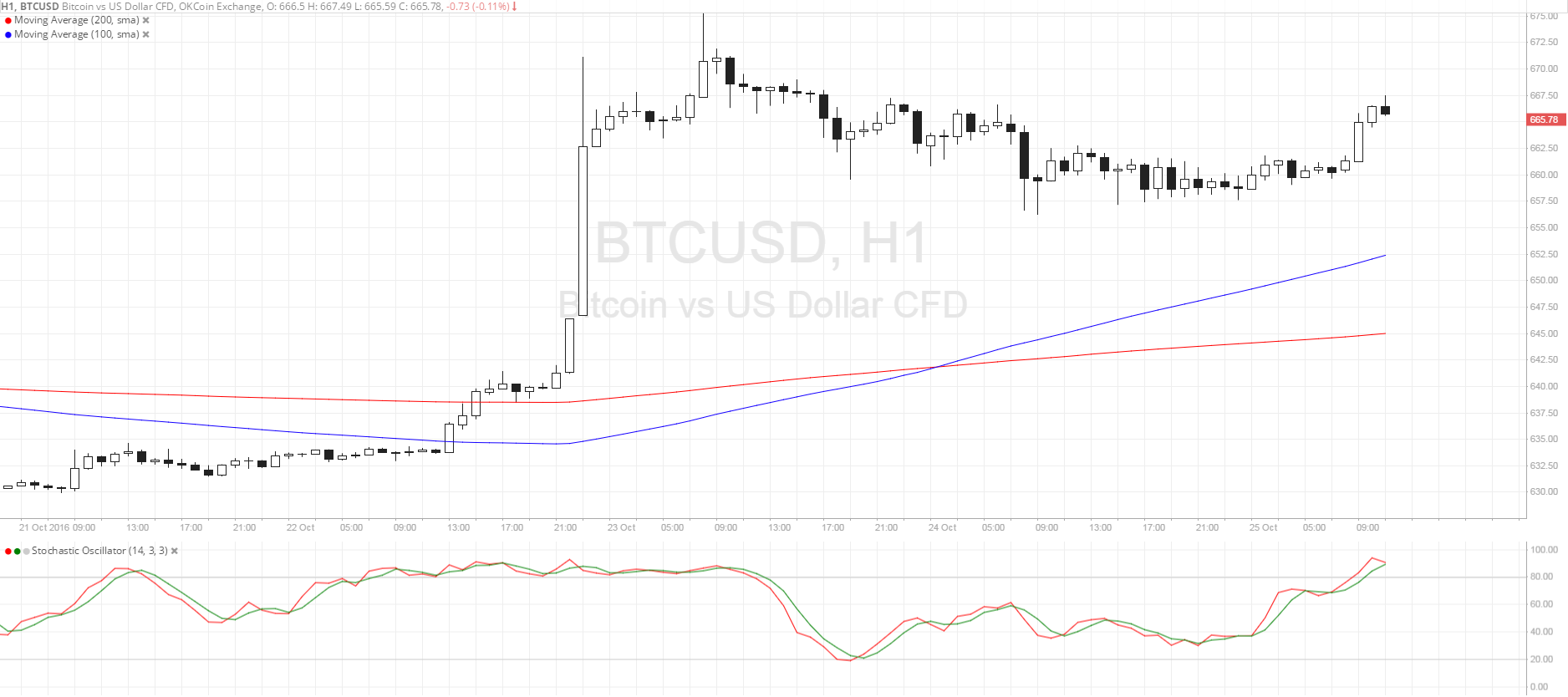

- Bitcoin price recently made a strong rally but fell back in consolidation as bulls struggled to keep the momentum going.

- Buying pressure seems to be returning since price broke to the upside of the consolidation pattern and appears to have completed a quick pullback.

- Price could head back to the previous highs from here or carry on with a larger retracement.

Bitcoin price seems to be regaining bullish momentum after breaking above this short-term consolidation pattern.

Technical Indicators Signals

The 100 SMA is still safely above the longer-term 200 SMA after its recent crossover, which means that the climb could carry on. The gap between the moving averages is widening so bullish momentum is picking up, likely taking bitcoin price up to the previous highs at $675 or higher.

However, stochastic is already indicating overbought conditions, which suggests that profit-taking could happen on the recent rally. If so, bitcoin price could make a larger correction to the dynamic 100 SMA support or the area of interest highlighted in a previous article.

Stronger selling pressure could even spur a break below the nearby support zones, opening the case for a selloff once the oscillator heads south from the overbought area on this bitcoin chart.

Market Events

Risk appetite seems to be picking up in the financial markets once more, owing to the lack of negative headlines and an improvement in the economic outlook according to some central bank officials. ECB Governor Mario Draghi and BOE Governor Mark Carney have testimonies lined up today and their remarks could carry a lot of weight in directing market sentiment.

Risk-taking has been favoring the higher-yielding bitcoin these days against the safe-haven US dollar, although the latter could still draw support from stronger Fed rate hike expectations. Speeches from Fed officials have been mixed yesterday, keeping the odds higher for a hike in December rather than November.

Watch out for potential profit-taking activity towards the end of the week since it coincides with the end of the month and comes ahead of larger catalysts lined up in the first week of November.

Charts from SimpleFX