That’s another day done, and once again it’s been a pretty interesting day of trading in the bitcoin price from an intraday perspective. Price just keeps giving us opportunities to get in and out of the markets, and our strategy has been ready to take advantage of these opportunities on pretty much every signal. We’ve had a couple of crossovers, so every box isn’t ticked, but when we compare action over this week and last to action at the end of September/early October, it’s night and day.

We’re not done yet.

The European session might be over, but we’ve got plenty of US action to go, and the Asian session won’t be far behind. So, with this in mind, and as we head into the just mentioned periods, here’s what we’re chasing.

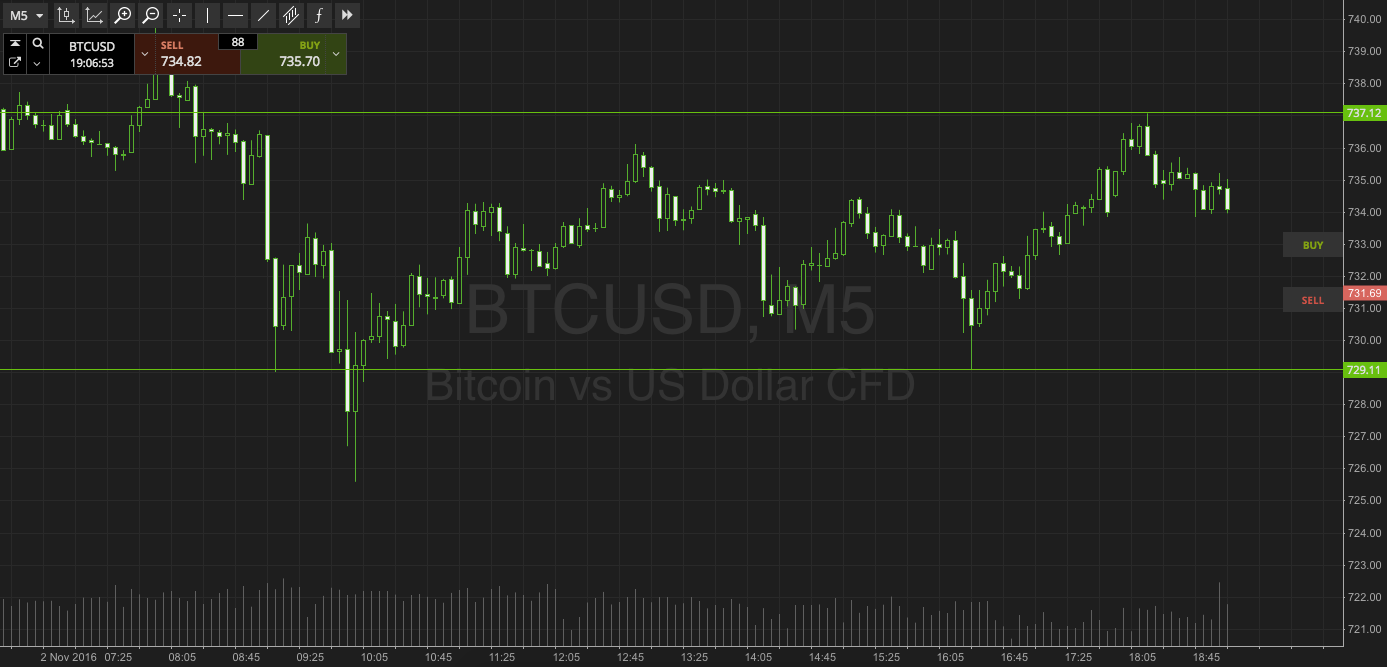

The chart below shows our key levels, and shows action from somewhere in the region of the last twelve hours in the bitcoin price.

As the chart shows, our range in focus for this evening’s session is defined by in term support to the downside at 729 and in term resistance to the upside at 737.

These levels are just about wide enough for us to go at rice with an intrarange strategy, but we are going to focus on breakout alone for now, purely based on the fact that that is the way price seems to be responding to key levels right now. This may alter if things flatten out.

So, if we see price break through resistance, we will look for a close above that level to validate an upside target of 745.

Conversely, a close below support will signal short towards 720. A stop loss on both positions a few dollars either side of the entry should help to keep risk nice and tightly defined.

Happy trading!

Charts courtesy of SimpleFX