Bitcoin Price Key Highlights

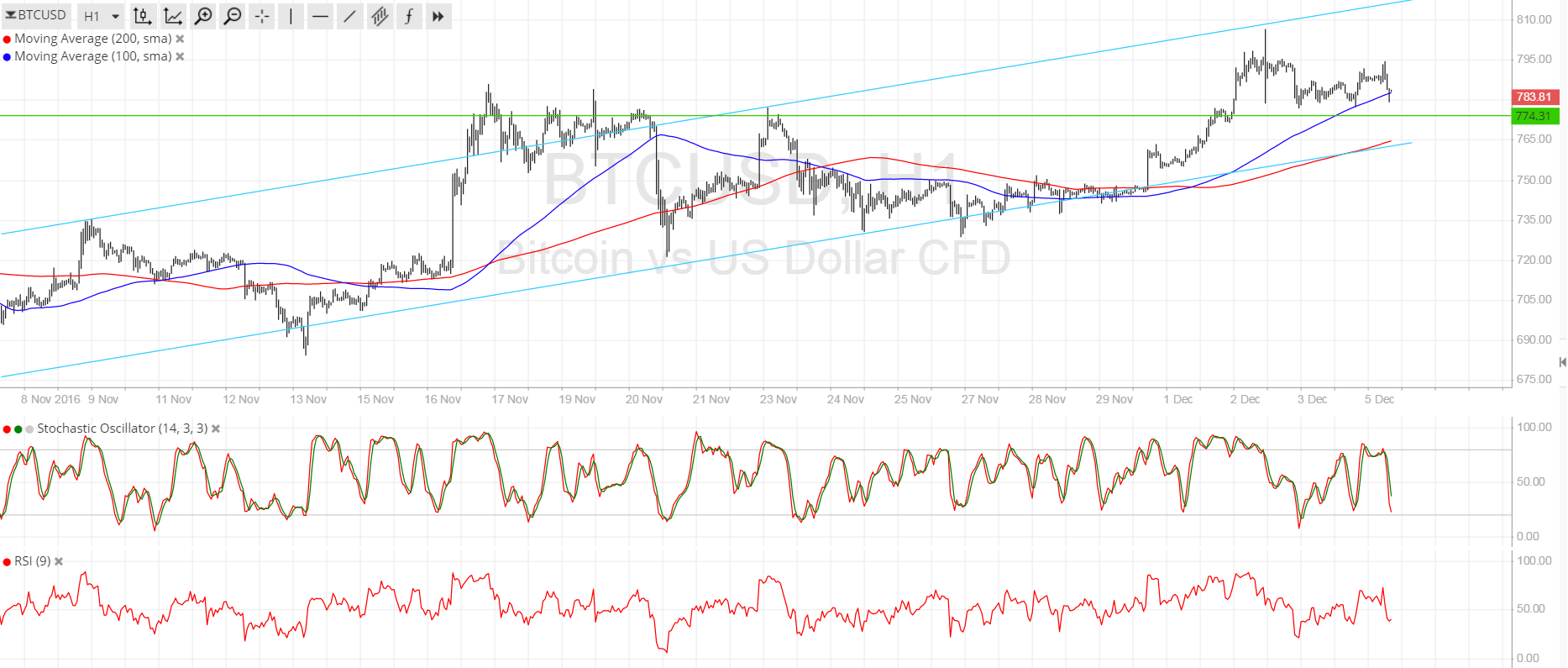

- Bitcoin price has been consistently trending higher, moving inside an ascending channel formation visible on the 4-hour and 1-hour charts.

- Price has just bounced off the channel resistance around $800 and is heading back towards support.

- A bounce from the channel bottom could be in the cards as more bulls are waiting at that area.

Bitcoin price continues to move in an uptrend and is currently making a correction to draw more buyers to the mix.

Technical Indicators Signals

The 100 SMA is above the longer-term 200 SMA so the path of least resistance is still to the upside, which basically means that support is more likely to hold than break. Also, the gap between the moving averages is widening to reflect strengthening bullish momentum. The 200 SMA coincides with the channel support, adding to its strength as a floor.

Stochastic is heading south so bitcoin price could follow suit, allowing the correction to materialize. Similarly, RSI is heading lower to indicate that sellers are on top of their game for now. Once the oscillators reach the oversold regions and turn higher, buyers could regain the upper hand and push for a climb back to the previous highs or channel resistance closer to $815-820.

Note that there’s an area of interest near $775, as this has previously held as resistance. Bulls could be waiting with long positions at this level so a bounce might take place even before bitcoin price reaches the channel support.

Risk appetite appears to be off to a weak start this week, as the Italian referendum resulted in a “No” victory and caused PM Renzi to step down. To add to the political uncertainty in the global markets, New Zealand PM Key has also announced that he would be stepping down from his post.

While this normally leads to weakness among higher-yielding and riskier assets, bitcoin price might be able to hold on to its gains if the uncertainty is strong enough to drive traders away from traditional assets or fiat currencies again. Keep in mind that bitcoin price remains strongly supported by investor activity in China, as traders in the mainland are seeking to hedge their yuan-denominated holdings.

Charts from SimpleFX