Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin Price Key Highlights

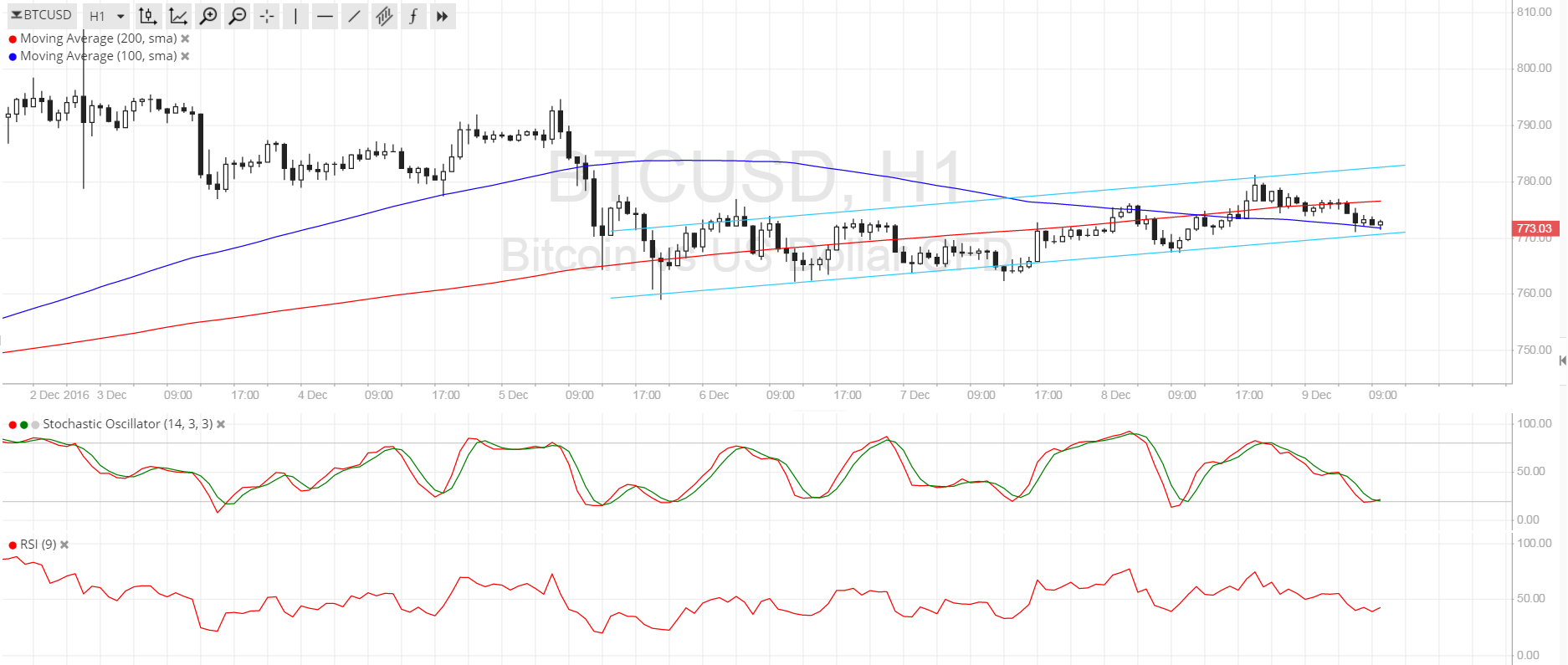

- Bitcoin price is still stuck inside the small ascending channel highlighted in a previous article.

- Price bounced off support as expected and made a test of the resistance, putting it back on track towards testing the bottom once more.

- Technical indicators are giving mixed signals at the moment, although traders might be waiting for more market clues.

Bitcoin price continues to tread slightly higher as bulls refuse to let up, keeping the cryptocurrency in its short-term uptrend.

Technical Indicators Signals

The 100 SMA completed its downward crossover from the longer-term 200 SMA, signaling that the path of least resistance is to the downside. This could give sellers more reason to push for a break of the channel and a potential selloff until the lows at $760 or lower.

Stochastic is on the move down to show that bears are on top of their game for now, but the oscillator is closing in on the oversold region to show that selling momentum could fade soon. RSI is still cruising sideways, barely giving any strong directional hints at the moment.

A bounce off the channel support, which lines up with the 100 SMA dynamic inflection point, could lead to a move back up to the resistance at $785. Stronger bullish pressure could lead to a break higher to the next resistance at $790-800.

Market Events

Bitcoin price barely budged after the ECB announced its adjustments to its QE program, indicating that the cryptocurrency is likely holding out for much larger events. It also shrugged off mixed inflation reports from China, as the CPI came in stronger tha expected at 2.3% versus 2.2% while the PPI fell short at 1.5% versus 2.2%. Perhaps this is because both readings chalked up improvements from earlier reports, hinting that the Chinese government might not need to aggressively pursue easing or yuan devaluation in the next few days.

Still, profit-taking activity could happen over the weekend as usual, with traders gearing up for next week’s FOMC statement. Although a rate hike has been priced in already, investors might want to be a little more cautious in anticipating a potential surprise from the Fed that might undo the dollar’s gains.

Charts from SimpleFX