So we are midway through the week, and what a week it has been so far. Action in the bitcoin price has given us plenty to talk about, with sharp upside movements being the order of the day for the first couple of days of the week. It all started over the weekend, and a number of fundamental factors are coming into play as far as influencing how price is moving is concerned. Risk-off sentiment as initiated by way of US political uncertainty, and Chinese capital restrictions are both likely affecting the way things move, and we have been able to take advantage of this movement plenty of times so far this week. With any luck, we can continue to do so, as we head into the latter half.

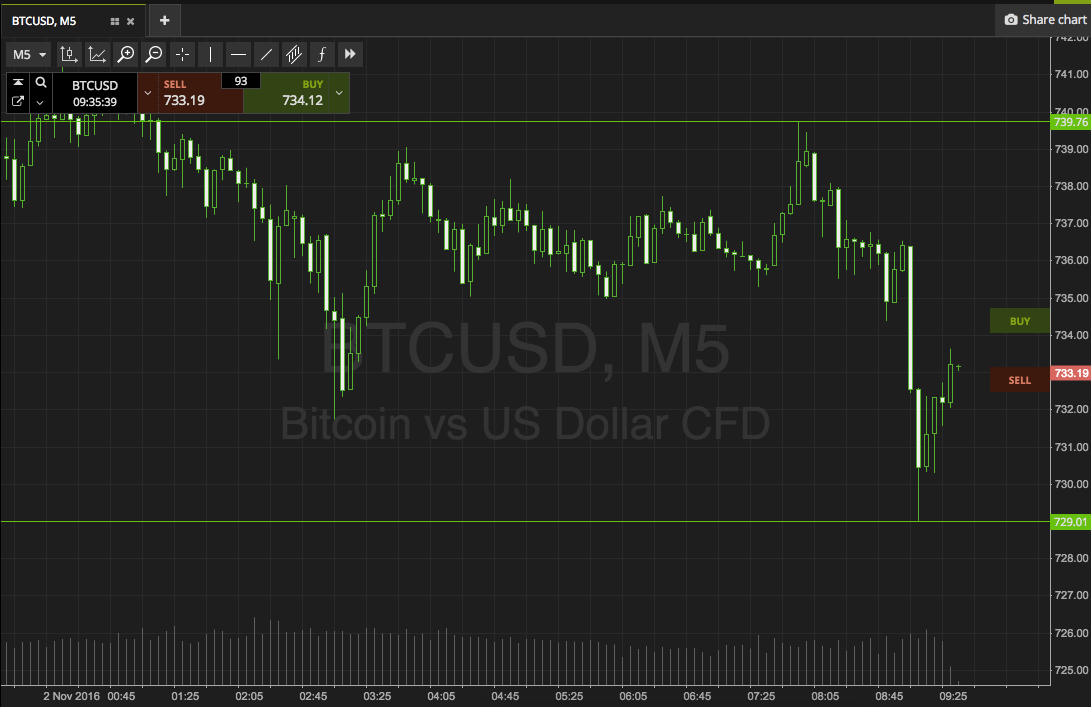

So, with this said, and as we move into the early morning session out of Europe, here is a look at what we’re going for today, and where we are looking to get in and out of the markets according to our intraday strategy. As ever, take a look at the chart below to get an idea of the levels in focus.

As the chart shows, our range for today’s session is defined by 729 to the downside as support, and 739 to the upside serving as resistance. With about $10 worth of range to go at here, there is plenty of room for intrarange action. Looking at things from a breakout perspective, however, if price manages to close below support, we are going to get in short towards an immediate downside target of 700. A stoploss on this one somewhere in the region of 731 works well to define risk. Conversely, a close above resistance will signal a long entry towards 746. Again we need a stoploss, and somewhere in the region of 738 looks good.

Charts courtesy of SimpleFX