In this morning’s analysis, we noted that price had been relatively flat throughout the majority of this week, and that there was a chance that action could remain flat as we moved into the last day of the week and beyond into the weekend. We also noted, however, that when price consolidates as it has been doing over the past few days, we sometimes see some nice breakout volatility activity, as markets spring back into action after rebalancing.

We are about to close out the European session, and it looks as though the latter of these two suggestions has proven the most accurate.

Price ran up through our predefined in term resistance level earlier today, and enabled us to get in to a long entry on the break. We quickly took out our upside target, and are heading into this evening’s session with a nice net profit on the day. With any luck, we will get a continuation of this action this evening, and see some more momentum driven volatility going forward.

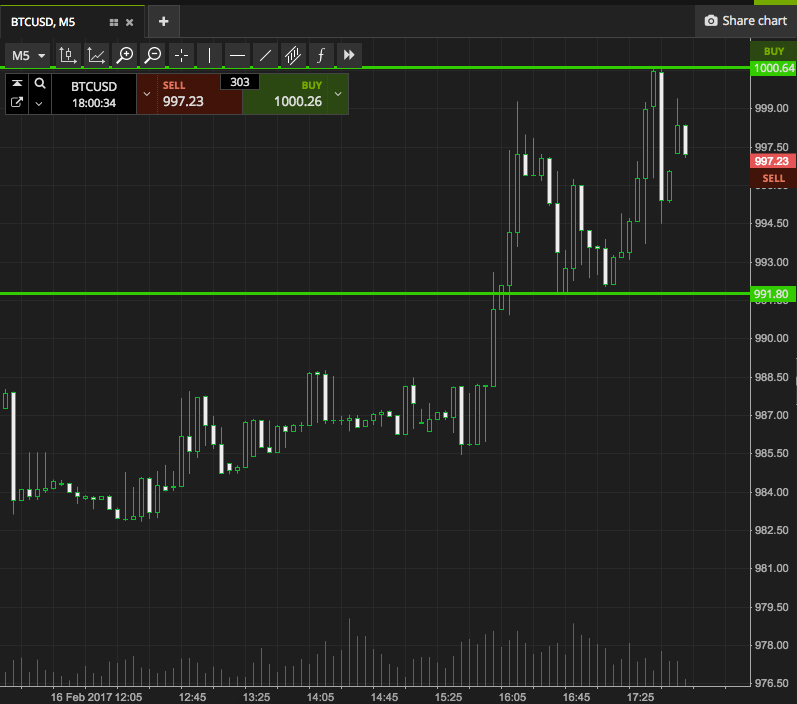

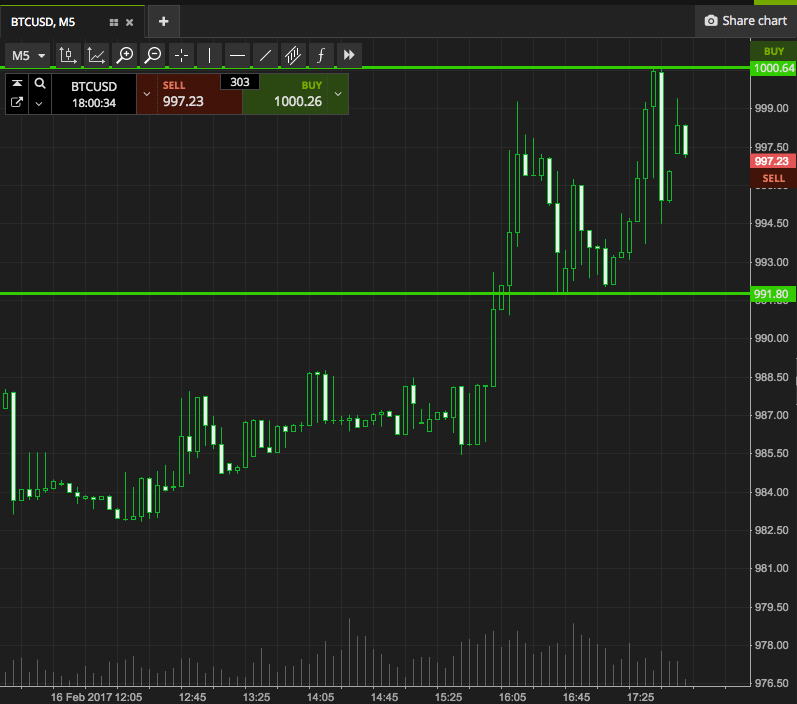

So, with this noted, let’s get some levels outlined for the session this evening, and see if we can put forward some areas of focus for the US afternoon and beyond. As ever, take a quick look at the chart below to get an idea of what’s on, and where things stand.

So, as the chart shows, the range we are looking at for this evening is defined by resistance to the upside at 1000 flat, and support to the downside at 991. Just breakout for now, with a skewed focus towards the 1000 level.

A close above 1000 will get us in a long position towards 1010. Conversely, a close below support will put us in short toward 985. Stop losses just the other side of our entry will kill risk on the trades.

Charts courtesy of SimpleFX