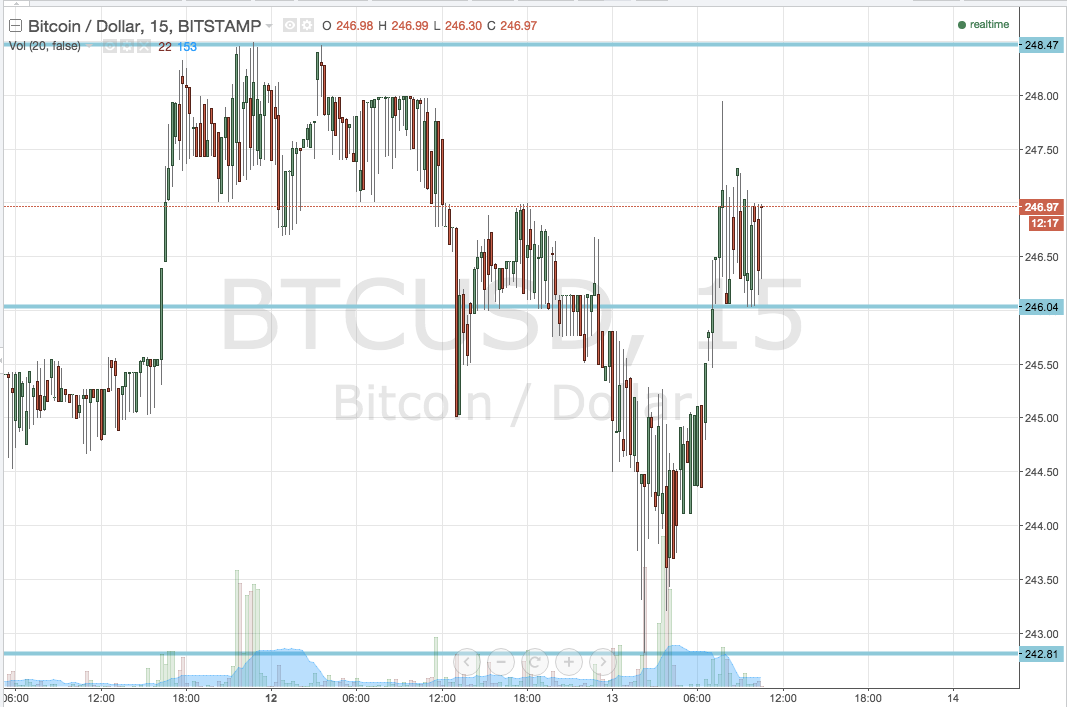

Late yesterday evening we published our twice daily bitcoin price watch piece. In the article, we highlightedthe levels that we would be keeping an eye on during the Asian session on Monday night, and suggested where we would look to get in and out of the markets according to our intraday strategy. Now action has matured overenight, and as we head into a fresh European session on Tuesday, what are we looking at from a key level perspective, and where are we aiming to get in and out of the markets today to take advantage of any volatility in the bitcoin price? Take a quick look at the chart.

As you can see, action overnight was pretty volatile. We got quite a lot of movement in and around our predefined range, but failed to take out any of our predefined targets. With this said, the levels we are looking to take advantage of today are in term support at 246.04 and in term resistance at 248.47.

Initially, we will look for a break above 248.47 to validate an immediate upside target of 253 flat. With about 5 dollars worth of reward onoffer, a stop loss somewhere around 247.50 will maintain a positive risk reward profile and ensure we are taken out of the trade in the event of a bias reversal.

Looking the other way, if we get a break below in term support at 246.04, and a cloe below this level on the intraday chart, we will look to enter short towards a downside target of 242.82.

Charts courtesy of Trading View