Bitcoin Price Key Highlights

- Bitcoin price finally made a convincing break past the $800 barrier, opening the path for further upside targets.

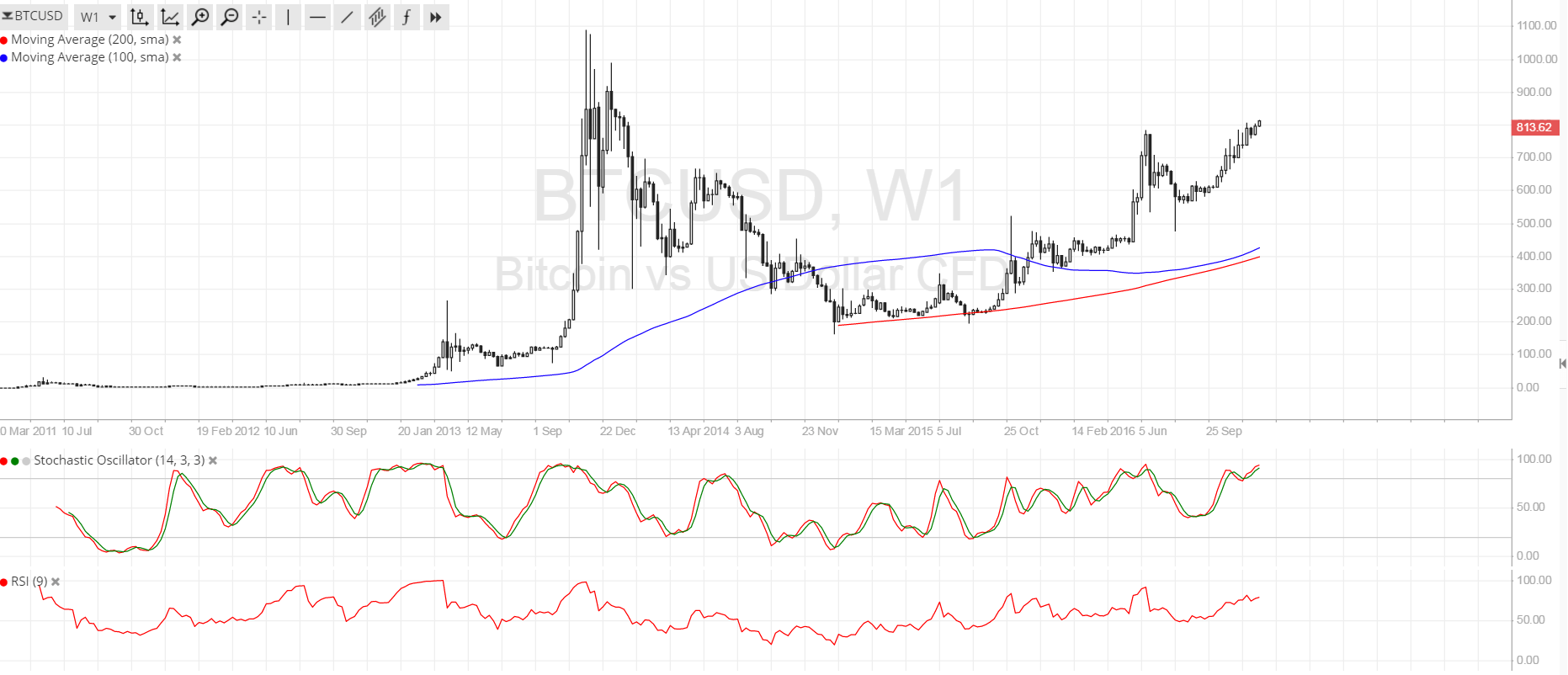

- Zooming out to the weekly time frame of bitcoin shows the next resistance levels.

- On a short-term perspective, bitcoin price made it up to the top of the channel illustrated in a previous article.

Bitcoin price seems to be set for one more push higher before the end of the year as it successfully took out the $800 barrier.

Technical Indicators Signals

The 100 SMA is still above the longer-term 200 SMA on the weekly time frame so the path of least resistance in the long run is still to the upside. In other words, this means that bitcoin price is more likely to continue its climb rather than reverse. In fact, the break past $800 might draw more bulls to the game as volume picks up and sustains the rally.

However, stochastic is already indicating overbought conditions, which means that buyers could feel the exhaustion. This could pave the way for short-term pullbacks, possibly until the $780-800 area as bulls wait for bargain prices to hop in.

Meanwhile, RSI is still on its way up so there’s some bullish momentum left. Bitcoin price could head up to the next ceiling around $915 then onto the $1000 major psychological level or all the way up to $1100.

Market Events

Reports that US president-elect Trump picked a bitcoin supporter as the Budget Director injected a fresh round of confidence in the cryptocurrency and startups operating in this sphere. Mick Mulvaney will head the OMB and has previously accepted bitcoin donations and has also shown support for blockchain developments.

Apart from that, reports that a group of international banks are piloting a blockchain-based gold settlement scheme is also lifting bitcoin price, as this suggests that the cryptocurrency and its ledger have plenty of potential lined up for next year.

Still, be mindful of any signs of profit-taking as the end of the year approaches, with traders keen on locking in gains to crunch their trade performance numbers before reestablishing positions in January.

Charts from SimpleFX