Things are really starting to move now in the bitcoin price. Yesterday evening we noted that we were going to keep an eye on the 4000 level as a major upside driver if and when it was reached (and subsequently broken) primarily because it serves as a key psychological level of resistance. Overnight, we didn’t see the level broken, but price did trend towards the level in question and it’s now looking considerably likely that we will get a break near term.

With this in mind, we are going to incorporate this level into our primary strategy today. So, let’s get some levels in place that we can use to go at the markets moving forward into the European session this morning.

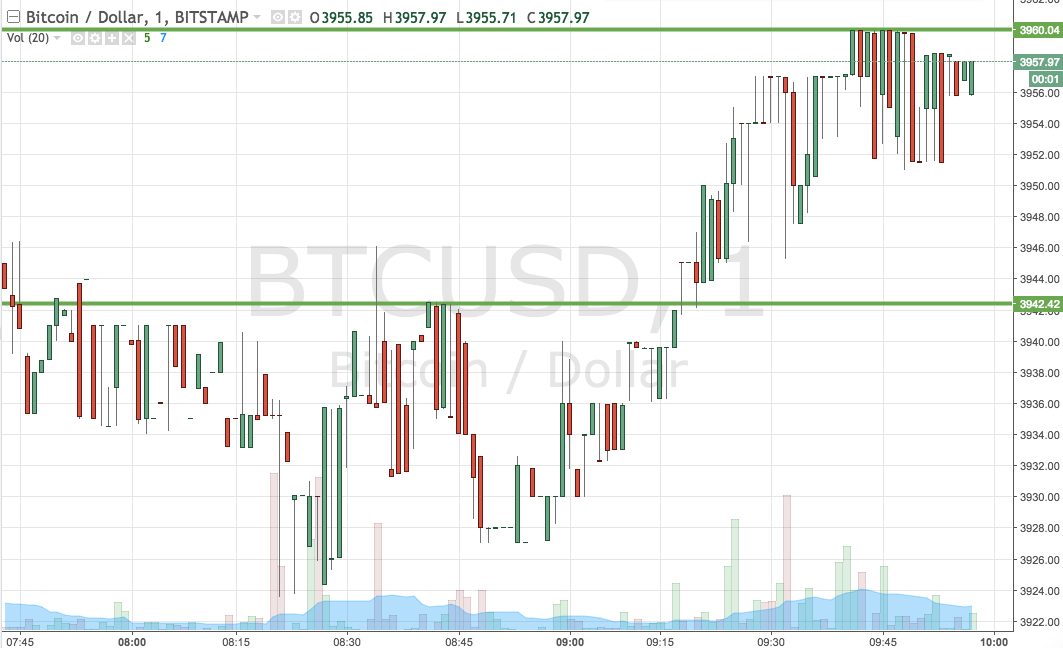

As ever, take a quick look at the chart below before we get started so as to get an idea why things stand and how action overnight brought us to the point at which we find ourselves this morning. It is a one-minute candlestick chart has a wiki range overlaid in green

As the chart illustrates, we are going with a pretty tight range for the session today (at least as compares to some of those we have used over the last few weeks) and so we are limited to breakout scalp positions.

Our support level comes in at 3942 to the downside and our first trade will be to enter short on a close below this level towards an immediate downside target of 3928. A stop loss this one somewhere in the region of 3950 will ensure that we are taken out of that position for just a small loss in the event of things turning against us.

Looking long, our second trade comes from a close above resistance, on which we will enter long towards an upside target of 4000 flat. A stop on this one at 3950 once again looks good.

Chart courtesy of Trading View