Bitcoin Price Key Highlights

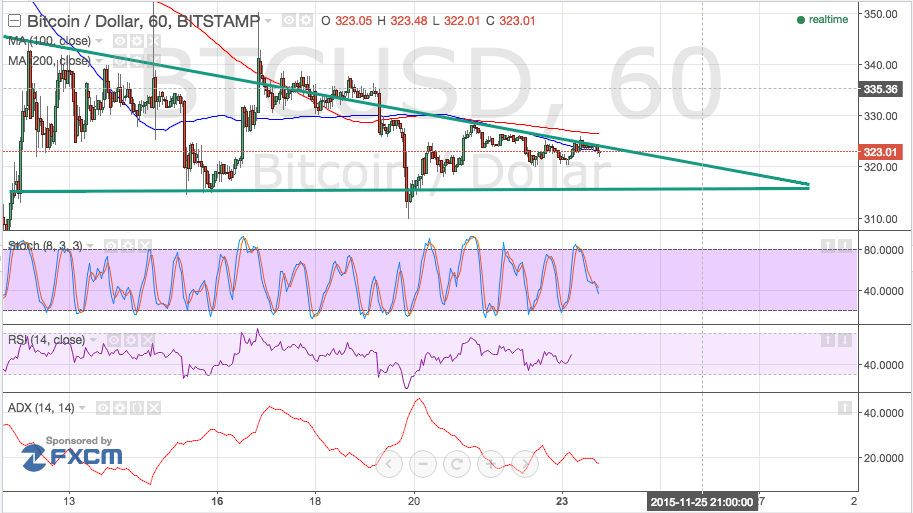

- Bitcoin price is forming a descending triangle pattern with its lower highs and support around $315.

- Price is currently testing the top of the triangle near the 100 SMA, which has held as a dynamic inflection point in the past.

Bitcoin price could be due for a decline to the bottom of the descending triangle, as technical indicators are showing that bears are taking control.

More Sell Signals?

First off, the short-term 100 SMA is below the longer-term 200 SMA, indicating that the path of least resistance is to the downside. Any pop higher from the descending triangle resistance at $325 could lead to a test of the 200 SMA, which might be able to keep further gains in check.

Next, stochastic is heading south so bitcoin price could follow suit. RSI is on middle ground, however, and starting to point higher so price could keep testing the resistance from here.

The average directional index is below the 20.0 level, indicating ranging market conditions. This means that bitcoin price could stay inside the descending triangle for the time being.

A breakout in either direction could spur a strong trend for bitcoin price in the coming weeks, although its hard to imagine that any catalysts could trigger a sharp rally or breakdown. The US dollar could enjoy stronger bullish pressure in the coming weeks leading up to the Fed’s December interest rate decision since the US central bank is widely expected to tighten monetary policy.

With that, a downside break of support could lead to a test of the next potential floor at the $300 level. On the other hand, an upside break of resistance at $325 could lead to a rally up to the triangle highs at $340.

Intraday support level – $320

Intraday resistance level – $325

Technical Indicators Settings:

- 100 SMA and 200 SMA

- Stochastic (8, 3, 3)

- RSI (14)

- ADX (14, 14)

Charts from BitStamp, courtesy of TradingView

very nice!