Markets are about to draw to a close out of Europe, and it looks as though it has been one of those weak market days. Action has been relatively flat, and aside from a small spike in volume at the market open, we haven’t really seen any interesting volatility throughout the session. This might all change, with the US session just about getting started now, and getting back into full swing after the holiday weekend. Whatever happens, we are going to set up against either side of the market in an attempt to draw a profit from any volatility. We likely won’t need to change anything from this morning, with perhaps the exception of our target and stop placement just to accommodate the lack of any real volume (and the inference this has for sustained momentum). So, without further it do, let’s have a look at the markets, and see what we can do about setting up our intraday strategy for this evening.

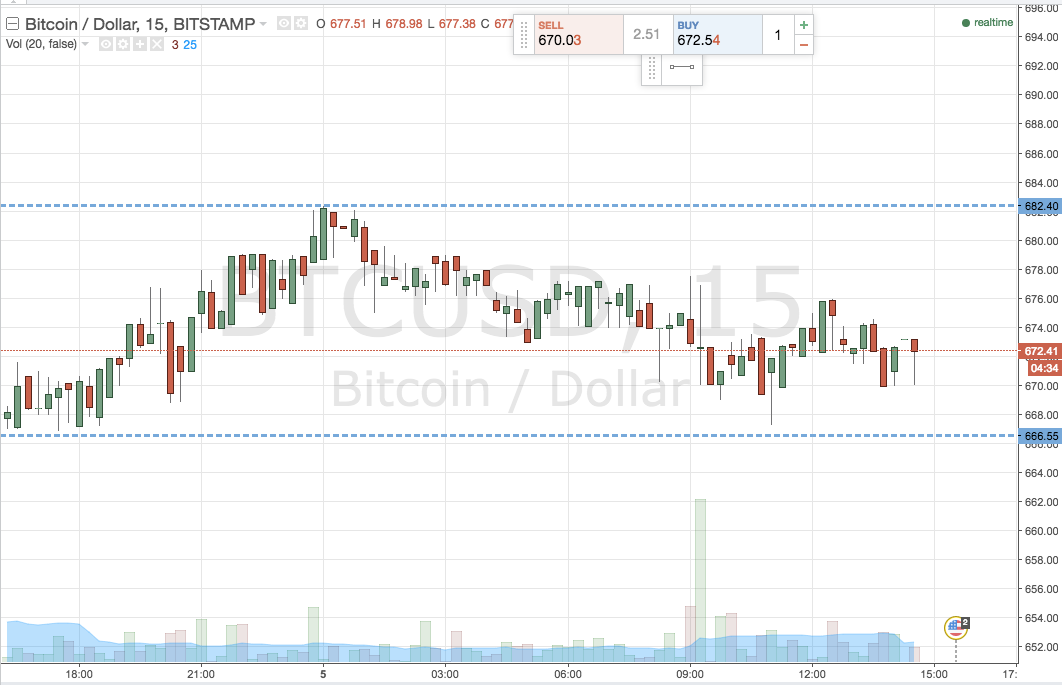

As ever, take a quick look at the 15 minute candlestick chart below to get an idea of the key levels in focus.

As the chart shows, action today remained well within our predefined range, and so – as mentioned – we are holding our levels firm for this evening. Specifically, this entails keeping support at 666 and resistance at 682. As we said earlier, intrarange is on with this sort of parameter width, so long at support and short at resistance. A stop loss just the other side of each entry defines risk.

Since we are looking at what is likely going to be weak volatility this evening, we are going to tighten our targets from this morning. A close above resistance will still signal for us to enter a long trade, but only to as far as 688 flat. A stop at 680 keeps things tight. A close below support signals short towards 659, stop at 66

Happy Trading!

Charts courtesy of Trading View