Okay, here we go, it is Tuesday, and our bitcoin price trading strategy is in full swing. Things were relatively flat yesterday, and this meant that we weren’t able to get into any real opportunities, but overnight, things started to pick up, and we – as predicted – were able to take advantage of some movement out of the Asian session initiation.

With any luck, we are going to get more of the same during today’s European session.

The US markets will open again for business today after the extended weekend, and this should result in some added volatility for the late European and evening sessions later on.

So, what happened overnight?

Well, price broke through our predefined resistance level to the upside, and we were able to get in to a long position towards our predefined target on the break. It was only a quick turnaround trade (our range was relatively tight) but a profit is a profit, and it gets us back into a nice swing of momentum.

So, as we move forward into today’s session, where are we looking to get in and out of the markets, and what will we look to use as our key levels going forward? Let’s take a look.

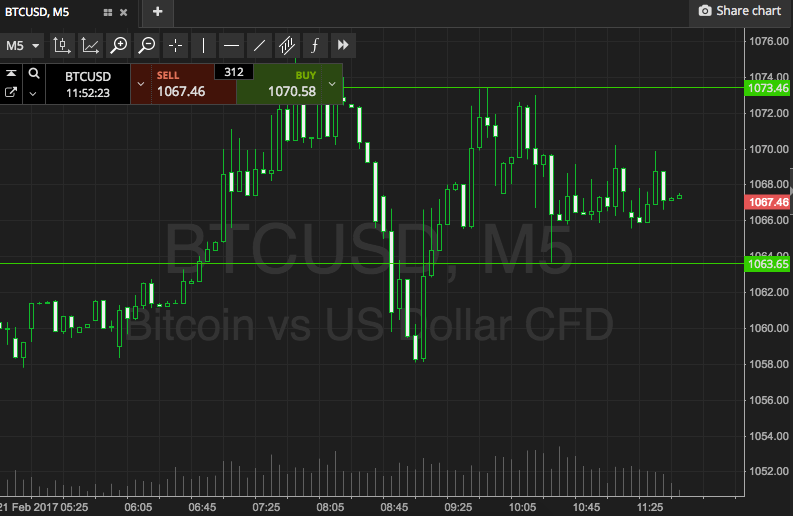

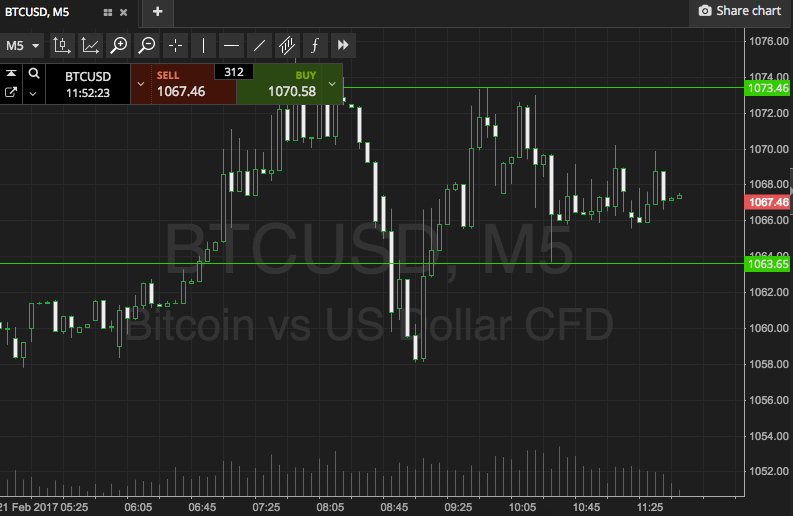

As ever, take a look at the chart below to get an idea of what is on.

As the chart shows, the range in focus for today’s session is defined by support to the downside at 1063 and resistance to the upside at 1073. A nice solid $10 range.

A run through resistance will put us on the watch for a close above that level, and if we get that close, it will signal a long entry towards an upside target of 1085. Conversely, a close below support will signal short towards 1053. A stop loss on both trades just the other side of the entry will ensure we are taken out of the position in the event of a bias reversal.

Charts courtesy of SimpleFX